Question: I need help on how to calculate problems I got wrong correctly. please show the work On December 1 of the current year, the following

I need help on how to calculate problems I got wrong correctly. please show the work

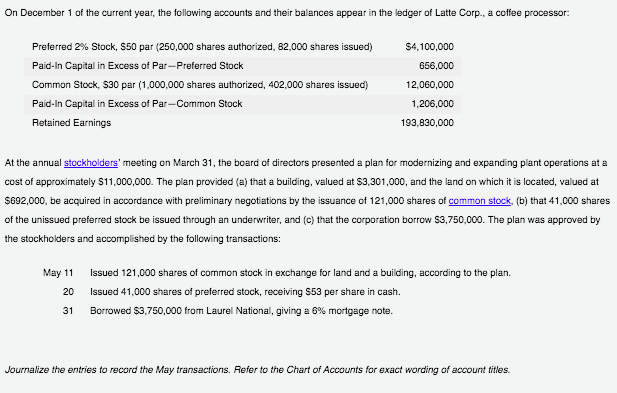

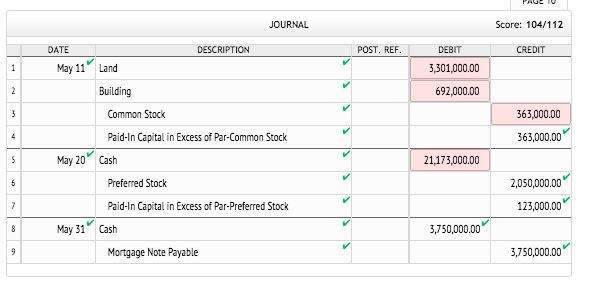

On December 1 of the current year, the following accounts and their balances appear in the ledger of Latte Corp., a coffee processor: Preferred 2% Stock, S50 par (250,000 shares authorized, 82,000 shares issued) Paid-In Capital in Excess of Par-Preferred Stock Common Stock, $30 par (1,000,000 shares authorized, 402,000 shares issued) Paid-In Capital in Excess of Par-Common Stock Retained Earnings $4,100,000 656,000 12,060,000 1,206,000 193,830,000 At the annual stockholders meeting on March 31, the board of directors presented a plan for modernizing and expanding plant operations at a cost of approximately S11,000,000. The plan provided (a) that a building, valued at $3,301,000, and the land on which it is located, valued at $692,000, be acquired in accordance with preliminary negotiations by the issuance of 121,000 shares of common stock, (b) that 41,000 shares of the unissued preferred stock be issued through an underwriter, and (c) that the corporation borrow $3,750,000. The plan was approved by the stockholders and accomplished by the following transactions: May 11 Issued 121,000 shares of cornmon stock in exchange for land and a building, according to the plan. 20 Issued 41,000 shares of preferred stock, receiving $53 per share in cash Borrowed $3.750,000 from Laurel National, giving a 6% mortgage note. 31 Journalize the entries to record the May transactions. Refer to the Chart of Accounts for exact wording of account titles. JOURNAL Score: 104/112 DATE DESCRIPTION POST. REF DEBIT CREDIT May 11 Land 3,301,000.00 692,000.00 Building Common Stock 363,000.00 Paid-In Capital in Excess of Par-Common Stock 363,000.00 SMay 20 Cash 21,173,000.00 2050,000.00 Preferred Stock Paid-In Capita in Excess of Par-Preferred Stock 123,000.00 3750,000.00 May 31 Cash 3750,000.00 Mortgage Note Payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts