Question: I need help please no excel description i need help on what formulas to use for these 6. What is the value of a $1000

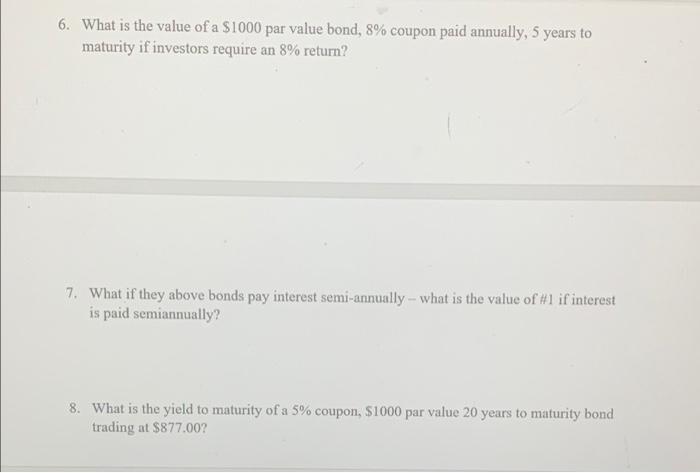

6. What is the value of a $1000 par value bond, 8% coupon paid annually, 5 years to maturity if investors require an 8% return? 7. What if they above bonds pay interest semi-annually - what is the value of #1 if interest is paid semiannually? 8. What is the yield to maturity of a 5% coupon, $1000 par value 20 years to maturity bond trading at $877.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts