Question: I need help, I have tried this question a few times, and I can not get it right. 2. How much life insurance do you

I need help, I have tried this question a few times, and I can not get it right.

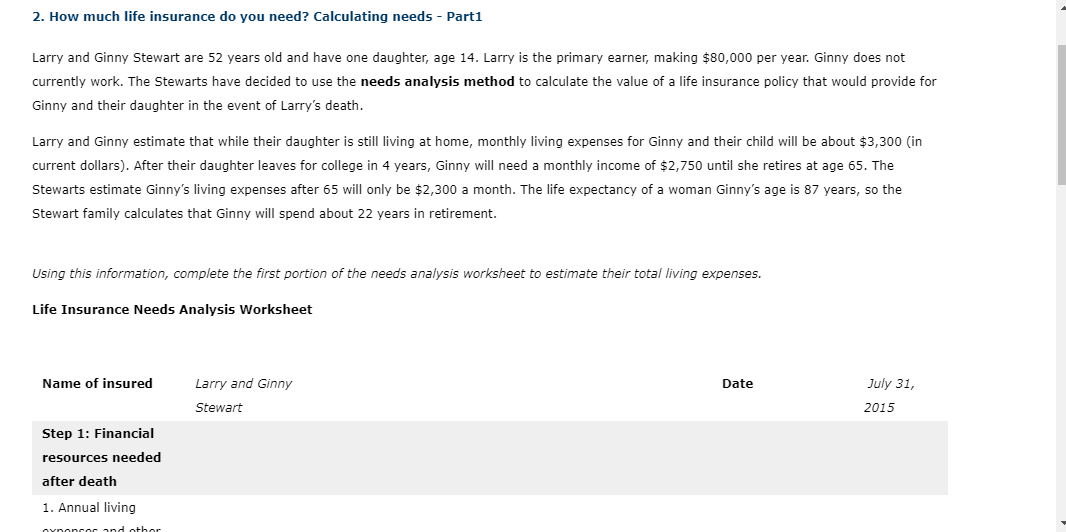

2. How much life insurance do you need? Calculating needs - Part1 Larry and Ginny Stewart are 52 years old and have one daughter, age 14. Larry is the primary earner, making $80,000 per year. Ginny does not currently work. The Stewarts have decided to use the needs analysis method to calculate the value of a life insurance policy that would provide for Ginny and their daughter in the event of Larry's death. Larry and Ginny estimate that while their daughter is still living at home, monthly living expenses for Ginny and their child will be about $3,300 (in current dollars). After their daughter leaves for college in 4 years, Ginny will need a monthly income of $2,750 until she retires at age 65 . The Stewarts estimate Ginny's living expenses after 65 will only be $2,300 a month. The life expectancy of a woman Ginny's age is 87 years, so the Stewart family calculates that Ginny will spend about 22 years in retirement. Using this information, complete the first portion of the needs analysis worksheet to estimate their total living expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts