Question: I need help particularly with knowing where to place the 5.5-year holding period in argus enterprise. CKCS Real Estate is looking to acquire Cavalier International

I need help particularly with knowing where to place the 5.5-year holding period in argus enterprise.

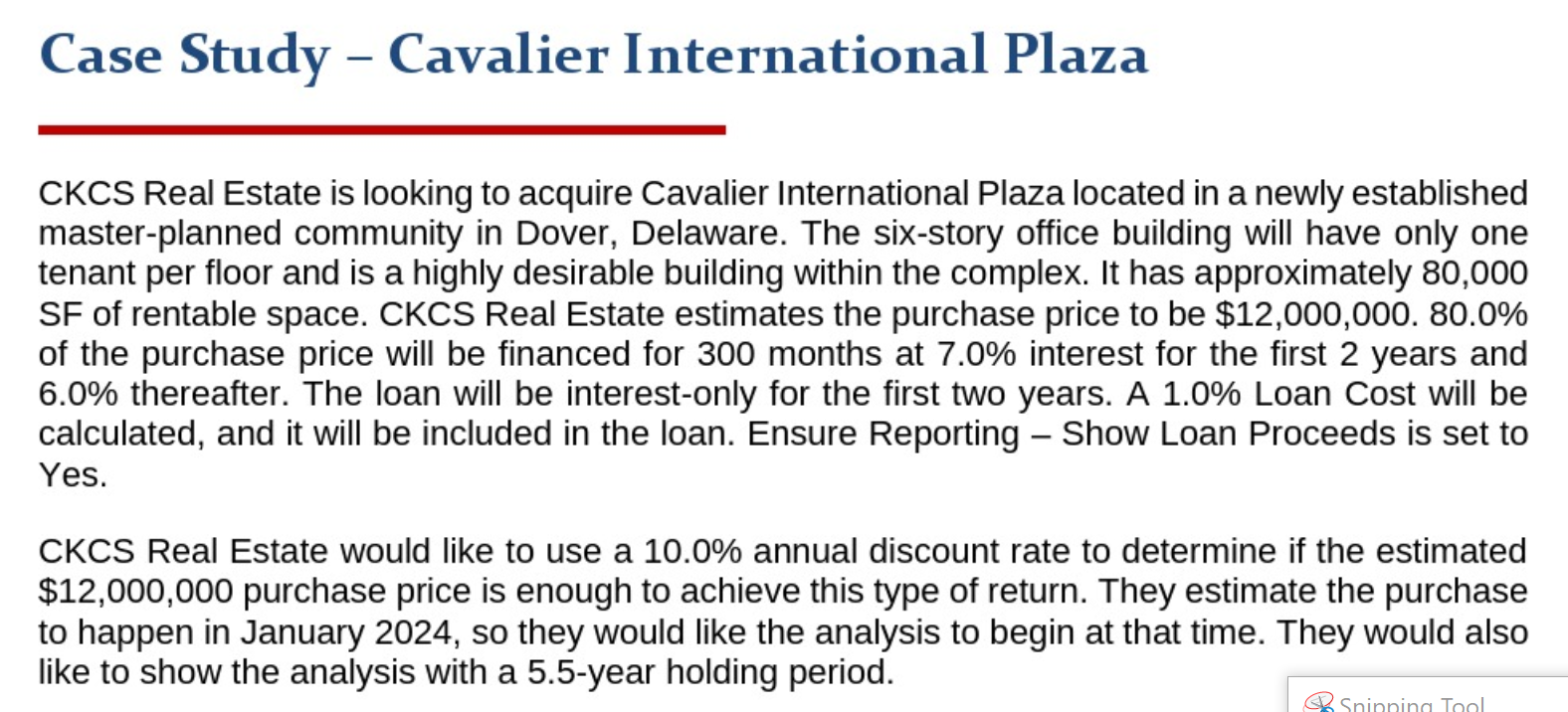

CKCS Real Estate is looking to acquire Cavalier International Plaza located in a newly established master-planned community in Dover, Delaware. The six-story office building will have only one tenant per floor and is a highly desirable building within the complex. It has approximately 80,000 SF of rentable space. CKCS Real Estate estimates the purchase price to be $12,000,000.80.0% of the purchase price will be financed for 300 months at 7.0% interest for the first 2 years and 6.0% thereafter. The loan will be interest-only for the first two years. A 1.0\% Loan Cost will be calculated, and it will be included in the loan. Ensure Reporting - Show Loan Proceeds is set to Yes. CKCS Real Estate would like to use a 10.0% annual discount rate to determine if the estimated $12,000,000 purchase price is enough to achieve this type of return. They estimate the purchase to happen in January 2024, so they would like the analysis to begin at that time. They would also like to show the analysis with a 5.5-year holding period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts