Question: I need help here. Let X, be a diffusion that satisfies ax, - (X, ! )d to (X,.()dB, where B is a standard Brownum

I need help here.

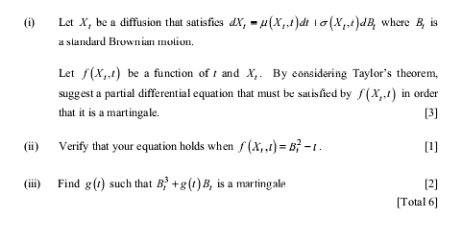

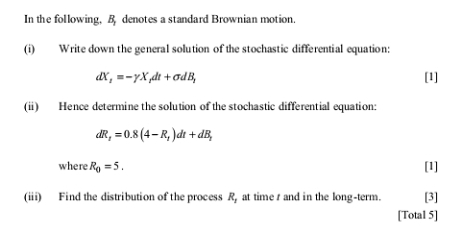

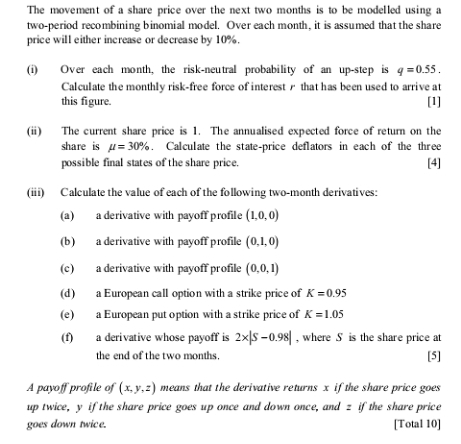

Let X, be a diffusion that satisfies ax, - " (X, ! )d to (X,.()dB, where B is a standard Brownum motion. Let f(X,,/) be a function of r and X. By considering Taylor's theorem, suggest a partial differential equation that must be satisfied by /( X,,( ) in order that it is a martingale. (3] Verify that your equation holds when / (X, .) = 8; -1. [1] (iii) Find g (r) such that B) + g (r) 8, is a martingale (2] [Total 6]In the following. 8, denotes a standard Brownian motion. (1) Write down the general solution of the stochastic differential equation: dX, --yX,di + odB, [1] (ii) Hence determine the solution of the stochastic differential equation: dR =0.8 (4-R, )di + dB, where Ro =5. [1] (ill) Find the distribution of the process R, at time r and in the long-term. (31 [Total 5]The movement of a share price over the next two months is to be modelled using a two-period recombining binomial model. Over each month, it is assumed that the share price will either increase or decrease by 10%. (i) Over each month, the risk-neutral probability of an up-step is q=0.55. Calculate the monthly risk-free force of interest " that has been used to arrive at this figure. [1] (ii) The current share price is 1. The annualised expected force of return on the share is #=30%. Calculate the state-price deflators in each of the three possible final states of the share price. [4] (iin) Calculate the value of each of the following two-month derivatives: (a) a derivative with payoff profile (1,0,0) (b) a derivative with payoff profile (0,1.0) (c) a derivative with payoff profile (0,0,1) ( p) a European call option with a strike price of K =0.95 (e) a European put option with a strike price of K =1.05 (f) a derivative whose payoff is 2x|$ -0.98) , where S is the share price at the end of the two months. [5] A payoff profile of (x. y. =) means that the derivative returns x if the share price goes up twice, y if the share price goes up once and down once, and z if the share price goes down twice. [Total 10]