Question: I need help finding the solution to Part C Revision of Depreciation A truck with a cost of $123,000 has an estimated residual value of

I need help finding the solution to Part C

I need help finding the solution to Part C

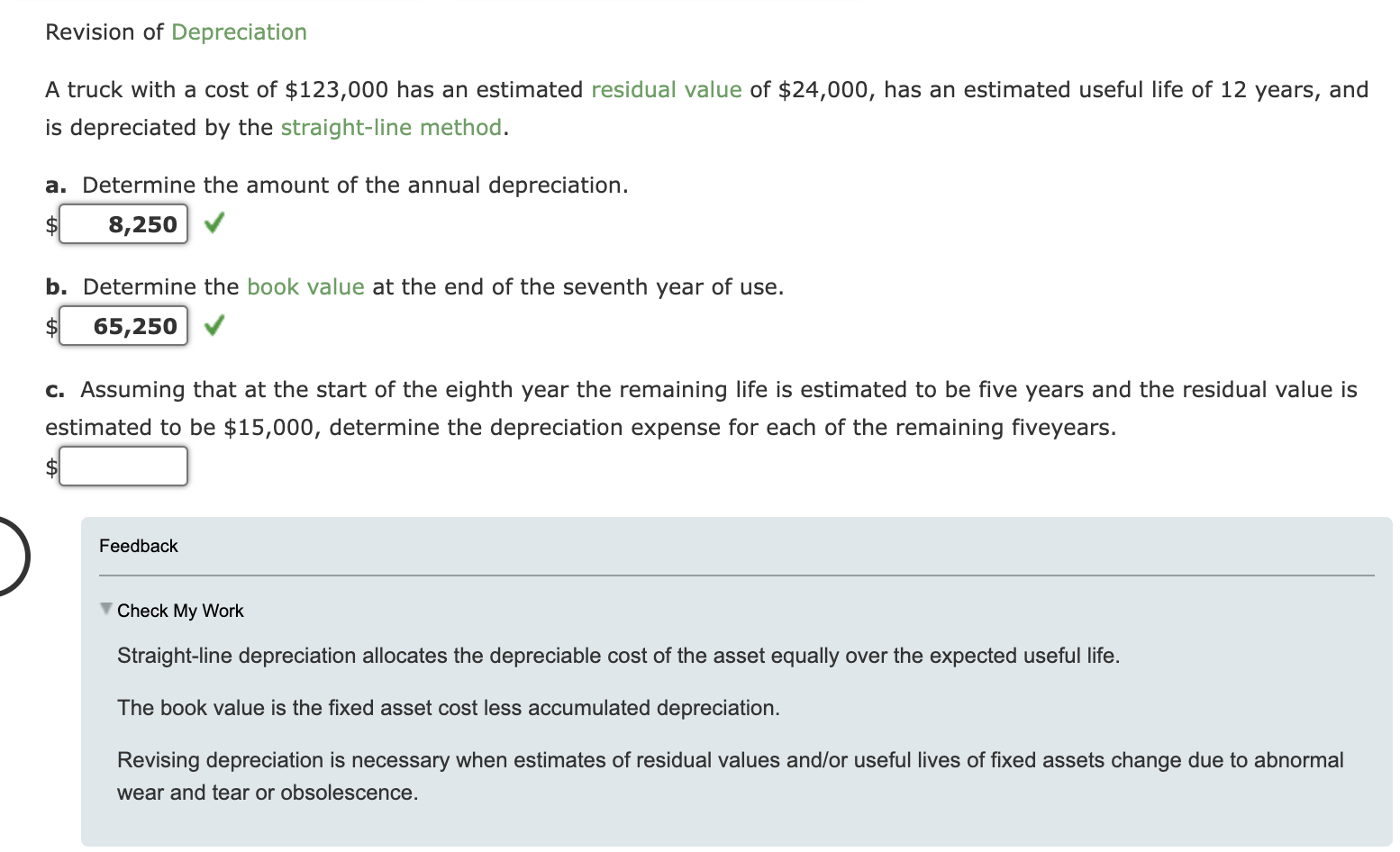

Revision of Depreciation A truck with a cost of $123,000 has an estimated residual value of $24,000, has an estimated useful life of 12 years, and is depreciated by the straight-line method. a. Determine the amount of the annual depreciation. $ b. Determine the book value at the end of the seventh year of use. $ c. Assuming that at the start of the eighth year the remaining life is estimated to be five years and the residual value is estimated to be $15,000, determine the depreciation expense for each of the remaining fiveyears. $ Feedback Check My Work Straight-line depreciation allocates the depreciable cost of the asset equally over the expected useful life. The book value is the fixed asset cost less accumulated depreciation. Revising depreciation is necessary when estimates of residual values and/or useful lives of fixed assets change due to abnormal wear and tear or obsolescence

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts