Question: PLEASE HELP FOR BOTH QUESTIONS ASAP! Sweet & Co. just announced it is increasing its annual dividend to $3 next year and establishing a policy

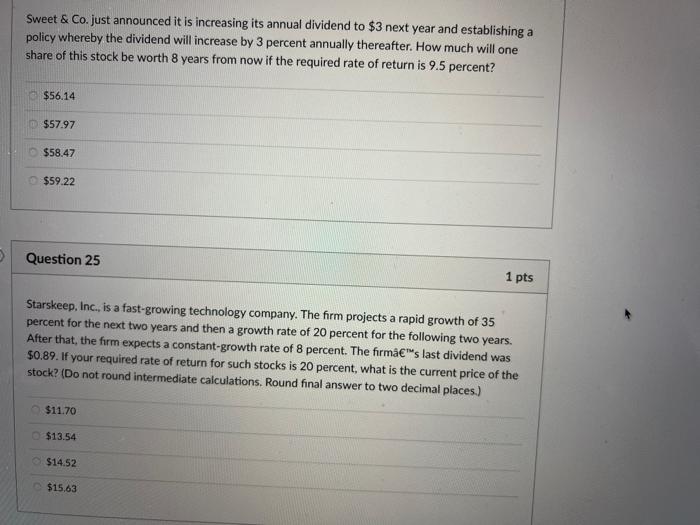

Sweet \& Co. just announced it is increasing its annual dividend to $3 next year and establishing a policy whereby the dividend will increase by 3 percent annually thereafter. How much will one share of this stock be worth 8 years from now if the required rate of return is 9.5 percent? $56.14 $57.97 $58.47 $59.22 Question 25 1 pts Starskeep, Inc., is a fast-growing technology company. The firm projects a rapid growth of 35 percent for the next two years and then a growth rate of 20 percent for the following two years. After that, the firm expects a constant-growth rate of 8 percent. The firma Eross last dividend was $0.89. If your required rate of return for such stocks is 20 percent, what is the current price of the stock? (Do not round intermediate calculations. Round final answer to two decimal places.) $11.70 $13.54 $14.52 $15.63

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts