Question: I need help finding the Tax rate. N NMN A B D F G H M 1 Discounted Cash-Flow Analysis 2 Estimating depreciation of an

I need help finding the Tax rate.

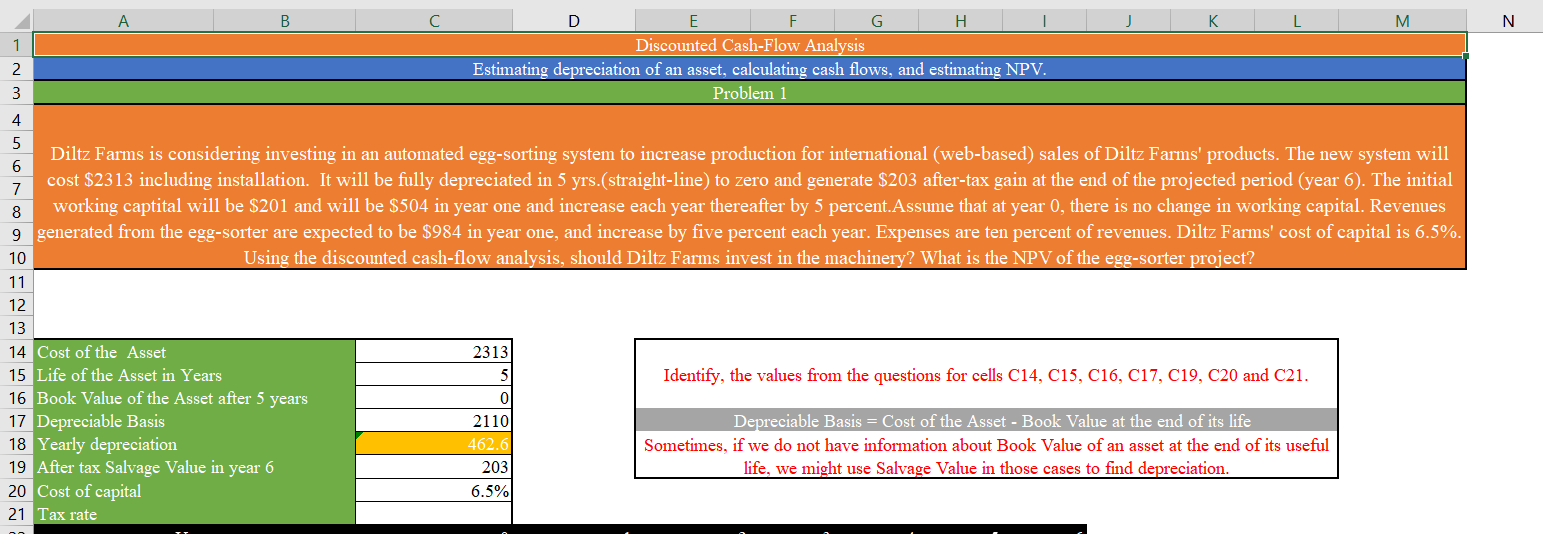

N NMN A B D F G H M 1 Discounted Cash-Flow Analysis 2 Estimating depreciation of an asset, calculating cash flows, and estimating NPV. 3 Problem 1 4. 5 Diltz Farms is considering investing in an automated egg-sorting system to increase production for international (web-based) sales of Diltz Farms' products. The new system will 6 7 cost $2313 including installation. It will be fully depreciated in 5 yrs.(straight-line) to zero and generate $203 after-tax gain at the end of the projected period (year 6). The initial 8 working captital will be $201 and will be $504 in year one and increase each year thereafter by 5 percent.Assume that at year 0, there is no change in working capital. Revenues 9 generated from the egg-sorter are expected to be $984 in year one, and increase by five percent each year. Expenses are ten percent of revenues. Diltz Farms' cost of capital is 6.5%. 10 Using the discounted cash-flow analysis, should Diltz Farms invest in the machinery? What is the NPV of the egg-sorter project? 11 12 13 14 Cost of the Asset 2313 15 Life of the Asset in Years 5 Identify, the values from the questions for cells C14, C15, C16, C17, C19, C20 and C21. 16 Book Value of the Asset after 5 years 17 Depreciable Basis 2110 Depreciable Basis = Cost of the Asset - Book Value at the end of its life 18 Yearly depreciation 462.6 Sometimes, if we do not have information about Book Value of an asset at the end of its useful 19 After tax Salvage Value in year 6 203 life, we might use Salvage Value in those cases to find depreciation. 20 Cost of capital 6.5% 21 Tax rate 0 N NMN A B D F G H M 1 Discounted Cash-Flow Analysis 2 Estimating depreciation of an asset, calculating cash flows, and estimating NPV. 3 Problem 1 4. 5 Diltz Farms is considering investing in an automated egg-sorting system to increase production for international (web-based) sales of Diltz Farms' products. The new system will 6 7 cost $2313 including installation. It will be fully depreciated in 5 yrs.(straight-line) to zero and generate $203 after-tax gain at the end of the projected period (year 6). The initial 8 working captital will be $201 and will be $504 in year one and increase each year thereafter by 5 percent.Assume that at year 0, there is no change in working capital. Revenues 9 generated from the egg-sorter are expected to be $984 in year one, and increase by five percent each year. Expenses are ten percent of revenues. Diltz Farms' cost of capital is 6.5%. 10 Using the discounted cash-flow analysis, should Diltz Farms invest in the machinery? What is the NPV of the egg-sorter project? 11 12 13 14 Cost of the Asset 2313 15 Life of the Asset in Years 5 Identify, the values from the questions for cells C14, C15, C16, C17, C19, C20 and C21. 16 Book Value of the Asset after 5 years 17 Depreciable Basis 2110 Depreciable Basis = Cost of the Asset - Book Value at the end of its life 18 Yearly depreciation 462.6 Sometimes, if we do not have information about Book Value of an asset at the end of its useful 19 After tax Salvage Value in year 6 203 life, we might use Salvage Value in those cases to find depreciation. 20 Cost of capital 6.5% 21 Tax rate 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts