Question: I need help please as soon as possible!!! Tax Return Instructions 1. Prepare a Form 1120 Corporate Tax Return for 2021. The following forms must

I need help please as soon as possible!!!

Tax Return Instructions

1. Prepare a Form 1120 Corporate Tax Return for 2021. The following forms must be completed:

* Form 1120: U.S. Corporation Income Tax Return (pages 1 6)

* Schedule D (for Form 1120): Capital Gains and Losses

* Form 1125-A: Cost of Goods Sold

* Form 1125-E: Compensation of Officers

* Form 8949: Sale and Disposition of Capital Assets

* Form 4562: Depreciation

* Form 4797: Sales of Business Property

In addition, you must attach supporting schedules for line items in the tax return whenever required, e.g., Line 26 of Form 1120. DO NOT complete Form 2220: Underpayment of Estimated Tax by Corporations.

2. When completing the return, round amounts to the nearest dollar (and leave the cents columns blank). Do not place zeros on lines for which there is no amount (unless the instructions tell you to do so); merely leave the line blank. You must prepare the return by hand. You must use a pencil when preparing your return; no ink, no typing, no computer-generated print.

FACTS:

Surf King, Inc., is located at 1100 Reef Road, Big Sur, California 93920. The corporation uses the calendar year and accrual basis for both book and tax purposes. It is engaged in the sale of surfboards with an employer identification number (EIN) of 57-2016014. The company incorporated on December 31, 2017 and began business on January 2, 2018. Balance sheet information at January 1, 2021 and December 31, 2022, and an income statement for 2021 (all on a book basis) are included in a separate file on Blackboard.

Other information follows.

1. Estimated Tax Payments: The corporation paid federal estimated tax payments of $480,000 towards its federal tax liability for 2021.

2. Inventory and Cost of Goods Sold (Form 1125-A)

The corporation uses the periodic inventory method and prices its inventory using the lower of FIFO cost or market. Only beginning inventory, ending inventory, and purchases should be reflected on Form 1125-A. No other costs or expenses are allocated to cost of goods sold. Note: the corporation is exempt from the uniform capitalization (UNICAP) rules because average gross income for the previous three years was less than $10 million.

Line 9(a) Check (ii)

(b), (c), & (d) Not applicable

(e) & (f) No

3. Compensation of Officers (Form 1125-E)

| (a) | (b) | (c) | (d) | (f) |

| Sergio Calabra | 356-87-4322 | 100% | 25% | $150,000 |

| Nicholas Buscarino | 423-89-6677 | 100% | 25% | 150,000 |

| Maria Provenzano | 465-34-2245 | 100% | 25% | 150,000 |

| Gia Giardano | 446-88-2145 | 100% | 25% | 150,000 |

| Total | $600,000 |

4. Bad Debts

For tax purposes, the corporation uses the direct write-off method of deducting bad debts. For book purposes the corporation uses an allowance for doubtful accounts. For 2021, actual write-offs were $36,000.

5. Additional Information (Schedule K)

| 1b Accrual | 6-7 No |

| 2a 451140 | 8 Do not check box |

| b Retail sales | 9 Fill in the correct amount |

| c Surfboards | 10 3 |

| 3 No | 11 Do not check box |

| 4a No | 12 Not applicable |

| 4b Yes; omit Schedule G | 13-15a No |

| 5 No (both a and b) | 15b Not applicable |

| 16-26 NO |

6. Capital Gains and Losses

The corporation had the following stock sales during 2021.

- Sold 50 shares of Vetco Corp. common stock on June 18, 2021 for $120,000. The corporation acquired this stock on September 18, 2020 for $135,000.

- Sold 200 shares of Random Corp. common stock on October 8, 2021 for $100,000. The corporation acquired the stock on December 15, 2016 for $80,000.

- Sold 300 shares of Dustin Corp. common stock on December 12, 2021 for $75,000. The corporation acquired the stock on December 15, 2016 for $45,000.

In addition, the corporation has a $20,000 capital loss carryover from 2020.

7. Fixed Assets and Depreciation Assets Acquired Prior to 2021

Fixed Asset Information

- Building acquired for $1,500,000 and placed in service on January 2, 2018.

- Two pieces of equipment acquired and placed in service on January 2, 2018:

- Equipment #1: $400,000

- Equipment #2: $800,000

- Delivery trucks acquired for $200,000 and placed in service on July 18, 2019

Book Depreciation Information: The corporation uses straight-line depreciation over the useful lives of assets as follows:

- Building, 50 years

- Equipment, 15 years

- Delivery trucks, 5 years

The corporation takes a half-years depreciation in the year of acquisition and the year of disposition and assumes no salvage value. The book financial statements reflect these calculations.

Tax Depreciation Information: All assets are MACRS property as follows:

- Building, 39 year nonresidential real property

- Equipment, 7 year property

- Delivery trucks, 5 year property

The corporation did not elect Section 179 or take any bonus depreciation on any of the above properties. The trucks are not listed property or subject to the luxury automobile limitations. The company did not make the expensing election under Section 179 or take bonus depreciation on any property acquired before 2021.

Accumulated tax depreciation through December 31, 2020, on these properties is as follows:

- Store building: $113,835

- Equipment 1: 225,080

- Equipment 2: 450,160

- Delivery trucks: 104,000

You will need to calculate 2021 tax depreciation for all assets.

8. Sale of Equipment in 2021

On October 16, 2021, the corporation sold Equipment #1 for $425,000 (that had originally cost $400,000 when purchased on January 2, 2018). The corporation had no Section 1231 losses from prior years.

9. Purchase of Equipment in 2021

On October 17, 2021, the corporation acquired and placed in service a piece of equipment costing $1,600,000. The equipment is seven-year MACRS property for tax depreciation. The corporation is electing to expense $500,000 of the equipment under Section 179 but elected out of bonus depreciation. This is the companys only fixed asset purchase for 2021.

For book purposes, the property is ten-year and the corporation will use straight-line depreciation.

10. Organizational Expenditures:

The corporation incurred $11,000 of organization expenditures on January 2, 2018. For book purposes, the corporation expensed the entire expenditure. For tax purposes, the corporation elected under Sec. 248 to deduct $5,000 in 2018 and amortize the remaining $6,000 over 180 months with a full months amortization taken for January 2018. The corporation reports this amortization expense on Form 4562 and includes it in Other Deductions on Form 1120.

11. Other information:

* All meal expenses were incurred at eligible restaurants.

* Ignore AMT and accumulated earnings tax.

* The corporation is not required to complete Schedule M-3.

* The corporation received its dividends from taxable, domestic corporations, the stock of which Surf King owns less than 15%.

* The corporation paid $90,000 in cash dividends to its shareholders during the year and charged the payment directly to retained earnings.

* The state income tax on the book income statement is the exact amount of such taxes incurred during the year. Therefore, no book to tax difference adjustment is necessary.

* Assume the corporation is not entitled to any credits.

* Do not complete Form 2220 and ignore the impact of any estimated tax underpayment penalties.

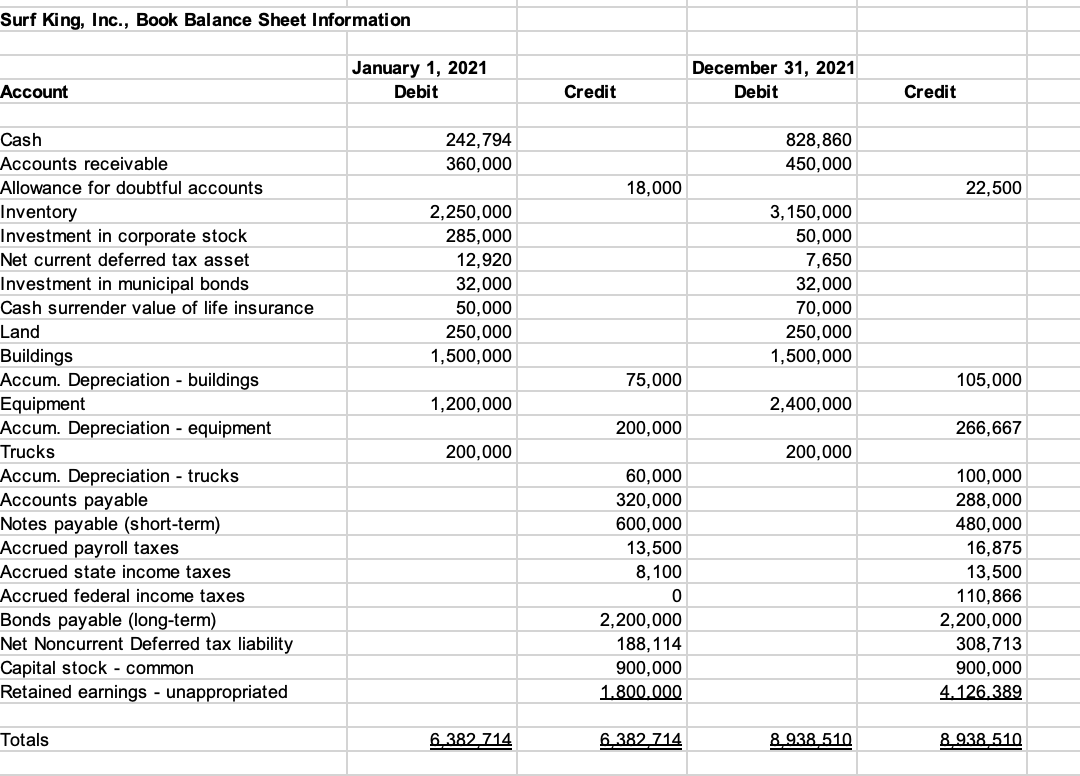

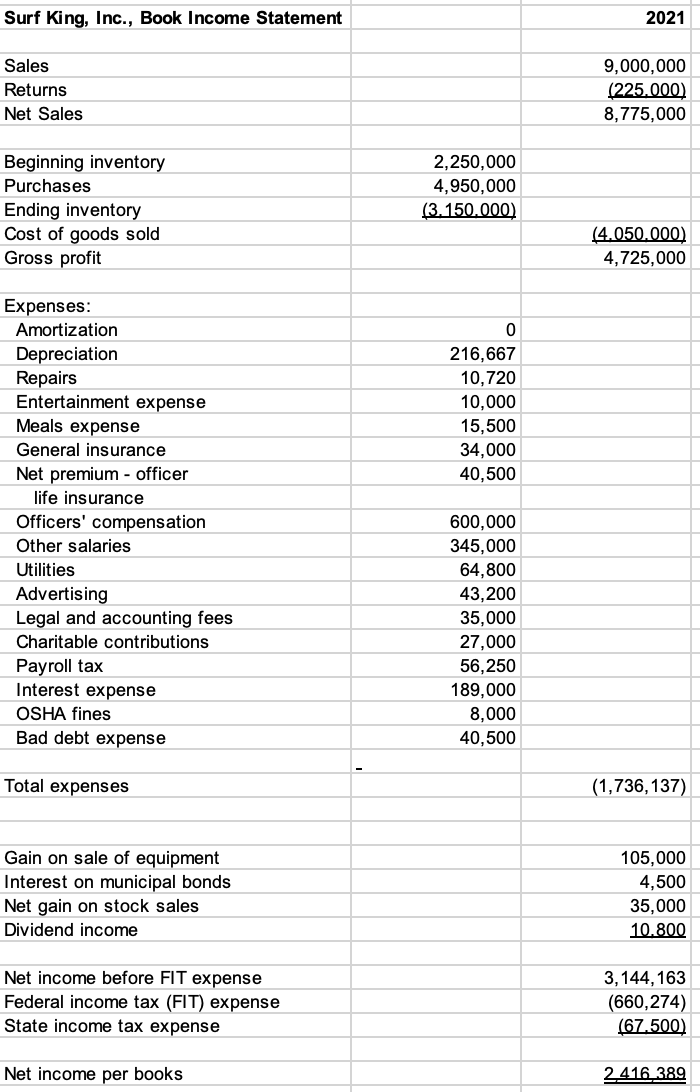

Surf King, Inc., Book Balance Sheet Information January 1, 2021 Debit December 31, 2021 Debit Account Credit Credit 242,794 360,000 828,860 450,000 18,000 22,500 2,250,000 285,000 12,920 32,000 50,000 250,000 1,500,000 3,150,000 50,000 7,650 32,000 70,000 250,000 1,500,000 75,000 105,000 1,200,000 2,400,000 Cash Accounts receivable Allowance for doubtful accounts Inventory Investment in corporate stock Net current deferred tax asset Investment in municipal bonds Cash surrender value of life insurance Land Buildings Accum. Depreciation - buildings Equipment Accum. Depreciation - equipment Trucks Accum. Depreciation - trucks Accounts payable Notes payable (short-term) Accrued payroll taxes Accrued state income taxes Accrued federal income taxes Bonds payable (long-term) Net Noncurrent Deferred tax liability Capital stock - common Retained earnings - unappropriated 200,000 266,667 200,000 200,000 60,000 320,000 600,000 13,500 8,100 0 2,200,000 188,114 900,000 1.800.000 100,000 288,000 480,000 16,875 13,500 110,866 2,200,000 308,713 900,000 4.126.389 Totals 6.382 714 6.382 714 8.938 510 8.938_510 Surf King, Inc., Book Income Statement 2021 Sales Returns Net Sales 9,000,000 (225.000) 8,775,000 Beginning inventory Purchases Ending inventory Cost of goods sold Gross profit 2,250,000 4,950,000 (3.150.000) (4.050.000) 4,725,000 0 216,667 10,720 10,000 15,500 34,000 40,500 Expenses: Amortization Depreciation Repairs Entertainment expense Meals expense General insurance Net premium - officer life insurance Officers' compensation Other salaries Utilities Advertising Legal and accounting fees Charitable contributions Payroll tax Interest expense OSHA fines Bad debt expense 600,000 345,000 64,800 43,200 35,000 27,000 56,250 189,000 8,000 40,500 Total expenses (1,736, 137) Gain on sale of equipment Interest on municipal bonds Net gain on stock sales Dividend income 105,000 4,500 35,000 10.800 Net income before FIT expense Federal income tax (FIT) expense State income tax expense 3, 144, 163 (660,274) (67.500) Net income per books 2416 389 Surf King, Inc., Book Balance Sheet Information January 1, 2021 Debit December 31, 2021 Debit Account Credit Credit 242,794 360,000 828,860 450,000 18,000 22,500 2,250,000 285,000 12,920 32,000 50,000 250,000 1,500,000 3,150,000 50,000 7,650 32,000 70,000 250,000 1,500,000 75,000 105,000 1,200,000 2,400,000 Cash Accounts receivable Allowance for doubtful accounts Inventory Investment in corporate stock Net current deferred tax asset Investment in municipal bonds Cash surrender value of life insurance Land Buildings Accum. Depreciation - buildings Equipment Accum. Depreciation - equipment Trucks Accum. Depreciation - trucks Accounts payable Notes payable (short-term) Accrued payroll taxes Accrued state income taxes Accrued federal income taxes Bonds payable (long-term) Net Noncurrent Deferred tax liability Capital stock - common Retained earnings - unappropriated 200,000 266,667 200,000 200,000 60,000 320,000 600,000 13,500 8,100 0 2,200,000 188,114 900,000 1.800.000 100,000 288,000 480,000 16,875 13,500 110,866 2,200,000 308,713 900,000 4.126.389 Totals 6.382 714 6.382 714 8.938 510 8.938_510 Surf King, Inc., Book Income Statement 2021 Sales Returns Net Sales 9,000,000 (225.000) 8,775,000 Beginning inventory Purchases Ending inventory Cost of goods sold Gross profit 2,250,000 4,950,000 (3.150.000) (4.050.000) 4,725,000 0 216,667 10,720 10,000 15,500 34,000 40,500 Expenses: Amortization Depreciation Repairs Entertainment expense Meals expense General insurance Net premium - officer life insurance Officers' compensation Other salaries Utilities Advertising Legal and accounting fees Charitable contributions Payroll tax Interest expense OSHA fines Bad debt expense 600,000 345,000 64,800 43,200 35,000 27,000 56,250 189,000 8,000 40,500 Total expenses (1,736, 137) Gain on sale of equipment Interest on municipal bonds Net gain on stock sales Dividend income 105,000 4,500 35,000 10.800 Net income before FIT expense Federal income tax (FIT) expense State income tax expense 3, 144, 163 (660,274) (67.500) Net income per books 2416 389

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts