Question: I need help on these questions, please show the work as well (If applicable). I greatly appreciate it! If the yield curve is upward sloping,

I need help on these questions, please show the work as well (If applicable). I greatly appreciate it!

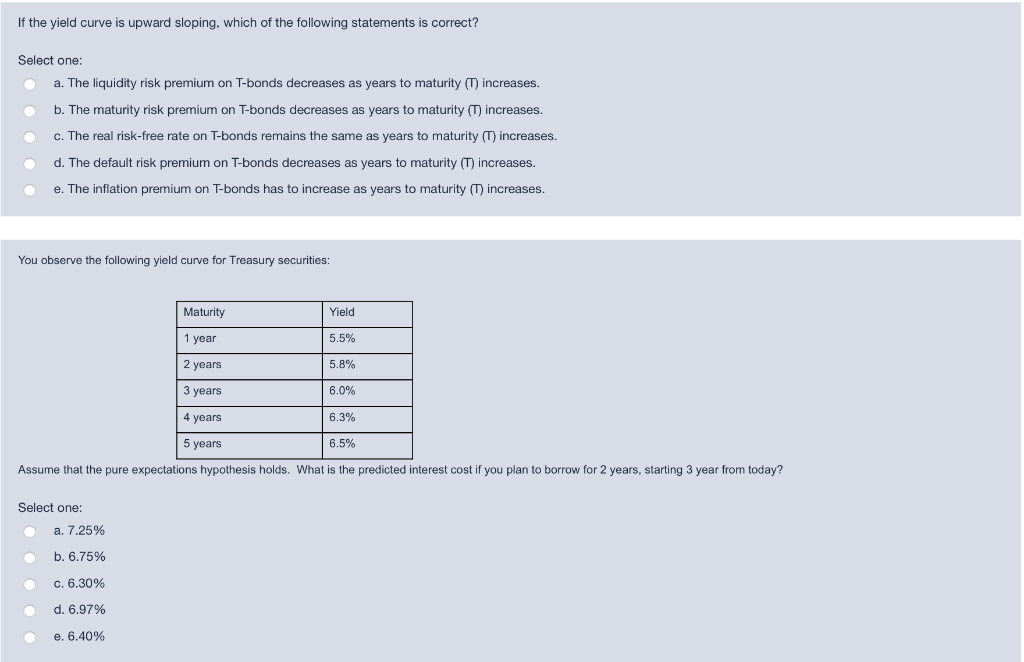

If the yield curve is upward sloping, which of the following statements is correct? Select one: a. The liquidity risk premium on T-bonds decreases as years to maturity () increases. b. The maturity risk premium on T-bonds decreases as years to maturity (T) increases. c. The real risk-free rate on T-bonds remains the same as years to maturity (T) increases. d. The default risk premium on T-bonds decreases as years to maturity (T) increases. e. The inflation premium on T-bonds has to increase as years to maturity (T) increases. You observe the following yield curve for Treasury securities: Maturity Yield 5.5% 1 year 2 years 5.8% 6.0% 3 years 4 years 6.3% 5 years 6.5% Assume that the pure expectations hypothesis holds. What is the predicted interest cost if you plan to borrow for 2 years, starting 3 year from today? Select one: a. 7.25% b. 6.75% c. 6.30% d. 6.97% e. 6.40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts