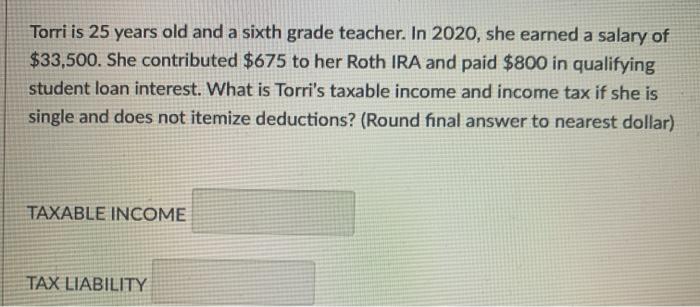

Question: i need help figuring this out Torri is 25 years old and a sixth grade teacher. In 2020, she earned a salary of $33,500. She

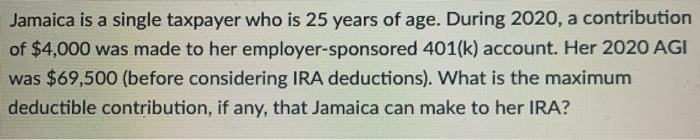

Torri is 25 years old and a sixth grade teacher. In 2020, she earned a salary of $33,500. She contributed $675 to her Roth IRA and paid $800 in qualifying student loan interest. What is Torri's taxable income and income tax if she is single and does not itemize deductions? (Round final answer to nearest dollar) TAXABLE INCOME TAX LIABILITY Jamaica is a single taxpayer who is 25 years of age. During 2020, a contribution of $4,000 was made to her employer-sponsored 401(k) account. Her 2020 AGI was $69,500 (before considering IRA deductions). What is the maximum deductible contribution, if any, that Jamaica can make to her IRA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts