Question: I need help please, I only have one more try! Mark Harris operates a kiosk in downtown Chicago, at which he sells one style of

I need help please, I only have one more try!

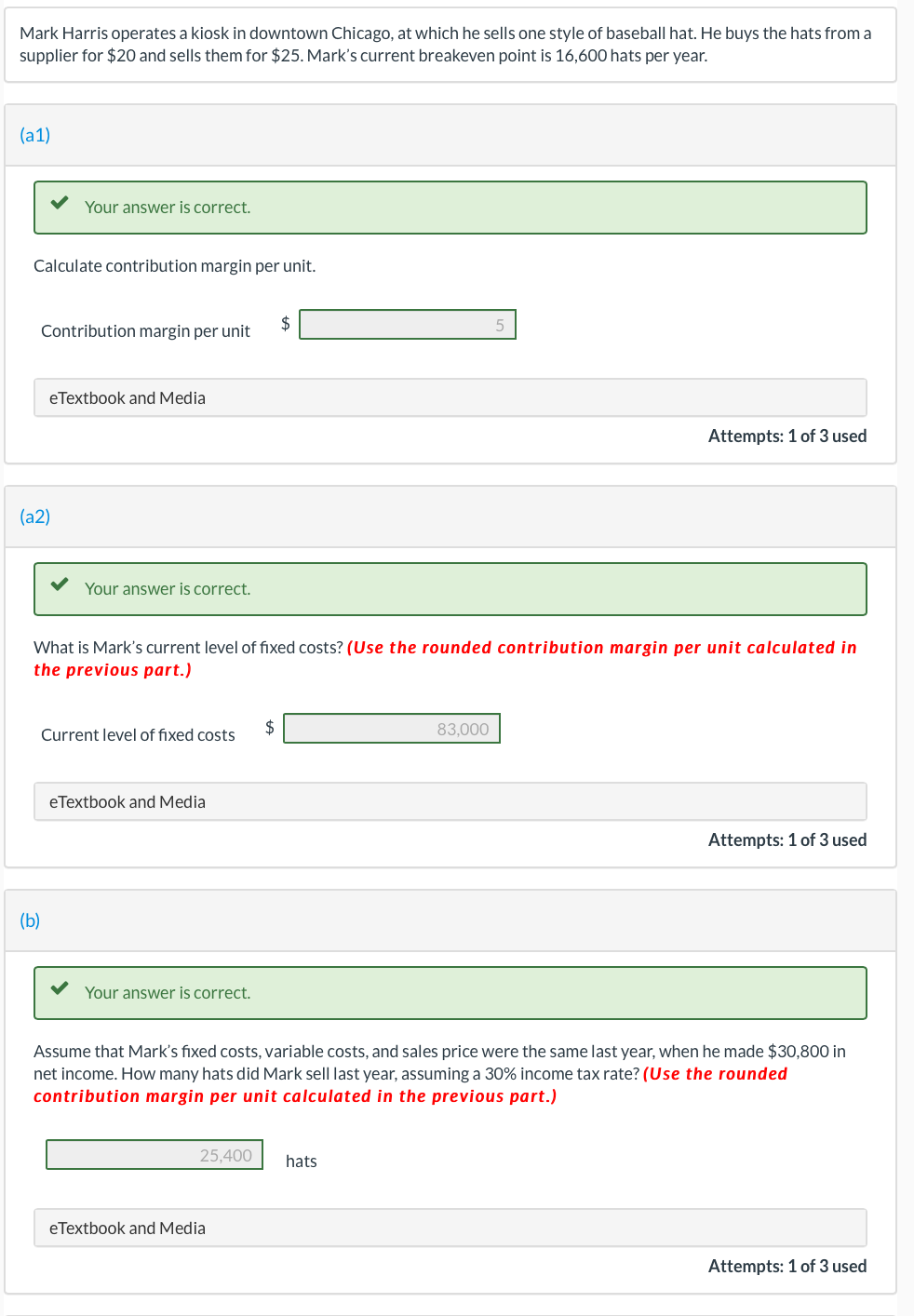

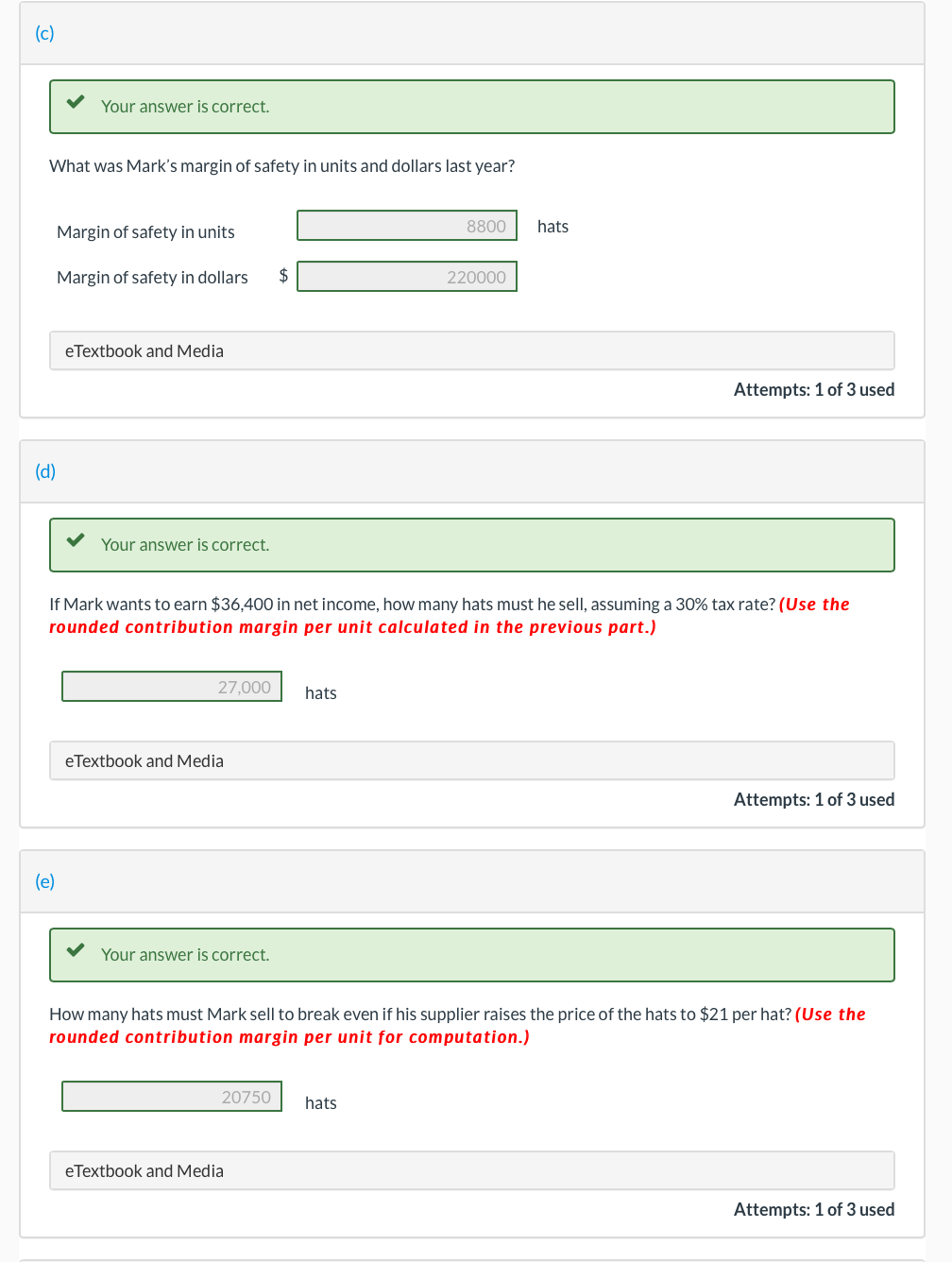

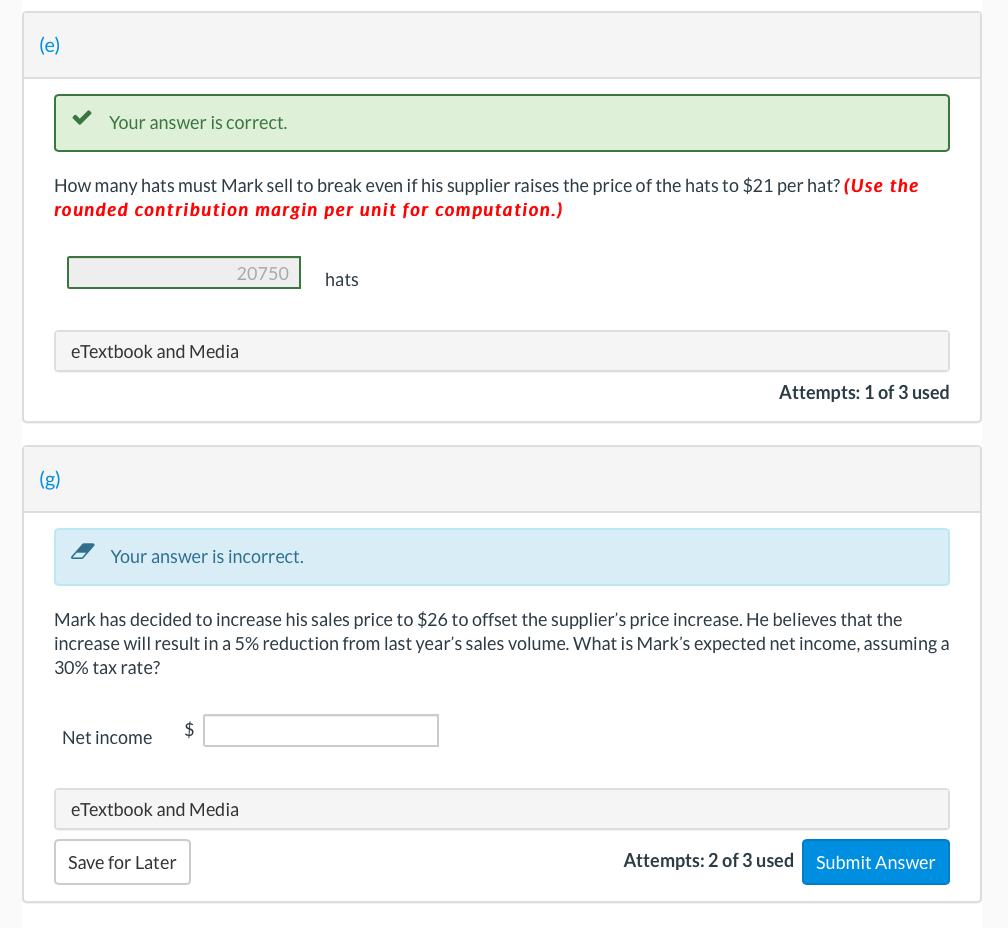

Mark Harris operates a kiosk in downtown Chicago, at which he sells one style of baseball hat. He buys the hats from a supplier for $20 and sells them for $25. Mark's current breakeven point is 16,600 hats per year. (a1) Your answer is correct. Calculate contribution margin per unit. $ Contribution margin per unit 5 e Textbook and Media Attempts: 1 of 3 used (a2) Your answer is correct. What is Mark's current level of fixed costs? (Use the rounded contribution margin per unit calculated in the previous part.) Current level of fixed costs $ 83.000 e Textbook and Media Attempts: 1 of 3 used (b) Your answer is correct. Assume that Mark's fixed costs, variable costs, and sales price were the same last year, when he made $30,800 in net income. How many hats did Mark sell last year, assuming a 30% income tax rate? (Use the rounded contribution margin per unit calculated in the previous part.) 25,400 hats e Textbook and Media Attempts: 1 of 3 used (c) Your answer is correct. What was Mark's margin of safety in units and dollars last year? 8800 hats Margin of safety in units Margin of safety in dollars $ 220000 e Textbook and Media Attempts: 1 of 3 used (d) Your answer is correct. If Mark wants to earn $36,400 in net income, how many hats must he sell, assuming a 30% tax rate? (Use the rounded contribution margin per unit calculated in the previous part.) 27,000 hats e Textbook and Media Attempts: 1 of 3 used (e) Your answer is correct. How many hats must Mark sell to break even if his supplier raises the price of the hats to $21 per hat? (Use the rounded contribution margin per unit for computation.) 20750 hats e Textbook and Media Attempts: 1 of 3 used (e) Your answer is correct. How many hats must Mark sell to break even if his supplier raises the price of the hats to $21 per hat? (Use the rounded contribution margin per unit for computation.) 20750 hats e Textbook and Media Attempts: 1 of 3 used (g) Your answer is incorrect. Mark has decided to increase his sales price to $26 to offset the supplier's price increase. He believes that the increase will result in a 5% reduction from last year's sales volume. What is Mark's expected net income, assuming a 30% tax rate? $ Net income e Textbook and Media Save for Later Attempts: 2 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts