Question: I need help on part 3 (preparing the stockholders equity section of the balance sheet for both plans). > Decision Case 13-1 Lena Kay and

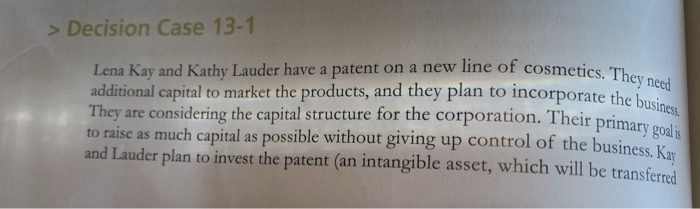

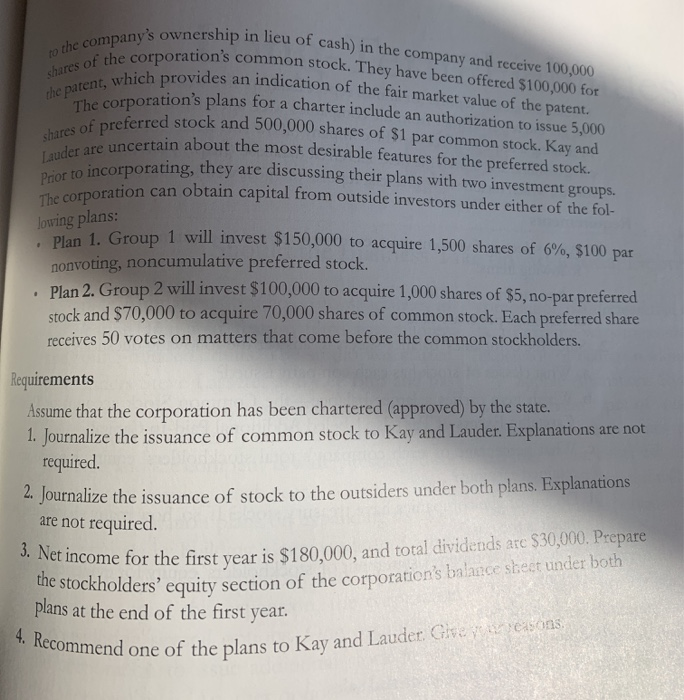

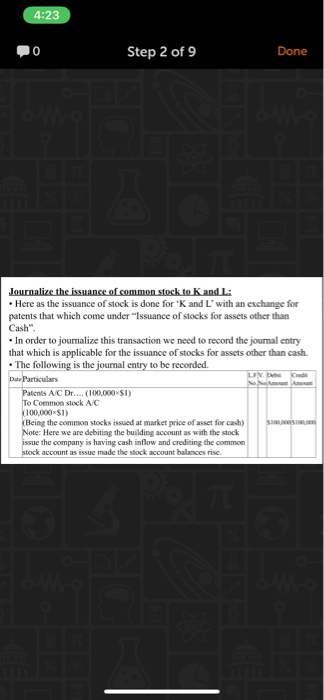

> Decision Case 13-1 Lena Kay and Kathy Lauder have a patent on a new line of cosmetics, Th additional capital to market the products, and they plan to incorporate the bus They are considering the capital structure for the corporation. Their primar to raise as much capital as possible without giving up control of the business Ka and Lauder plan to invest the patent (an intangible asset, which will be transferred ess 's ownership in lieu of cash) in the company and receive 100,000 hares of tuehich provides an indication of the fair market value of the patent. the company's he patent, which provides a hares of preferred and oration's common stock. They have been offered $100,000 for on's plans for a charter include an authorization to issue 5,000 ed stock and 500,000 shares of $1 par common stock. Kay and e uncertain about the most desirable features for the preferred stock. o incorporating, they are discussing their plans with two investment groups. Prior The corpora owing plans: ration can obtain capital from outside investors under either of the fol- I will invest $150,000 to acquire 1,500 shares of 6%, $100 par n 1. Group nonvoting, noncumulative preferred stock Plan 2. Group 2 will invest $100,000 to acquire 1,000 shares of $5, no-par preferred stock and $70,000 to acquire 70,000 shares of common stock. Each preferred share receives 50 votes on matters that come before the common stockholders. , Pla . Kequirements Assume that the corporation has been chartered (approved) by the state. I. Journalize the issuance of common stock to Kay and Lauder. Explanations are not required the issuance of stock to the outsiders under both plans. Explanations are not required etincome for the first year is $180,000, and total dividends are $30,000. Prepare e stockholders'equity section of the corporation's balance shest under both plans at the end of the first year easons 4. Recomme end one of the plans to Kay and Lauden 0 Step 2 of 9 Done KandLi Here as the issuance of stock is done for 'K and L' with an exchange for patents that which come under "Issuance of stocks for assets other than Cash" In order to joumalize this transaction we need to record the journal entry that which is applicable for the issuance of stocks for assets other than cash. The following is the journal entry o be recorded Date Particulars Patents A/C Dr.... 00,00 S1) To Common stock A/C 100,000 5I) Being the common stocks issued at market price of asset for cash) suusUn Here we are debiting the building account as with the stock the company is having cash inflow and crediting the common k account as issue made the stock account balances rise. 4:23 0 Step 3 of S Done 2. Here as the corporation is having two altematives to accumulate the required capital for expansion of business we are asked to prepare the journal entries under the assumption of stock issue in each of the alternatives. The following are the journal entries that which need to be recorded in each lan > Decision Case 13-1 Lena Kay and Kathy Lauder have a patent on a new line of cosmetics, Th additional capital to market the products, and they plan to incorporate the bus They are considering the capital structure for the corporation. Their primar to raise as much capital as possible without giving up control of the business Ka and Lauder plan to invest the patent (an intangible asset, which will be transferred ess 's ownership in lieu of cash) in the company and receive 100,000 hares of tuehich provides an indication of the fair market value of the patent. the company's he patent, which provides a hares of preferred and oration's common stock. They have been offered $100,000 for on's plans for a charter include an authorization to issue 5,000 ed stock and 500,000 shares of $1 par common stock. Kay and e uncertain about the most desirable features for the preferred stock. o incorporating, they are discussing their plans with two investment groups. Prior The corpora owing plans: ration can obtain capital from outside investors under either of the fol- I will invest $150,000 to acquire 1,500 shares of 6%, $100 par n 1. Group nonvoting, noncumulative preferred stock Plan 2. Group 2 will invest $100,000 to acquire 1,000 shares of $5, no-par preferred stock and $70,000 to acquire 70,000 shares of common stock. Each preferred share receives 50 votes on matters that come before the common stockholders. , Pla . Kequirements Assume that the corporation has been chartered (approved) by the state. I. Journalize the issuance of common stock to Kay and Lauder. Explanations are not required the issuance of stock to the outsiders under both plans. Explanations are not required etincome for the first year is $180,000, and total dividends are $30,000. Prepare e stockholders'equity section of the corporation's balance shest under both plans at the end of the first year easons 4. Recomme end one of the plans to Kay and Lauden 0 Step 2 of 9 Done KandLi Here as the issuance of stock is done for 'K and L' with an exchange for patents that which come under "Issuance of stocks for assets other than Cash" In order to joumalize this transaction we need to record the journal entry that which is applicable for the issuance of stocks for assets other than cash. The following is the journal entry o be recorded Date Particulars Patents A/C Dr.... 00,00 S1) To Common stock A/C 100,000 5I) Being the common stocks issued at market price of asset for cash) suusUn Here we are debiting the building account as with the stock the company is having cash inflow and crediting the common k account as issue made the stock account balances rise. 4:23 0 Step 3 of S Done 2. Here as the corporation is having two altematives to accumulate the required capital for expansion of business we are asked to prepare the journal entries under the assumption of stock issue in each of the alternatives. The following are the journal entries that which need to be recorded in each lan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts