Question: problem 2 Problem 2: Blink Blink Corp.. on March 31, 2018, sold an old machine that originally cost $64,000 and had accumulated depreciated of $61,000

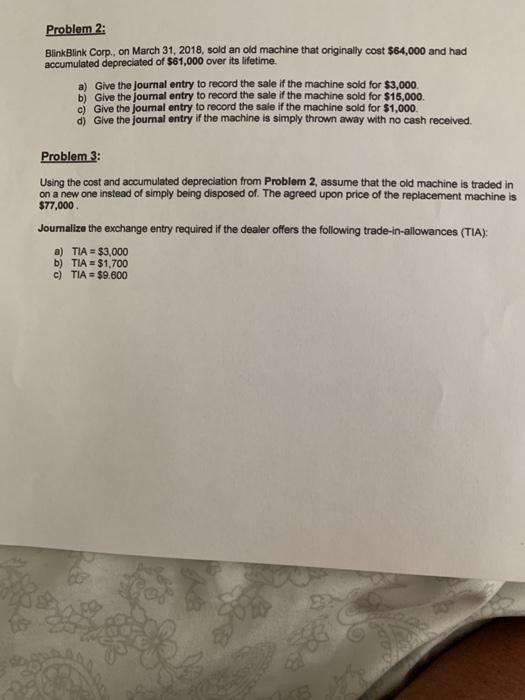

Problem 2: Blink Blink Corp.. on March 31, 2018, sold an old machine that originally cost $64,000 and had accumulated depreciated of $61,000 over its lifetime. a) Give the journal entry to record the sale if the machine sold for $3,000. b) Give the journal entry to record the sale if the machine sold for $15,000 c) Give the journal entry to record the sale if the machine sold for $1,000 Give the journal entry if the machine is simply thrown away with no cash received Problem 3: Using the cost and accumulated depreciation from Problem 2 assume that the old machine is traded in on a new one instead of simply being disposed of. The agreed upon price of the replacement machine is $77,000 Joumalize the exchange entry required if the dealer offers the following trade-in-allowances (TIA): a) TIA = $3,000 b) TI=$1,700 c) TIA = $9 600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts