Question: I need help figuring out this question. Consider the following data: Remember the Montreal Exchange contract on Government of Canada bonds, the CGB contract. The

I need help figuring out this question.

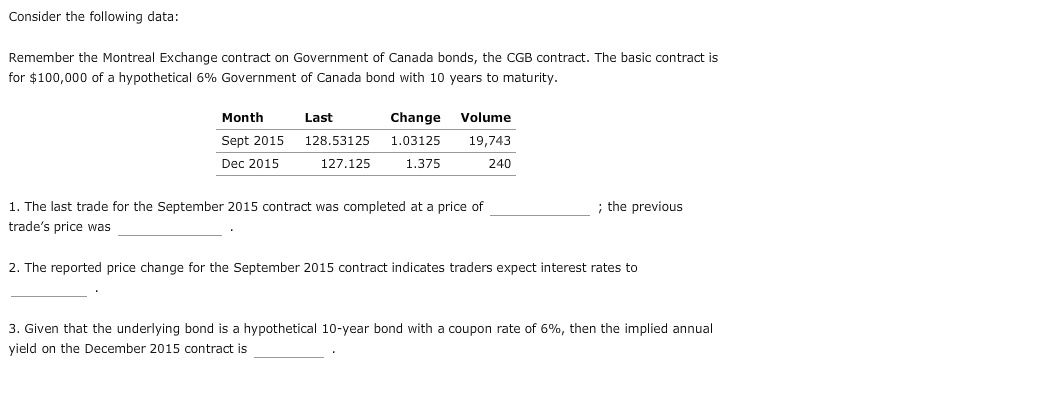

Consider the following data: Remember the Montreal Exchange contract on Government of Canada bonds, the CGB contract. The basic contract is for $100,000 of a hypothetical 6% Government of Canada bond with 10 years to maturity. Month Sept 2015 Dec 2015 Last 128.53125 127.125 Change Volume 1.03125 19,743 1.375 240 ; the previous 1. The last trade for the September 2015 contract was completed at a price of trade's price was 2. The reported price change for the September 2015 contract indicates traders expect interest rates to 3. Given that the underlying bond is a hypothetical 10-year bond with a coupon rate of 6%, then the implied annual yield on the December 2015 contract is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts