Question: i need help please thank you Disney Swoops Into Action, Buying Marvel for $4 Billion By Brooks Barnes and Michael Cieply Aug. 31, 2009 LOS

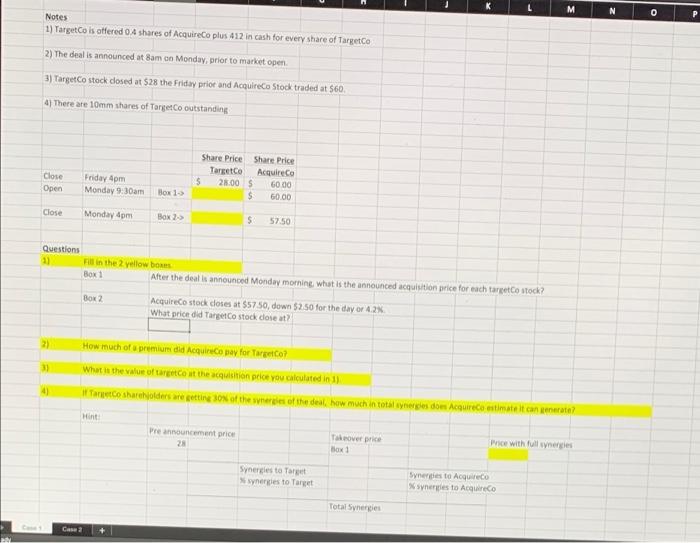

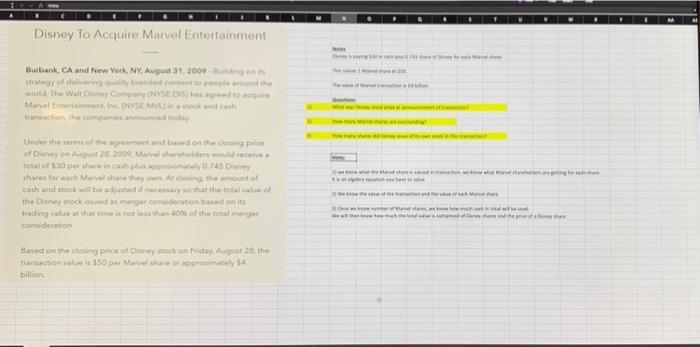

Disney Swoops Into Action, Buying Marvel for $4 Billion By Brooks Barnes and Michael Cieply Aug. 31, 2009 LOS ANGELES The Walt Disney Company's surprise deal to acquire Marvel Entertainment for $4 billion redraws the architecture of Hollywood and spotlights how the media giant has become more aggressive than its peers about growth. Disney said on Monday that it would pay cash and stock to acquire Marvel, the comic book publisher and movie studio whose library of 5,000 characters includes some of the world's best-known superheroes: Spider-Man, the X-Men, Thor, Iron Man and the Fantastic Four. The deal was valued at about $50 a share, a 29 percent premium, On Monday, Marvel shares shot up 25 percent to $48.37. Marvel has forcefully exploited its most popular characters through motion pictures, video games and consumer products. But Disney sees an opportunity to plug Marvel into its vaunted global marketing and distribution system. "Marvel's brand and its treasure trove of content will now benefit from our extraordinary reach," Robert A. Iger, Disney's chief executive, said in an interview. "We paid a price that reflects the value they've created and the value we can create as one company. It's a full price, but a fair price." Certain Marvel characters can be immediately integrated into Disney's theme parks in California, Paris and Hong Kong. (For now, Walt Disney World in Florida is off limits because of a pact Marvel has in place with Universal Studios there.) Disney's cable channels, in particular Disney XD, will have new intellectual property to mine. And the potential in consumer products is huge, especially overseas. The brooding Marvel characters tend to be more popular with boys - an area where Disney could use help. While the likes of "Hannah Montana" and the blockbuster Princesses merchandising line have solidified Disney's hold on little girls, franchises for boys have been harder to come by. The acquisition points to the film industry's biggest issue at the moment: access to capital. Those who have it are finding opportunity; those who do not may be left behind. Editors' Picks Marvel had tried to pay for its films with the help of $525 million in financing, but found it impossible on "Iron Man" and "Hulk" to meet a condition that required it to raise a third of its cash by selling off certain overseas distribution rights. F. Peter Cuneo, Marvel's vice chairman, told investors in May that the company would self-finance a third of each film to get around that requirement. This would be a much easier chore with Disney's muscle behind it. The deal underscores Disney's focus on growth and could herald a new wave of media consolidation, analysts said. While some observers questioned the price as too steep - Disney shares fell 3 percent to about $26 on Monday - most saw the acquisition as a smart, ambitious expansion maneuver, Mr. Iger, who orchestrated Disney's $7.4 billion purchase of Pixar in 2006, is now firmly one of the media world's most powerful dealmakers. Acquiring Marvel makes Disney a partner with Paramount Pictures, Sony Pictures Entertainment and 20th Century Fox, all of which have long-term deals to make or distribute movies based on superhero characters. Sony holds the film rights to Spider- Man, for instance, while Fox has the X-Men and Fantastic Four in perpetuity. Paramount, a unit of Viacom, has an agreement to distribute five Marvel films, including two "Iron Man" sequels, over the next few years, Disney said it would honor the contract, but the goal is clearly to bring Marvel's movies in-house. "We believe Viacom is unlikely to retain distribution rights to Marvel films after the agreement" ends, said Michael C. Morris, a UBS analyst. A Paramount statement read in part, "We look forward to continuing to work with Marvel and, with today's announcement, to working with Disney." As Disney's film division becomes suddenly crowded, the company may find its new partnerships bumping into one another. Just last month, Disney's new DreamWorks partners found themselves assuring executives that they would avoid any conflict with the "Pirates of the Caribbean" franchise as they sought to develop a film based on Michael Crichton's novel "Pirate Latitudes." The deal is not without risk. Questions include whether Marvel's lesser-known characters can be effectively groomed into stars and to what degree the most valuable and heavily exploited assets (Spider-Man, the X-Men) have weakened in box-office power. Some Marvel fans voiced their disapproval of the deal on www.newsarama.com, a Web site that covers comic books, mostly with concerns that Disney would exert too much editorial control over the Marvel characters. "If you want poor kids in Bali to run around with a Hulk lunchbox, then sign on with Disney," one poster, peterpersy, wrote. Marvel's development state is relatively thin: the company works on only five or six scripts at once, compared with the dozens under way at major studios, though in Marvel's case virtually all are expected to become finished films. Yet Marvel, like Pixar, has made an enormous impression by racking up an almost unbroken series of hits -- two films based on the Incredible Hulk were soft - after having risen from bankruptcy in 1998. Last year, the studio struck gold with "Iron Man," which sold $585 million in tickets at the global box office. Marvel's publishing business is also strong. The company was the top comics publisher in 2008, edging out its closest rival, DC Comics, in both unit market share (46 percent to 32 percent) and retail dollar share (41 percent to 30 percent). The comic book industry had about $715 million in sales last year, according to Milton Griepp, the publisher and founder of ICv2, an online trade publication that covers pop culture for retailers. Ike Perlmutter, Marvel's chief executive, will continue to oversee the superhero properties, and will work directly with Disney's global lines of business to build and further integrate Marvel's characters. The executive, who outmaneuvered the billionaire financiers Ronald O. Perelman and Carl C. Icahn to acquire Marvel out of bankruptcy, will receive about $1.44 billion in cash and Disney stock, regulatory filings suggest. "This is an unparalleled opportunity for Marvel," Mr. Perlmutter said in a statement "Disney is the perfect home." M N Notes 1) TargetCois atfered 0.4 shares of AcquireCo plus 412 in cash for every share of Target Co 2) The deal is announced at 8am on Monday, prior to market open 3) TargetCo stock closed at $28the Friday prior and AcquireCo Stock traded at $60. 4) There are 10mm shares of Target Co outstanding Close Open Friday 4pm Monday 9:30am Share Price Share Price Targetco AcquireCo $ 28.00 S 6000 $ 60.00 Box 1-> Close Monday 4pm Box 2-> $ 57.50 Questions 11 Fill in the yellow bones Box1 After the deal is announced Monday morning what is the announced acquisition price for each target stock? BOK 2 AcquireCo stock doses at $5750, down $2.50 for the day or What price did TargetCo stock dose at? 2) 31 How much of a premium di Acquire.co pay for Treto? What is the value of target at the acquisition price you calculated in 1) to shareholders are gettine son of the series of the deal how much in total types dom Acirea estimate concerte? Hint Pre announcement price 28 To over Band Price with full synergies Synergies to Target Synergies to Target Synergies to Acquire Synerles to Acquire.co Total Synergies Caa Disney To Acquire Marvel Entertainment Burbank, CA and New York, NY, August 31, 2009 reality and place world. The Wall by Company SEOS Marvel tertainment Inc. (NYSC Vsto cash transaction the companies and Under the treat this great and on the caprice of Doney on August 20, 2009 Marvel shoes wool roce total of 530 per share in the porum.745 Oy shares forosch Marvel share the Atding the amount of cash and stock will be added if necessary to that the total w the Disney stock marcation based on its trading viste at that times that of the total meg consideration Based on the closing price of Disney stoon Miday, August 28. the transaction value ic550 per Melhor patoly 54 billion Disney Swoops Into Action, Buying Marvel for $4 Billion By Brooks Barnes and Michael Cieply Aug. 31, 2009 LOS ANGELES The Walt Disney Company's surprise deal to acquire Marvel Entertainment for $4 billion redraws the architecture of Hollywood and spotlights how the media giant has become more aggressive than its peers about growth. Disney said on Monday that it would pay cash and stock to acquire Marvel, the comic book publisher and movie studio whose library of 5,000 characters includes some of the world's best-known superheroes: Spider-Man, the X-Men, Thor, Iron Man and the Fantastic Four. The deal was valued at about $50 a share, a 29 percent premium, On Monday, Marvel shares shot up 25 percent to $48.37. Marvel has forcefully exploited its most popular characters through motion pictures, video games and consumer products. But Disney sees an opportunity to plug Marvel into its vaunted global marketing and distribution system. "Marvel's brand and its treasure trove of content will now benefit from our extraordinary reach," Robert A. Iger, Disney's chief executive, said in an interview. "We paid a price that reflects the value they've created and the value we can create as one company. It's a full price, but a fair price." Certain Marvel characters can be immediately integrated into Disney's theme parks in California, Paris and Hong Kong. (For now, Walt Disney World in Florida is off limits because of a pact Marvel has in place with Universal Studios there.) Disney's cable channels, in particular Disney XD, will have new intellectual property to mine. And the potential in consumer products is huge, especially overseas. The brooding Marvel characters tend to be more popular with boys - an area where Disney could use help. While the likes of "Hannah Montana" and the blockbuster Princesses merchandising line have solidified Disney's hold on little girls, franchises for boys have been harder to come by. The acquisition points to the film industry's biggest issue at the moment: access to capital. Those who have it are finding opportunity; those who do not may be left behind. Editors' Picks Marvel had tried to pay for its films with the help of $525 million in financing, but found it impossible on "Iron Man" and "Hulk" to meet a condition that required it to raise a third of its cash by selling off certain overseas distribution rights. F. Peter Cuneo, Marvel's vice chairman, told investors in May that the company would self-finance a third of each film to get around that requirement. This would be a much easier chore with Disney's muscle behind it. The deal underscores Disney's focus on growth and could herald a new wave of media consolidation, analysts said. While some observers questioned the price as too steep - Disney shares fell 3 percent to about $26 on Monday - most saw the acquisition as a smart, ambitious expansion maneuver, Mr. Iger, who orchestrated Disney's $7.4 billion purchase of Pixar in 2006, is now firmly one of the media world's most powerful dealmakers. Acquiring Marvel makes Disney a partner with Paramount Pictures, Sony Pictures Entertainment and 20th Century Fox, all of which have long-term deals to make or distribute movies based on superhero characters. Sony holds the film rights to Spider- Man, for instance, while Fox has the X-Men and Fantastic Four in perpetuity. Paramount, a unit of Viacom, has an agreement to distribute five Marvel films, including two "Iron Man" sequels, over the next few years, Disney said it would honor the contract, but the goal is clearly to bring Marvel's movies in-house. "We believe Viacom is unlikely to retain distribution rights to Marvel films after the agreement" ends, said Michael C. Morris, a UBS analyst. A Paramount statement read in part, "We look forward to continuing to work with Marvel and, with today's announcement, to working with Disney." As Disney's film division becomes suddenly crowded, the company may find its new partnerships bumping into one another. Just last month, Disney's new DreamWorks partners found themselves assuring executives that they would avoid any conflict with the "Pirates of the Caribbean" franchise as they sought to develop a film based on Michael Crichton's novel "Pirate Latitudes." The deal is not without risk. Questions include whether Marvel's lesser-known characters can be effectively groomed into stars and to what degree the most valuable and heavily exploited assets (Spider-Man, the X-Men) have weakened in box-office power. Some Marvel fans voiced their disapproval of the deal on www.newsarama.com, a Web site that covers comic books, mostly with concerns that Disney would exert too much editorial control over the Marvel characters. "If you want poor kids in Bali to run around with a Hulk lunchbox, then sign on with Disney," one poster, peterpersy, wrote. Marvel's development state is relatively thin: the company works on only five or six scripts at once, compared with the dozens under way at major studios, though in Marvel's case virtually all are expected to become finished films. Yet Marvel, like Pixar, has made an enormous impression by racking up an almost unbroken series of hits -- two films based on the Incredible Hulk were soft - after having risen from bankruptcy in 1998. Last year, the studio struck gold with "Iron Man," which sold $585 million in tickets at the global box office. Marvel's publishing business is also strong. The company was the top comics publisher in 2008, edging out its closest rival, DC Comics, in both unit market share (46 percent to 32 percent) and retail dollar share (41 percent to 30 percent). The comic book industry had about $715 million in sales last year, according to Milton Griepp, the publisher and founder of ICv2, an online trade publication that covers pop culture for retailers. Ike Perlmutter, Marvel's chief executive, will continue to oversee the superhero properties, and will work directly with Disney's global lines of business to build and further integrate Marvel's characters. The executive, who outmaneuvered the billionaire financiers Ronald O. Perelman and Carl C. Icahn to acquire Marvel out of bankruptcy, will receive about $1.44 billion in cash and Disney stock, regulatory filings suggest. "This is an unparalleled opportunity for Marvel," Mr. Perlmutter said in a statement "Disney is the perfect home." M N Notes 1) TargetCois atfered 0.4 shares of AcquireCo plus 412 in cash for every share of Target Co 2) The deal is announced at 8am on Monday, prior to market open 3) TargetCo stock closed at $28the Friday prior and AcquireCo Stock traded at $60. 4) There are 10mm shares of Target Co outstanding Close Open Friday 4pm Monday 9:30am Share Price Share Price Targetco AcquireCo $ 28.00 S 6000 $ 60.00 Box 1-> Close Monday 4pm Box 2-> $ 57.50 Questions 11 Fill in the yellow bones Box1 After the deal is announced Monday morning what is the announced acquisition price for each target stock? BOK 2 AcquireCo stock doses at $5750, down $2.50 for the day or What price did TargetCo stock dose at? 2) 31 How much of a premium di Acquire.co pay for Treto? What is the value of target at the acquisition price you calculated in 1) to shareholders are gettine son of the series of the deal how much in total types dom Acirea estimate concerte? Hint Pre announcement price 28 To over Band Price with full synergies Synergies to Target Synergies to Target Synergies to Acquire Synerles to Acquire.co Total Synergies Caa Disney To Acquire Marvel Entertainment Burbank, CA and New York, NY, August 31, 2009 reality and place world. The Wall by Company SEOS Marvel tertainment Inc. (NYSC Vsto cash transaction the companies and Under the treat this great and on the caprice of Doney on August 20, 2009 Marvel shoes wool roce total of 530 per share in the porum.745 Oy shares forosch Marvel share the Atding the amount of cash and stock will be added if necessary to that the total w the Disney stock marcation based on its trading viste at that times that of the total meg consideration Based on the closing price of Disney stoon Miday, August 28. the transaction value ic550 per Melhor patoly 54 billion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts