Question: I need help figuring out the Retained Earnings and Dividends. Also, how do I complete the income statement from here? Peyton Approved Closing Entries For

I need help figuring out the Retained Earnings and Dividends. Also, how do I complete the income statement from here?

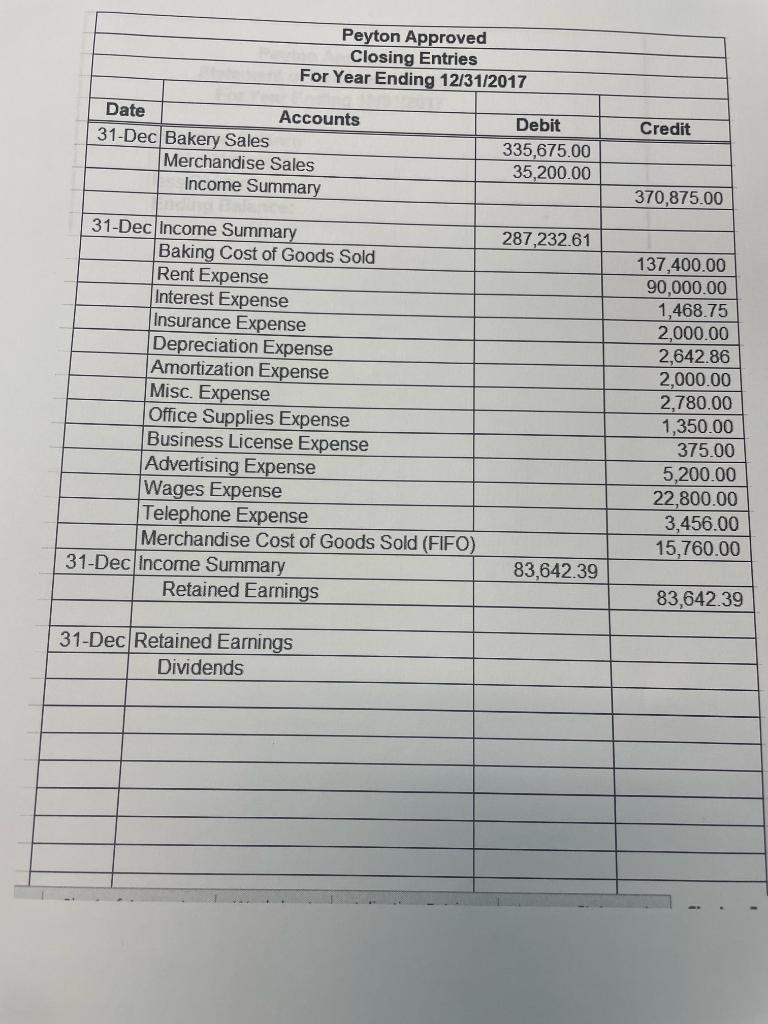

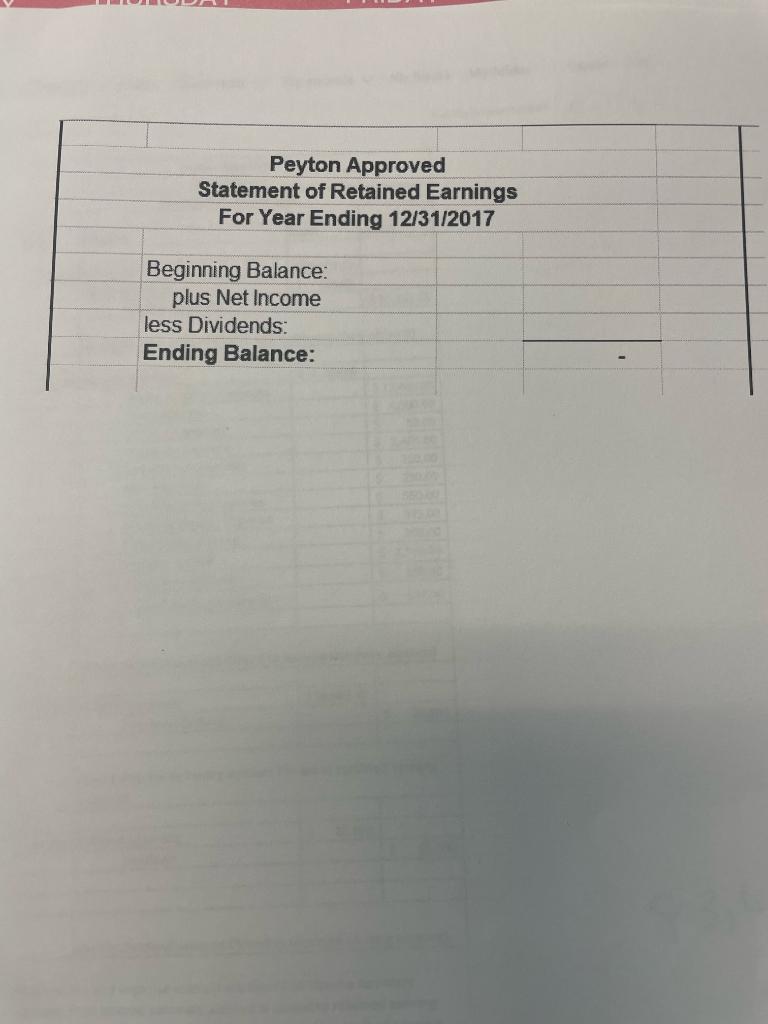

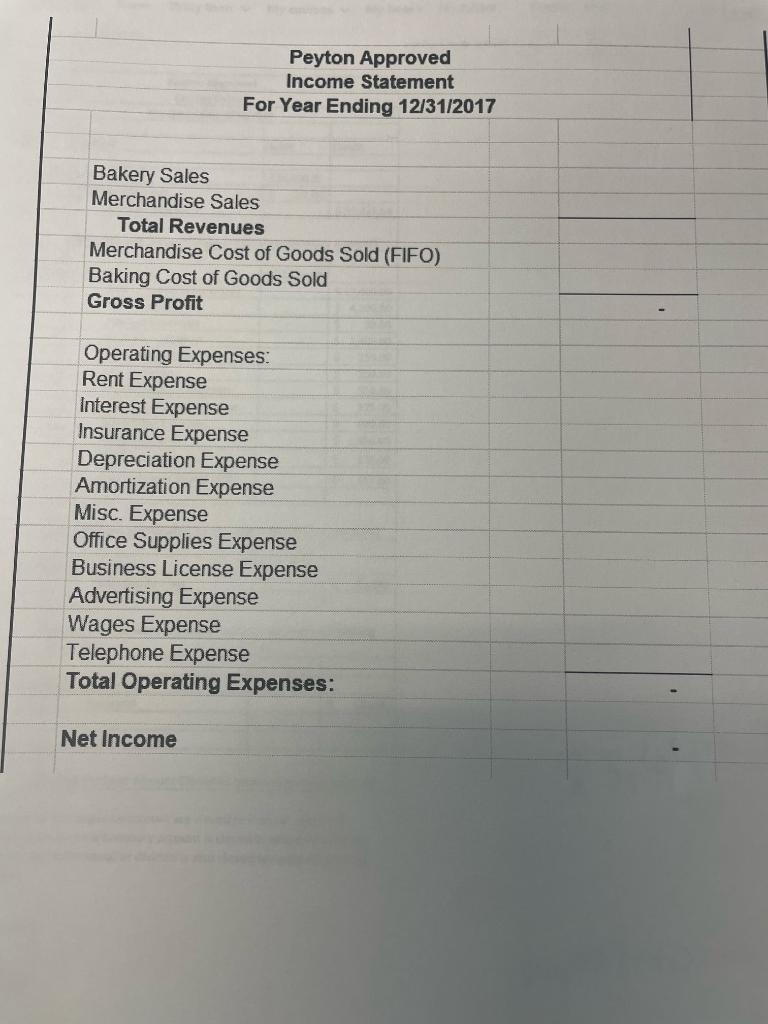

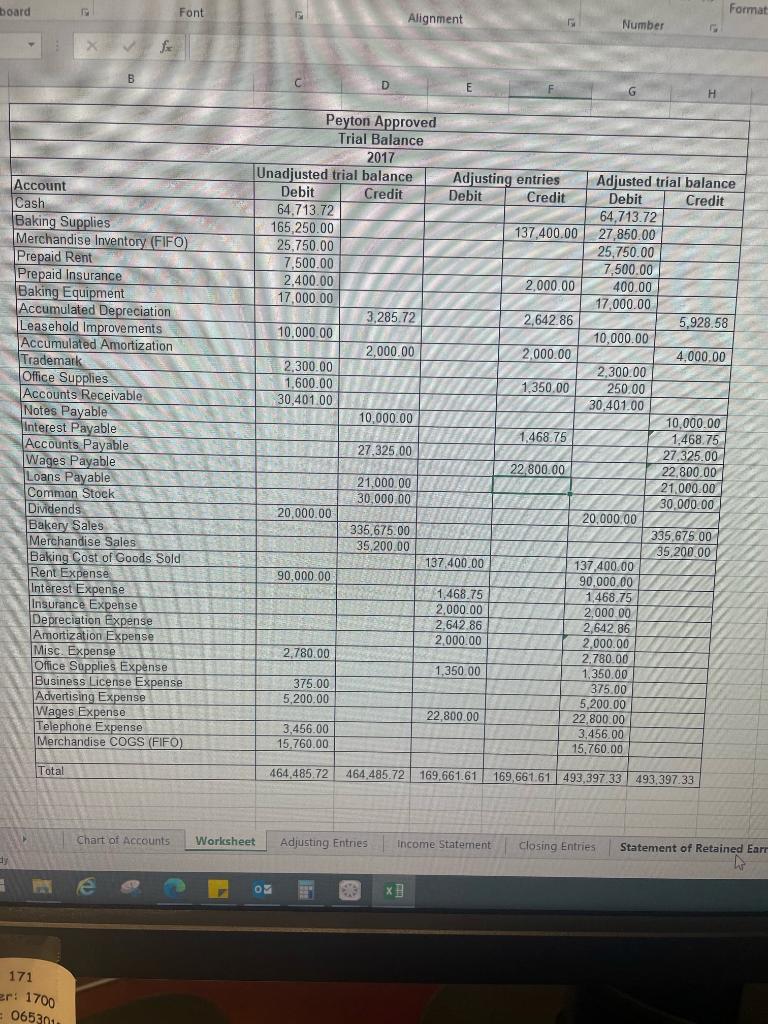

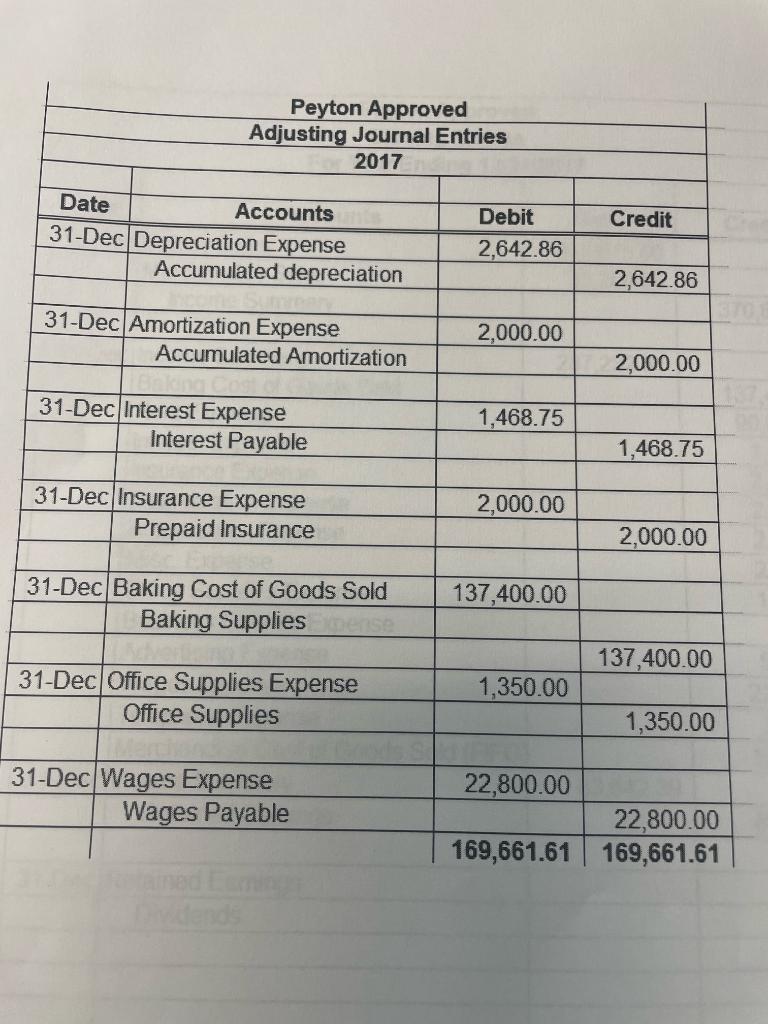

Peyton Approved Closing Entries For Year Ending 12/31/2017 Accounts Date 31-Dec Bakery Sales 31-Dec Income Summary Merchandise Sales Income Summary Baking Cost of Goods Sold Rent Expense Interest Expense Insurance Expense Depreciation Expense Amortization Expense Misc. Expense Office Supplies Expense Business License Expense Advertising Expense Wages Expense Telephone Expense Merchandise Cost of Goods Sold (FIFO) Retained Earnings 31-Dec Income Summary 31-Dec Retained Earnings Dividends Debit 335,675.00 35,200.00 287,232.61 83,642.39 Credit 370,875.00 137,400.00 90,000.00 1,468.75 2,000.00 2,642.86 2,000.00 2,780.00 1,350.00 375.00 5,200.00 22,800.00 3,456.00 15,760.00 83,642.39 Peyton Approved Statement of Retained Earnings For Year Ending 12/31/2017 Beginning Balance: plus Net Income less Dividends: Ending Balance: Peyton Approved Income Statement For Year Ending 12/31/2017 Bakery Sales Merchandise Sales Total Revenues Merchandise Cost of Goods Sold (FIFO) Baking Cost of Goods Sold Gross Profit Operating Expenses: Rent Expense Interest Expense Insurance Expense Depreciation Expense Amortization Expense Misc. Expense Office Supplies Expense Business License Expense Advertising Expense Wages Expense Telephone Expense Total Operating Expenses: Net Income board fix H 171 er: 1700 065301 Font Account Cash Baking Supplies Merchandise Inventory (FIFO) Prepaid Rent Prepaid Insurance Baking Equipment Accumulated Depreciation Leasehold Improvements Accumulated Amortization Trademark Office Supplies Accounts Receivable Notes Payable Interest Payable Accounts Payable Wages Payable Loans Payable Common Stock Dividends Dividends Bakery Sales Bakery Sales Merchandise Sales Baking Cost of Goods Sold Rent Expense Interest Expense Insurance Expense Depreciation Expense Amortization Expense Misc. Expense Office Supplies Expense Business License Expense Advertising Expense Wages Expense Telephone Expense Merchandise COGS (FIFO) Total Alignment G Format D Peyton Approved Trial Balance 2017 Unadjusted trial balance Debit Credit 64,713.72 165,250.00 25,750.00 7,500.00 2,400.00 17,000.00 3,285.72 10,000.00 2,000.00 2,300.00 1,600.00 30,401.00 10,000.00 1 27,325.00 21,000.00 30.000.00 20,000.00 20,000.00 335,675.00 35,200.00 137,400.00 137,400.00 90,000.00 90,000,00 1,468.75 1,468.75 2,000.00 2,000.00 2,642.86 2,642 86 2,000.00 2,000.00 2,780.00 2.780.00 1,350.00 1,350.00 375.00 375.00 5,200.00 5,200.00 22,800.00 22,800.00 3,456.00 3,456.00 15.760.00 15,760.00 464,485.72 464,485.72 169,661.61 169,661.61 493,397.33 493,397.33 Chart of Accounts Worksheet Adjusting Entries Income Statement Closing Entries Statement of Retained Earr W e OM 6.3 X Adjusting entries Debit Credit 137,400.00 2,000.00 2,642.86 2,000.00 1.350.00 1,468.75 22,800.00 Number G G H Adjusted trial balance Debit Credit 64,713.72 27,850.00 25,750.00 7,500.00 400.00 17,000.00 5,928.58 10,000.00 4,000,00 2,300.00 250.00 30,401.00 10,000.00 1,468.75 27,325.00 22,800.00 21,000.00 30,000.00 335,675.00 35,200.00 Peyton Approved Adjusting Journal Entries 2017 Date Accounts 31-Dec Depreciation Expense Accumulated depreciation 31-Dec Amortization Expense Accumulated Amortization 31-Dec Interest Expense Interest Payable 31-Dec Insurance Expense Prepaid Insurance 31-Dec Baking Cost of Goods Sold Baking Suppliesxpense 31-Dec Office Supplies Expense Office Supplies 31-Dec Wages Expense Wages Payable tained Dividends Debit Credit 2,642.86 2,642.86 2,000.00 2,000.00 1,468.75 1,468.75 2,000.00 2,000.00 137,400.00 137,400.00 1,350.00 1,350.00 22,800.00 22,800.00 169,661.61 169,661.61

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts