Question: I need help please! The only labels that are accepted: No journal entry required Accounts payable Accounts receivable Additional paid-in capital Advertising expense Bonds payable

I need help please! The only labels that are accepted:

- No journal entry required

- Accounts payable

- Accounts receivable

- Additional paid-in capital

- Advertising expense

- Bonds payable

- Cash

- Common stock

- Delivery expense

- Dividends

- Dividends payable

- Entertainment expense

- Gain

- Interest expense

- Interest receivable

- Interest revenue

- Loss

- Notes payable

- Notes receivable

- Preferred stock

- Rent expense

- Repairs and maintenance expense

- Retained earnings

- Salaries expense

- Sales revenue

- Service fee expense

- Service revenue

- Stock dividends

- Supplies

- Supplies expense

- Treasury stock

- Utilities expense

The only labels that are accepted:

- No journal entry required

- Accounts payable

- Accounts receivable

- Additional paid-in capital

- Advertising expense

- Bonds payable

- Cash

- Common stock

- Delivery expense

- Dividends

- Dividends payable

- Entertainment expense

- Gain

- Interest expense

- Interest receivable

- Interest revenue

- Loss

- Notes payable

- Notes receivable

- Preferred stock

- Rent expense

- Repairs and maintenance expense

- Retained earnings

- Salaries expense

- Sales revenue

- Service fee expense

- Service revenue

- Stock dividends

- Supplies

- Supplies expense

- Treasury stock

- Utilities expense

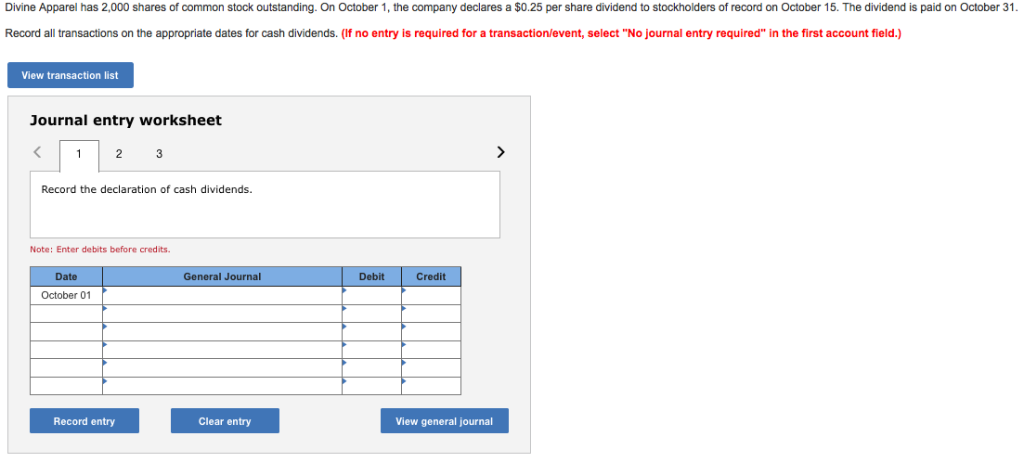

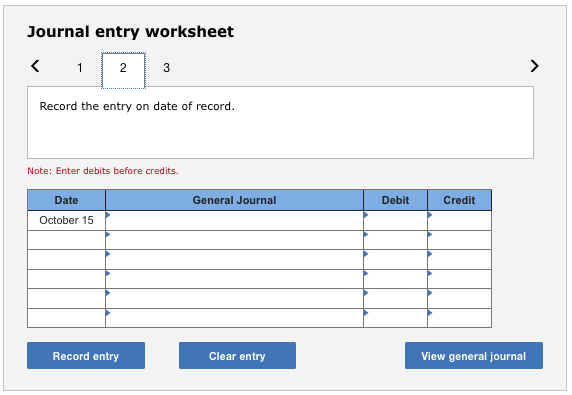

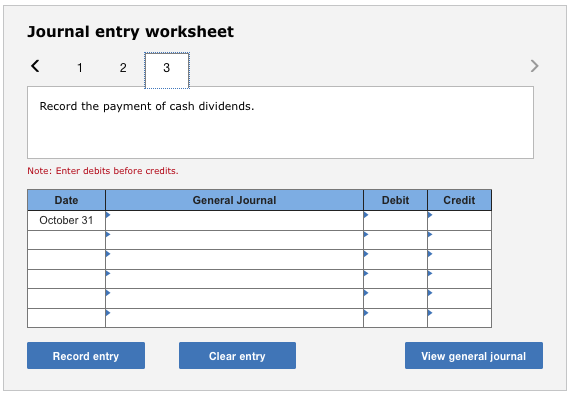

Divine Apparel has 2,000 shares of common stock outstanding. On October 1, the company declares a $0.25 per share dividend to stockholders of record on October 15. The dividend is paid on October 31 Record all transactions on the appropriate dates for cash dividends. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the declaration of cash dividends Note: Enter debits before credits. Date General Journal Debit Credit October 01 Record entry Clear entry View general journal Journal entry worksheet 3 Record the entry on date of record Note: Enter debits before credits. Date General Journal Debit Credit October 15 Record entry Clear entry View general journal Journal entry worksheet 3 Record the payment of cash dividends Note: Enter debits before credits. Date General Journal Debit Credit October 31 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts