Question: I need help on these questions, please show the work as well. I greatly appreciate it! A 30-day T-bill is currently yielding 5.5%. The following

I need help on these questions, please show the work as well. I greatly appreciate it!

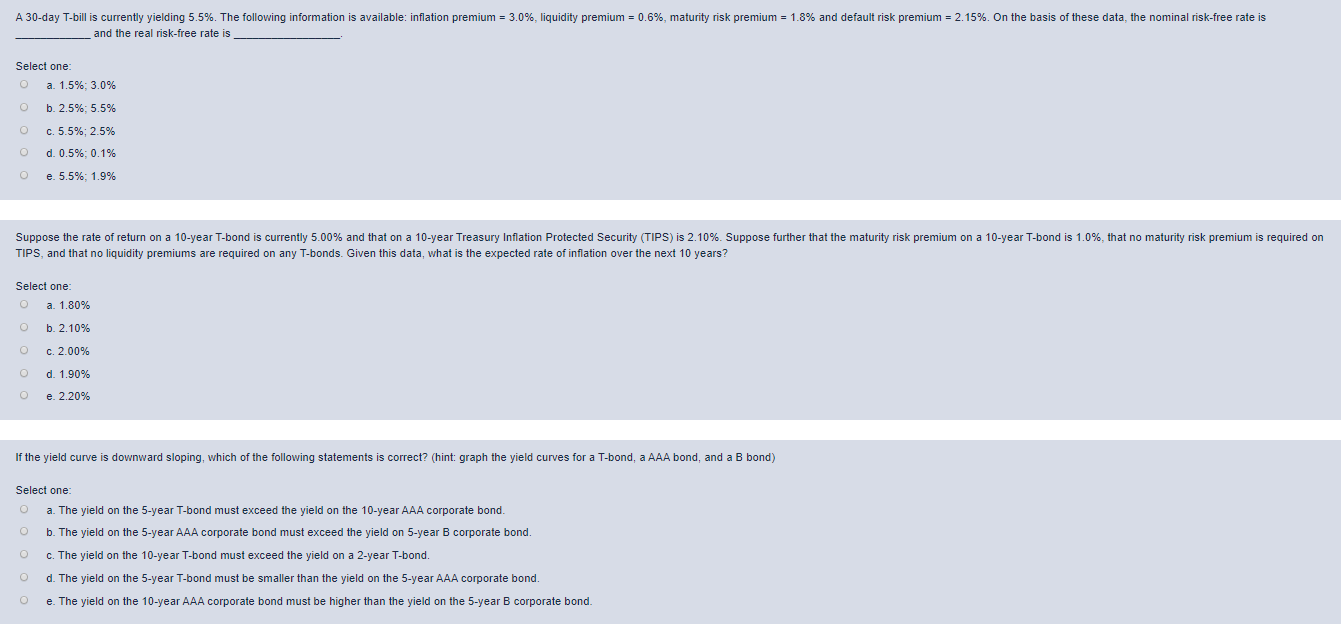

A 30-day T-bill is currently yielding 5.5%. The following information is available: inflation premium = 3.0%, liquidity premium = 0.6%, maturity risk premium = 1.8% and default risk premium = 2.15%. On the basis of these data, the nominal risk-free rate is __ and the real risk-free rate is Select one: O a. 1.5%; 3.0% O b. 2.5%; 5,5% O c. 5.5%; 2.5% O d. 0.5%; 0.1% O e. 5.5%: 1.9% Suppose the rate of return on a 10-year T-bond is currently 5.00% and that on a 10-year Treasury Inflation Protected Security (TIPS) is 2.10%. Suppose further that the maturity risk premium on a 10-year T-bond is 1.0%, that no maturity risk premium is required on TIPS, and that no liquidity premiums are required on any T-bonds. Given this data, what is the expected rate of inflation over the next 10 years? Select one: O a. 1.80% O b. 2.10% O c. 2.00% O d. 1.90% O e. 2.20% If the yield curve is downward sloping, which of the following statements is correct? (hint: graph the yield curves for a T-bond, a AAA bond, and a B bond) Select one: O a. The yield on the 5-year T-bond must exceed the yield on the 10-year AAA corporate bond. b. The yield on the 5-year AAA corporate bond must exceed the yield on 5-year B corporate bond. c. The yield on the 10-year T-bond must exceed the yield on a 2-year T-bond. O d. The yield on the 5-year T-bond must be smaller than the yield on the 5-year AAA corporate bond. e. The yield on the 10-year AAA corporate bond must be higher than the yield on the 5-year B corporate bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts