Question: Hello, Please help, i have attached the answer previously i was given and they were wrong. also i am attaching the info i have figured

Hello,

Please help,

i have attached the answer previously i was given and they were wrong. also i am attaching the info i have figured out.

thank you

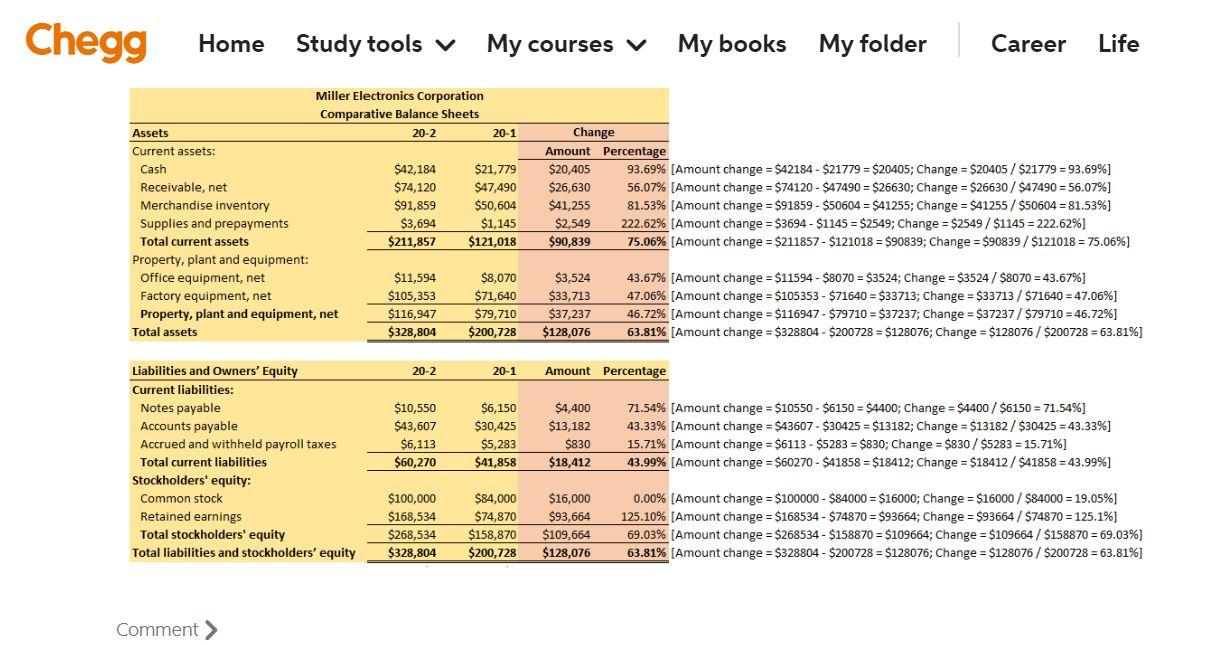

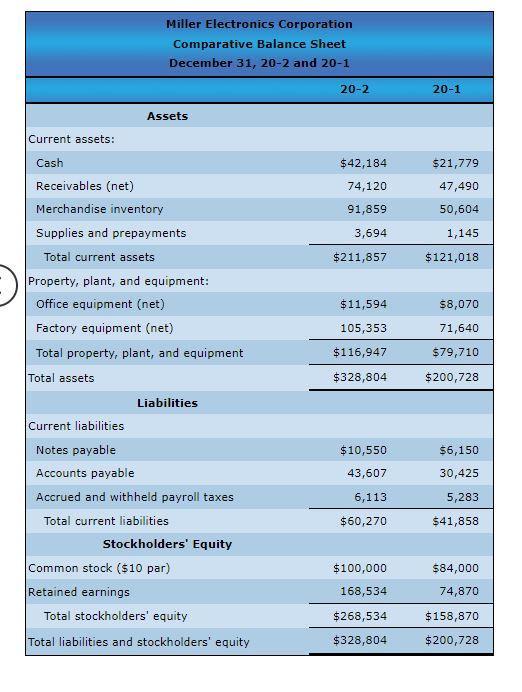

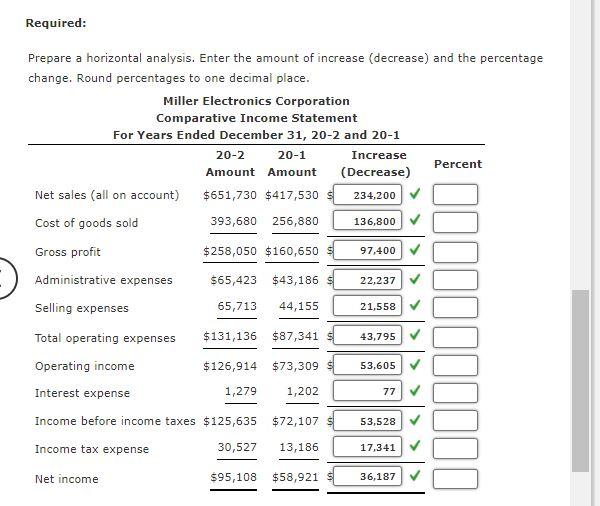

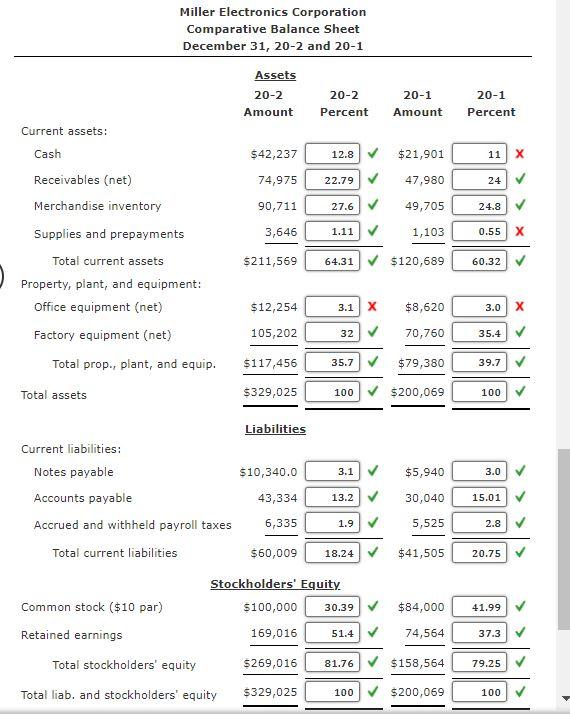

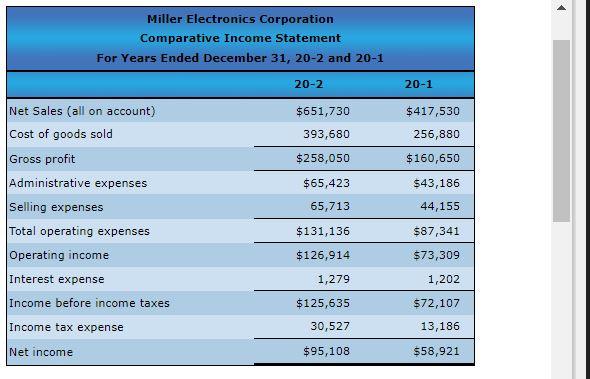

Chegg Home Study tools v My courses v My books My folder Career Life Miller Electronics Corporation Comparative Balance Sheets Assets 20-2 20-1 Current assets: Cash $42,184 $21,779 Receivable, net $74,120 $47,490 Merchandise inventory $91,859 $50,604 Supplies and prepayments $3,694 $1,145 Total current assets $211,857 $121,018 Property, plant and equipment: Office equipment, net $11,594 $8,070 Factory equipment, net $105,353 $71,640 Property, plant and equipment, net $116,947 $79,710 Total assets $328,804 $200,728 Change Amount Percentage $20,405 93.69% [Amount change = $42184 - $21779 = $20405; Change = $20405 / $21779 = 93.69%] $26,630 56.07% [Amount change = $74120 - $47490 = $26630; Change = $26630 / $47490 = 56.07%] $41,255 81.53% [Amount change = $91859 - $50604 = $41255; Change = $41255 / $50604 = 81.53%] $2,549 222.62% [Amount change = $3694 - $1145 = $2549; Change = $2549 / $1145 = 222.62%] $90,839 75.06% [Amount change = $211857 - $121018 = $90839; Change = $90839 / $121018 = 75.06%) $3,524 $33,713 $37,237 $128,076 43.67% [Amount change = $11594 - $8070 = $3524; Change = $3524 / $8070 = 43.67%] 47.06% [Amount change = $105353 - $71640 = $33713; Change = $33713 / $71640 = 47.06%] 46.72% [Amount change = $116947 - $79710 = $37237; Change = $37237 / $79710 = 46.72%] 63.81% [Amount change = $328804 - $200728 = $128076; Change = $128076 / $200728 = 63.81%] = 20-2 20-1 Amount Percentage = Liabilities and Owners' Equity Current liabilities: Notes payable Accounts payable Accrued and withheld payroll taxes Total current liabilities Stockholders' equity: Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $10,550 $43,607 $6,113 $60,270 $6,150 $30,425 $5,283 $41,858 $4,400 $13,182 $830 $18,412 71.54% [Amount change = $10550 - $6150 = $4400; Change = $4400 / $6150 = 71.54%] 43.33% [Amount change = $43607 - $30425 = $13182; Change = $13182/ $30425 = 43.33%) 15.71% [Amount change = $6113 - $5283 = $830; Change = $830 / $5283 = 15.71%] 43.99% [Amount change = $60270 - $41858 = $18412; Change = $18412 / $41858 = 43.99%] $100,000 $168,534 $268,534 $328,804 $84,000 $74,870 $158,870 $200,728 $16,000 $93,664 $109,664 $128,076 0.00% [Amount change = $100000 - $84000 = $16000; Change = $16000 / $84000 = 19.05%] 125.10% [Amount change = $168534 - $74870 = $93664; Change = $93664 / $74870 = 125.1%] 69.03% (Amount change = $268534 - $158870 = $109664; Change = $109664 / $158870 = 69.03%) 63.81% [Amount change = $328804 - $200728 = $128076; Change = $128076 / $200728 = 63.81%] Comment > Miller Electronics Corporation Comparative Balance Sheet December 31, 20-2 and 20-1 20-2 20-1 Assets Current assets: Cash $42,184 $21,779 47,490 74,120 Receivables (net) Merchandise inventory Supplies and prepayments 91,859 50,604 1,145 3,694 Total current assets $211,857 $121,018 $11,594 $8,070 71,640 105,353 $116,947 $79,710 $200,728 $328,804 $10,550 $6,150 Property, plant, and equipment: Office equipment (net) Factory equipment (net) Total property, plant, and equipment Total assets Liabilities Current liabilities Notes payable Accounts payable Accrued and withheld payroll taxes Total current liabilities Stockholders' Equity common stock ($10 par) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 43,607 30,425 6,113 5,283 $60,270 $41,858 $100,000 $84,000 74,870 168,534 $268,534 $ 158,870 $200,728 $328,804 Required: Prepare a horizontal analysis. Enter the amount of increase (decrease) and the percentage change. Round percentages to one decimal place. Miller Electronics Corporation Comparative Income Statement For Years Ended December 31, 20-2 and 20-1 20-2 20-1 Increase Percent Amount Amount (Decrease) Net sales (all on account) $651,730 $417,530 234,200 Cost of goods sold 393,680 256,880 136,800 Gross profit $258,050 $160,650 97,400 Administrative expenses $65,423 $43,186 22,237 Selling expenses 65,713 44,155 21,558 43,795 53,605 Total operating expenses $131,136 $87,341 Operating income $126,914 $73,309 Interest expense 1,279 1,202 Income before income taxes $125,635 $72,107 77 53,528 Income tax expense 30,527 13,186 17.341 Net income $95,108 $58,921 36,187 Miller Electronics Corporation Comparative Balance Sheet December 31, 20-2 and 20-1 Assets 20-2 20-2 Amount Percent 20-1 Amount 20-1 Percent Current assets: Cash $42,237 12.8 $21,901 11 74,975 22.79 47,980 24 Receivables (net) Merchandise inventory 90,711 27.6 49,705 24.8 3,646 1.11 / 1,103 $211,569 64.31 $120,689 60.32 Supplies and prepayments Total current assets Property, plant, and equipment: Office equipment (net) Factory equipment (net) Total prop, plant, and equip. $12,254 3.1 x $8,620 3.0 105,202 32 70,760 35.4 $117,456 35.7 $79,380 39.7 Total assets $329,025 100 $200,069 100 Liabilities 3.1 $5,940 3.0 Current liabilities: Notes payable Accounts payable Accrued and withheld payroll taxes Total current liabilities $10,340.0 43,334 6,335 13.2 30,040 15.01 1.9 5,525 2.8 $60,009 18.24 $41,505 20.75 Stockholders' Equity $100,000 169,016 30.39 $84,000 Common stock ($10 par) Retained earnings 41.99 51.4 74,564 37.3 Total stockholders' equity $269,016 81.76 $158,564 79.25 Total liab, and stockholders' equity $329,025 100 $200,069 100 Miller Electronics Corporation Comparative Income Statement For Years Ended December 31, 20-2 and 20-1 20-2 20-1 $651,730 $417,530 256,880 393,680 $258,050 $160,650 $ 65,423 $43,186 Net Sales (all on account) Cost of goods sold Gross profit Administrative expenses Selling expenses Total operating expenses Operating income Interest expense Income before income taxes 65,713 44,155 131,136 $87,341 $126,914 $73,309 1,202 1,279 $125,635 $72,107 13,186 Income tax expense 30,527 Net income $95,108 $58,921

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts