Question: I need help on this problem E7-31A. during 2018, 175,000 miles. After en-45,000 miles: during 2017: ? 65 miles in 2019, the company traded in

I need help on this problem E7-31A.

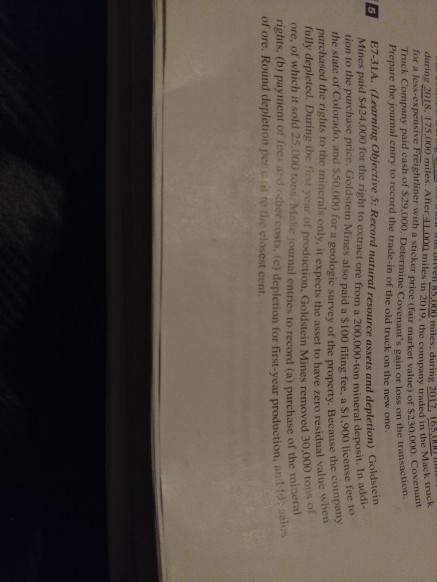

during 2018, 175,000 miles. After en-45,000 miles: during 2017: ? 65 miles in 2019, the company traded in the Mack for a less-expensive Freightliner with a sticker price (fair market value) of $230 ant Truck Company paid cash of $29,000. Determine Covenant' 30,000. Coven Prepare the journal entry to record the trad s gain or loss on the transaction. e-in of the old truck on the new one. E7-31A. (Learning Objective 5: Record natural resource assets and depletion) Goldstein Mines paid s424.000 for the right to extract ore from a 200,000-ton mineral deposit. I hase price. Goldstein Mines also paid a $100 filing fee, a $1.900 licopany fee to the state of Colorado, and $50,000 for a geologic survey of the property. Beca purchased the rights to the minerals only, it expects the asset to have zero residual value we fully depleted. During the fiat year of production, Gold stein Mines removed 30,000 tous o ore, of which it sold 25,000 tons. Make journal entries to record (a) purchase of the mi rights, (b) payment of fees ard rt d to hee costs, (c) depletion for first-year production, an of ore. Round depletion per t to the closest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts