Question: i need help please 5. Using the Appendices in the text, what is the Market Value today of a bond with a PAR value of

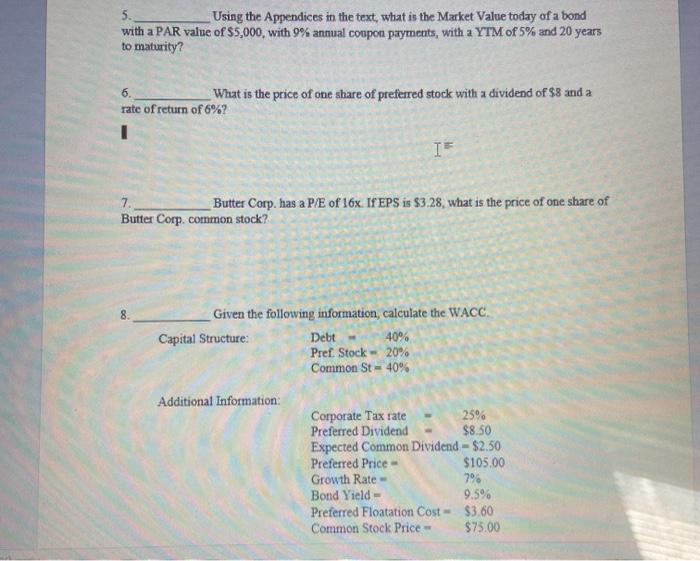

5. Using the Appendices in the text, what is the Market Value today of a bond with a PAR value of $5,000, with 9% annual coupon payments, with a YTM of 5% and 20 years to maturity? 6. What is the price of one share of preferred stock with a dividend of $8 and a rate of return of 6%? 1 IF 7. Butter Corp. has a P/E of 16x. If EPS is $3.28, what is the price of one share of Butter Corp. common stock? Given the following information, calculate the WACC Capital Structure: Debt 40% Pref. Stock - 20% Common St-40% Additional Information: Corporate Tax rate 25% Preferred Dividend $8.50 Expected Common Dividend - $2.50 Preferred Price - $105.00 Growth Rate - 7% Bond Yield- 9.5% Preferred Floatation Cost - $3.60 Common Stock Price - $75.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts