Question: I need help in completing the ratios for the most recent year for Costco and one of the three statements listed in requirement one of

I need help in completing the ratios for the most recent year for Costco and one of the three statements listed in requirement one of the project. If you need any more information please don't cancel the question and ask me what you need to understand my question is due tomorrow I have tried to figure out how to solve and to get the ratios but I keep getting it wrong I don't understand even with the books help and the only reason I have the book's explanation is that no one can help me figure it out and just cancel my question I don't intend to use your work I just want someone to explain to me how to solve and get ratios I don't understand math or accounting is hard

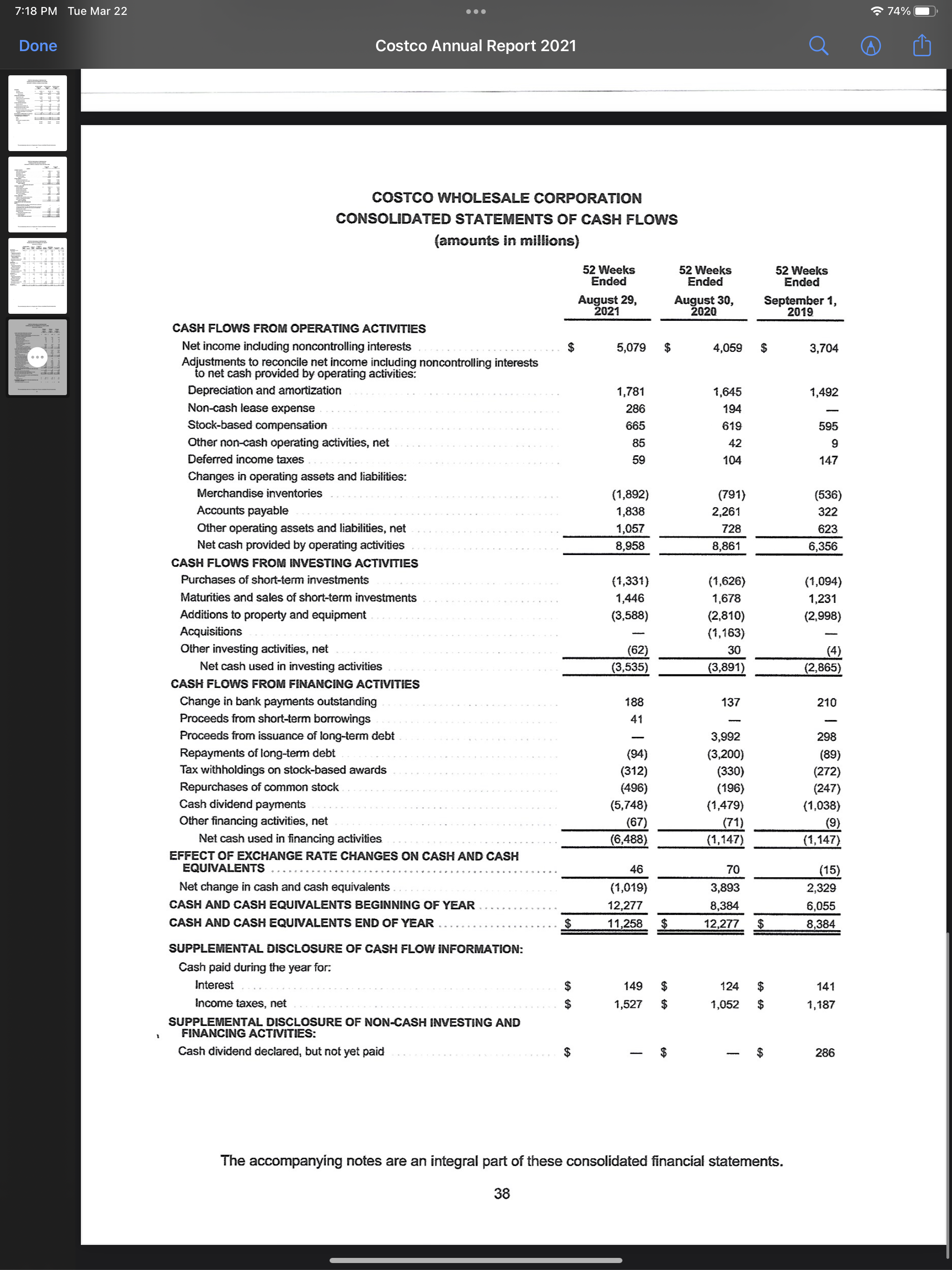

7:18 PM Tue Mar 22 74% Done Costco Annual Report 2021 Q COSTCO WHOLESALE CORPORATION CONSOLIDATED BALANCE SHEETS (amounts in millions, except par value and share data) August 29, August 30, 2021 2020 ASSETS CURRENT ASSETS Cash and cash equivalents $ 11,258 $ 12,277 Short-term investments 917 1,028 Receivables, net 1,803 1,550 Merchandise inventories 14,215 12,242 Other current assets 1,312 1,023 Total current assets 29,505 28,120 OTHER ASSETS Property and equipment, net . 23,492 21,807 Operating lease right-of-use assets . . .. 2,890 2,788 Other long-term assets . 3,381 2,841 TOTAL ASSETS .......... . . . . . . . . . . . .. 59,268 $ 55,556 LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable $ 16,278 $ 14,172 Accrued salaries and benefits . 4,090 3,605 Accrued member rewards 1,671 1,393 Deferred membership fees . . . . .. . 2,042 1,851 Current portion of long-term debt . . . . . . .. 799 95 Other current liabilities 4,561 3,728 Total current liabilities .. 29,441 24.844 OTHER LIABILITIES Long-term debt, excluding current portion 6,692 7,514 Long-term operating lease liabilities 2,642 2,558 Other long-term liabilities 2,415 1,935 TOTAL LIABILITIES 41,190 36,851 COMMITMENTS AND CONTINGENCIES EQUITY Preferred stock $0.01 par value; 100,000,000 shares authorized; no shares issued and outstanding Common stock $0.01 par value; 900,000,000 shares authorized; 441,825,000 and 441,255,000 shares issued and outstanding Additional paid-in capital 7,031 6,698 Accumulated other comprehensive loss . . .. (1,137) (1,297) Retained earnings 11,666 12,879 Total Costco stockholders' equity .. .. 17,564 18,284 Noncontrolling interests 514 421 TOTAL EQUITY . 18,078 18,705 TOTAL LIABILITIES AND EQUITY 59,268 $ 65,556 The accompanying notes are an integral part of these consolidated financial statements. 367122 PM Tue Mar 22 Insert Draw Layout Review View Problem Data A. You will be assigned a company by group. Requirements 1. Prepare comparative 2020 balance sheet (in good form) for the company. Round all percents to tenths (0.0%). Prepare a common-size income statement (see textbook for example). Prepare a trend analysis using the income statement for three years Compute the ratios listed on the following page. Compare with with industry averages (readyratios.com/sec) State your answers in correct format with proper iabels and rounding as -shown in the textbook, i.e., turnover-3. 4 times, Days' sales- 42 days, prot margin- 8. 3%, etc. . Prepare a one to one and a half page memo to me, making a recommendation to buy or not the stock of your company: Write about the reasons for your decision. The following are some ideas about what you might include in your one page memo. These are some suggestions. You will not likely use all these or you may use your own ideas as to how to write your memo. a. A brief summary of what your company does and any. recent news about your company. b. Comment .on any signicant numbers and changes .you see in your company based on the camparative balance sheet, the common size income statement, and the income statement trend percentages you created. 0. Comment on ratios you think are signicant. Comment on how the ratios for ' your company compare to industry ratio's. Is your company leading or trailing the industry in certain areas. d. Comment on your own personal experience with the company. What do you think about their products or services? Do you have a positive or negative view of the. way the company deals with customers. - e. Comment on whether the stock is expensive or a \"value\" stock. Comment on how the price-earnings ratio effects your buy or not to buy recommendation. f. Make a buy or no buy recommendation to m.e Back up your decision with ' appropriate analysis and numbers. Your analysis statement should be prepared on a word processor. The document should contain precise, clear statements indicating your group's viewpoints and supporting computations. Complete sentences composed of correct grammar and spelling should be applied in your document. Supbmit your analysis in the assignment dropbox In our NS Online class. ?73%- 7:18 PM Tue Mar 22 74% Done Costco Annual Report 2021 A COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF EQUITY (amounts in millions) Common Stock Accumulated Additional Other Total Costco Shares Paid-in Comprehensive Retained Stockholders' Noncontrolling Total (000's) Amount Capital Income (Loss) Earnings Equity Interests Equity BALANCE AT SEPTEMBER 2, 2018 438, 189 $ 4 $ 6,107 $ (1,199) $ 7,887 $ 12,799 $ 304 $ 13,103 Net income 3,659 3,659 15 3,704 Foreign-currency translation adjustment and other, net (237) (237) (8 (245) Stock-based compensation 598 598 - 598 Release of vested restricted stock units (RSUS), including tax effect 2,533 (272) (272) (272) Repurchases of common stock (1,097) (16) (231) (247) 1 (247) Cash dividends declared and other (1,057) (1,057) (1,057) BALANCE AT SEPTEMBER 1, 2019 439,625 A 6,417 (1,436) 10,25 15,24 341 15,584 Net income 4,002 4,002 57 4,059 Foreign-currency translation adjustment and other, net 139 139 23 162 Stock-based compensation 621 621 - 621 Release of vested RSUs, including tax effects 2,273 (330 (330) - (330) Repurchases of common stock (643) (10) (188) (198) (198) 11 1 Cash dividends declared (1,193) (1, 193) (1,193) BALANCE AT AUGUST 30, 2020 441,255 4 6,698 (1,297) 12,879 18,284 421 18,705 Net income 5,007 5,007 72 5,079 Foreign-currency translation adjustment and other, net 160 160 21 181 Stock-based compensation 668 668 - 668 Release of vested RSUs including tax effects 928 1 1 (312) (312) (312 Repurchases of common stock (1,358) (23) (472) (495) (495) Cash dividends declared 5,748) (5,748) (5,748) BALANCE AT AUGUST 29, 2021 441,825 $ S 7,031 $ (1,137) $ 11,666 $ 17,564 $ 514 $ 18,078 The accompanying notes are an integral part of these consolidated financial statements. 377:18 PM Tue Mar 22 . . . 74% Done Costco Annual Report 2021 Q COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF INCOME (amounts in millions, except per share data) 52 Weeks Ended 52 Weeks Ended 52 Weeks Ended August 29, August 30, September 1, 2021 2020 2019 REVENUE Net sales $ 192,052 $ 163,220 $ 149,351 Membership fees . 3.877 3,541 3.352 Total revenue 195,929 166,761 152,703 OPERATING EXPENSES Merchandise costs 170,684 144,939 132,886 Selling, general and administrative 18,461 16,332 14,994 Preopening expenses 76 55 86 Operating income 6,708 5,435 4,737 OTHER INCOME (EXPENSE) Interest expense (171) (160) (150) Interest income and other, net 143 92 178 INCOME BEFORE INCOME TAXES . 5,680 5,367 4,765 Provision for income taxes 1,601 1,308 1,061 Net income including noncontrolling interests 5,079 4,059 3,704 Net income attributable to noncontrolling interests (72) (57) 45) NET INCOME ATTRIBUTABLE TO COSTCO . . .. $ 5,007 $ 4,002 3,659 NET INCOME PER COMMON SHARE ATTRIBUTA Basic 11.30 $ 9.05 $ B.32 Diluted 1.27 $ 9.02 $ 3.26 Shares used in calculation (000's) Basic 443,089 442,297 439,755 Diluted . 444,346 443,901 442,923 The accompanying notes are an integral part of these consolidated financial statements. 347122 PM Tue Mar 22 "5' 73% I Insert Draw Layout Review View ACCT 1020 Principles of Accounting II Project Chapter 17 Specifications Objectives - Perform ratio and nancial statement analysis . Apply critical thinking skills (analysis, evaluation, inference) Due Date 'and Submission Projects must be submitted no later than: March 29 Problem Instructions Follow the problem instructions below assigned by yourinstructor and based on Chapter 17 problems from the Fundamental Accounting Principles text attached to the Project page. ' Resources Resources include Chapter 17 of your accounting text and you may also nd resources on the Internet reuters. com (for industry comparisons). Your instructor Is also available to assist you as well. ' , Presentation The work .for this project should be neatly prepared and presented. Computer-generated work (charts, graphs) can be used to strengthen your presentation. Prepare a cover sheet for your 1 project containing the following information: Your Name(s) . Chapter 17 Project ACCT-1020-(Section #) Semester - Spring 2022 Presentation is assessed and will be graded subjectively and competitively. 1 Analysis A percentage of the project score, is also basedlon your analysis and comments of the ndings. You will be asked to select a path of action. Your analysis score will not be based on the options you choose, but on the data and reasoning you use to back up your decision. Grading See the attached grade sheet for- additional information on the distribution of points for this project. Academic Integrity . Each project should be your original work. Violations of the Academic Integrity policy as outlined on the course syllabus will result In a grade of --0 on this project for all team members. Impact The score earned on this projectis worth 5% of your nal course grade. 7:18 PM Tue Mar 22 . . . 74% Done Costco Annual Report 2021 Q A COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (amounts in millions) 52 Weeks 52 Weeks 52 Weeks Ended Ended Ended August 29 August 30, September 1, 2021 2020 2019 CASH FLOWS FROM OPERATING ACTIVITIES Net income including noncontrolling interests $ 5,079 $ 4.059 $ 3,704 Adjustments to reconcile net income including noncontrolling interests to net cash provided by operating activities: Depreciation and amortization 1,781 1.645 1,492 Non-cash lease expense 28 194 Stock-based compensation 665 619 595 Other non-cash operating activities, net 85 42 9 Deferred income taxes 59 104 147 Changes in operating assets and liabilities: Merchandise inventories (1,892) (791) (536) Accounts payable ,838 2.261 322 Other operating assets and liabilities, net 1,057 728 523 Net cash provided by operating activities 8,958 8,861 5,356 CASH FLOWS FROM INVESTING ACTIVITIES Purchases of short-term investments (1,331) (1,626) (1,094) Maturities and sales of short-term investments 1,446 1,678 1,231 Additions to property and equipment (3,588) (2,810) (2,998) Acquisitions (1,163) Other investing activities, net (62) 30 ( 4) Net cash used in investing activities (3,535) (3,891) (2,865) CASH FLOWS FROM FINANCING ACTIVITIES Change in bank payments outstanding 188 137 210 Proceeds from short-term borrowings 41 Proceeds from issuance of long-term debt 3,992 298 Repayments of long-term debt (94) (3,200) (89) Tax withholdings on stock-based awards 312 (330) 272) Repurchases of common stock (496) (196) (247) Cash dividend payments (5,748) (1,479) (1,038) Other financing activities, net ( 67) (71) (9) Net cash used in financing activities 6,488) 1,147) 1,147) EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS . . . . . ....... 46 70 (15) Net change in cash and cash equivalents (1,019) 3,893 2,329 CASH AND CASH EQUIVALENTS BEGINNING OF YEAR . 12,277 3,38 6,055 CASH AND CASH EQUIVALENTS END OF YEAR ..... 11,258 12,277 8,384 SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: Cash paid during the year for: Interest 149 $ 24 141 Income taxes, net ,527 1,052 1,187 SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING ACTIVITIES: Cash dividend declared, but not yet paid $ $ 286 The accompanying notes are an integral part of these consolidated financial statements. 38

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts