Question: I need help formatting the ratios for an analysis. I think I have calculated them correctly. Instructions for the project: Instructions * Choose any publicly

I need help formatting the ratios for an analysis. I think I have calculated them correctly.

Instructions for the project:

Instructions

Choose any publicly traded company of your choice

Locate the companys latest published annual report

Review the balance sheet, income statement, and statement of cash flows

Calculate a minimum of ratios from the ratios studied during the course

Complete an analysis of the financial condition of the company based on the ratio analysis and additional information found in the annual report

Your final report should consist of the following:

o Overview of the company and its industry

o Productsservices offered

o History of the stock price

o Results of the financial ratio analysis

o Key financial highlights and lowlights found in the annual report

o Key points from the CEOs letter to shareholders in the annual report

o Recommendations to the company on how to improve its financial performance for the future.

o Provides the decision on whether to invest or not in this company with supporting information based on the financial analysis completed.

Length of assignment The final project should be to pages, not including the financial statements and the ratio analysis, which should be placed in the Appendix. The assignments should be submitted in a Word document with spreadsheets embedded in the Word document, as needed.

o A cover page is also required, but not part of the to pages of content. A properly formatted reference page and corresponding intext citations are also required.

You should use APA formatting

A minimum of five scholarly citations are required

Acceptable sources include scholarly articles published within the last five years and your textbook.

What I calculated for the ratios.

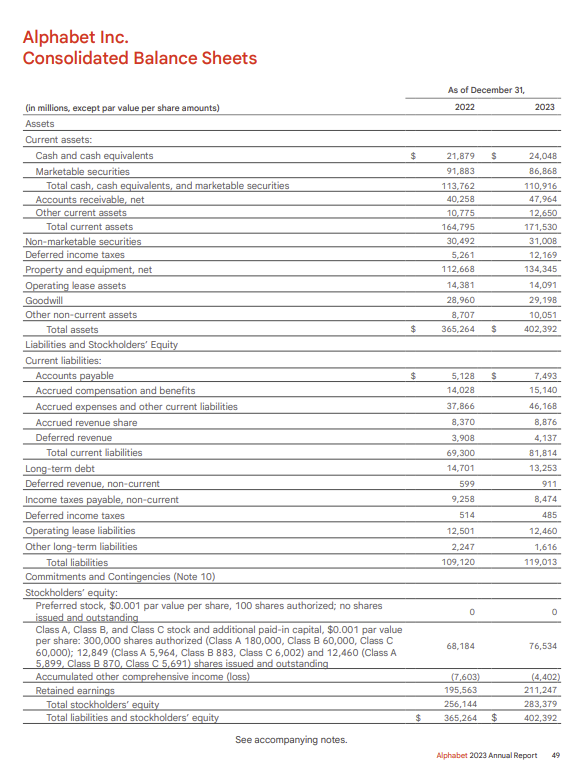

current ratio total current assetstotal current liabilities

quick ratio cash marketable securities accounts receivable current liabilities

debttoequity ratio total liabilitiestotal shareholders equity

return on assets net income total assets

return on equity net income shareholders equity

free cash flow net cash provided by operating activities purchases of property and equipment

dividend yield didnt pay dividends until page of annual report. Part I

Part II

Part III

Part IV

Alphabet Inc.

Consolidated Statements of Income

Year Ended December

begintabularccccccc

hline multirowbin millions, except per share amounts & multicolumncYear Ended December

hline & multicolumnc & multicolumnl &

hline Revenues & $ & & $ & & $ &

hline multicolumnlCosts and expenses:

hline Cost of revenues & & & & & &

hline Research and development & & & & & &

hline Sales and marketing & & & & & &

hline General and administrative & & & & & &

hline Total costs and expenses & & & & & &

hline Income from operations & & & & & &

hline Other income expense net & & & & & &

hline Income before income taxes & & & & & &

hline Provision for income taxes & & & & & &

hline Net income & $ & & $ & & $ &

hline Basic net income per share of Class A Class B and Class C stock & $ & & $ & & $ &

hline Diluted net income per share of Class A Class B and Class C stock & $ & & $ & & $ &

hline

endtabular

See accompanying notes.

So

Alphabet Annual Report Part I

Part II

Part III

Part IV

Alphabet Inc.

Consolidated Statements of Comprehensive Income

Year Ended December

begintabularccccccc

hline multirowbin millions & multicolumnl

hline & multicolumnr & & & &

hline Net income & $ & & $ & & $ &

hline multicolumnlOther comprehensive income loss:

hline Change in foreign currency translation adjustment & & & & & &

hline multicolumnlAvailableforsale investments:

hline Change in net unrealized gains losses & & & & & &

hline Less: reclassification adjustment for net gains losses included in net income & & & & & &

hline Net change, net of income tax benefit expense of $ $ and $ & & & & & &

hline multicolumnlCash flow hedges:

hline Change in net unrealized gains losses & & & & & &

hline Less: reclassification adjustment for net gains losses included in net income & & & & & &

hline Net change, net of income tax benefit expense of $$ and $ & & & & & &

hline Other comprehensive income loss & & & & & &

hline Comprehensive income & $ & & $ & & $ &

hline

endtabular

See accompanying notes.

Alphabet Annual Report

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock