Question: I need help on the above problem. I don't understand where the -$47,600, 92,400 are coming from, and why it is a negative 475,000 at

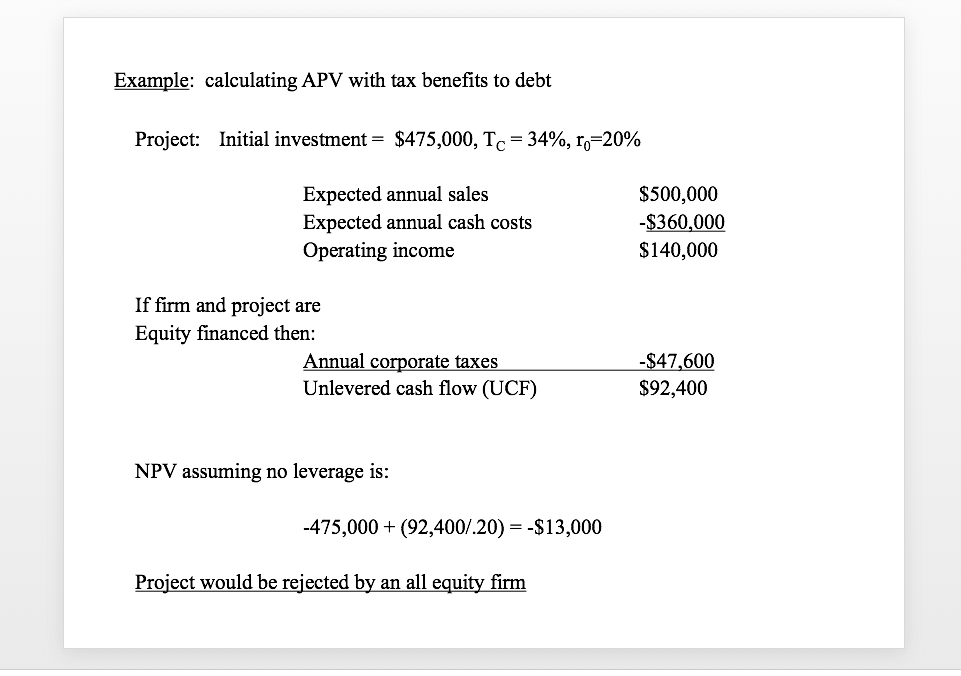

I need help on the above problem. I don't understand where the -$47,600, 92,400 are coming from, and why it is a negative 475,000 at the bottom. If someone oculd explain how to get these numbers and why, that would be awesome.

It would be much appreciated!

Example: calculating APV with tax benefits to debt Project: Initial investment $475,000, Tc-34%, ro-20% Expected annual sales Expected annual cash costs Operating income $500,000 $360,000 $140,000 If firm and project are Equity financed then: Annual corporate taxes Unlevered cash flow (UCF) -$47,600 $92,400 NPV assuming no leverage is: 475,000(92,400/.20)S13,000 Project would be rejected by an all equity firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts