Question: I need help plugging in the amounts on this spreadsheet based on the information provided. Can you please help me? This is a budget spreadsheet.

I need help plugging in the amounts on this spreadsheet based on the information provided. Can you please help me? This is a budget spreadsheet.

SEE BELOW

Today is your first day as the new Director of HIM. You were hired directly out of college. The budget is due next week and according to the CEOthere are no exceptions. Your predecessor has retired after 42 years. The Assistant quit because he was not promoted to Director. He was being paid $45,000 and will not be replaced. All other supervisory staff members are relatively new and serving as working supervisors. Because you are an RHIA rather than an RHIT, you are being paid $10,000 more than your predecessor. The Budget Data provided is the only data available because you cannot find anything in the disaster of an office that your predecessor left. For this assignment, you are to prepare the 12-month budget for FY 2022 (7/1/21-6/30/22). Display your 12 months budget on a single Excel spreadsheet showing all line items. Each month should be clearly labeled with all months on the same sheet.

Your assignment should include the budget assignment spreadsheet (see modules section of canvas), a memo, and a written explanation of budget assumption below. The memo and explanations should be submitted as one or two word document(s). DO NOT EMBED NOTES IN THE SPREADSHEET THAT YOU WANT ME TO CONSIDER In addition to the Budget Assumptions (see below) and the Prior Years Actual Data, the Budget Manager has given the following guidelines: Your overall budget must decrease by at least 10% from last year because there have been volume declines. You should not add any new expense accounts/line items. Salary increases are anticipated for the next fiscal year and are not expected to exceed 2% due to the poor economy. The Budget Manager expects you to give him the 12-month budget for all line items. If you increase or reduce any of these line items, you must thoroughly explain why. You cannot transfer costs to another department. Prepare a written summary of the basis for the changes to each account for the CFO to accompany your budget. Budget Assumptions for FY 2022: 1. Paper goods are expected to increase 2%. 2. The imaging/scanning project is fully implemented and 2 FTEs (1 of which is an analyst) and all temporary workers who were paid by the hospital will be eliminated. Average hourly compensation is $14.50/hour. 3. Prior to the scanning project being fully implemented you had 7 analysts. 4. Your coding consultant indicates that the consulting fees for her services will increase by 3%. She will do her audits in the Spring and Fall. She is the only consultant you use at this time. 5. The imaging project has replaced the need for microfilming. 6. The CFO states that all travel, training, dues, books, and employee relations budgets must be zero-based. (READ YOUR TEXTS TO ENSURE YOU PROVIDE A ZERO-BASED EXPLANATION.) A detailed explanation for these items must be provided showing the cost of each and how the cost was derived (see page 143-145 of your text). You have 9 AHIMA credentialed coders, 2 credentialed cancer registrars, and 4 supervisors (2 are AHIMA credentialed members). 7. This is your year to go to the National AHIMA meeting. Only the Director is allowed to go to the National meeting and you are going! Your CFO has asked you to learn as much as possible about implementing ICD-10 and an EHR system. The meeting is in Baltimore, MD. 8. Each week you are responsible for buying candy and assorted small sport items as giveaways for the Medical Staff. Cost is expected to increase by 2%. 9. There is no change expected in the rates applied by the Federal Government. The FICA can be calculated as a percentage of salaries. 10. During this past year it was decided that food would no longer be provided at Medical Staff meetings. Therefore, you no longer need to budget catered food for the Cancer Conferences or for the Medical Records Committee. 11. You will have a catered lunch from Dietary for HIM Week in November. You will have 50 employees in the department during HIM Week and 3 Volunteers. Additionally, you intend to invite your CFO and the President of the Medical Staff. No other catered meals are expected. In addition to a free lunch for HIM Week you will purchased a logo-line item from AHIMA. 12. You will continue to have employee incentive plans for your analysts and coders. These are flat payments made for achieving goals regardless of the employees rate of pay and are not tied to any compensation increase. The incentives are paid quarterly. 13. A full-time equivalent employee (FTE) is considered as one who could be paid 2,080 hours/year. 14. Temporary staff is not eligible for benefits. 15. Incentive compensation is not eligible for benefits. 16. Maintenance contracts are to be budgeted in the month they are due to be paid. 17. Your contracted release of information firm does not intend to make any changes to their services nor does it intend to raise its charges to you. Their 2 staff members are included in your employee count for HIM week. 18. The FICA amount is based on regular and temporary salaries as well as incentive compensation.

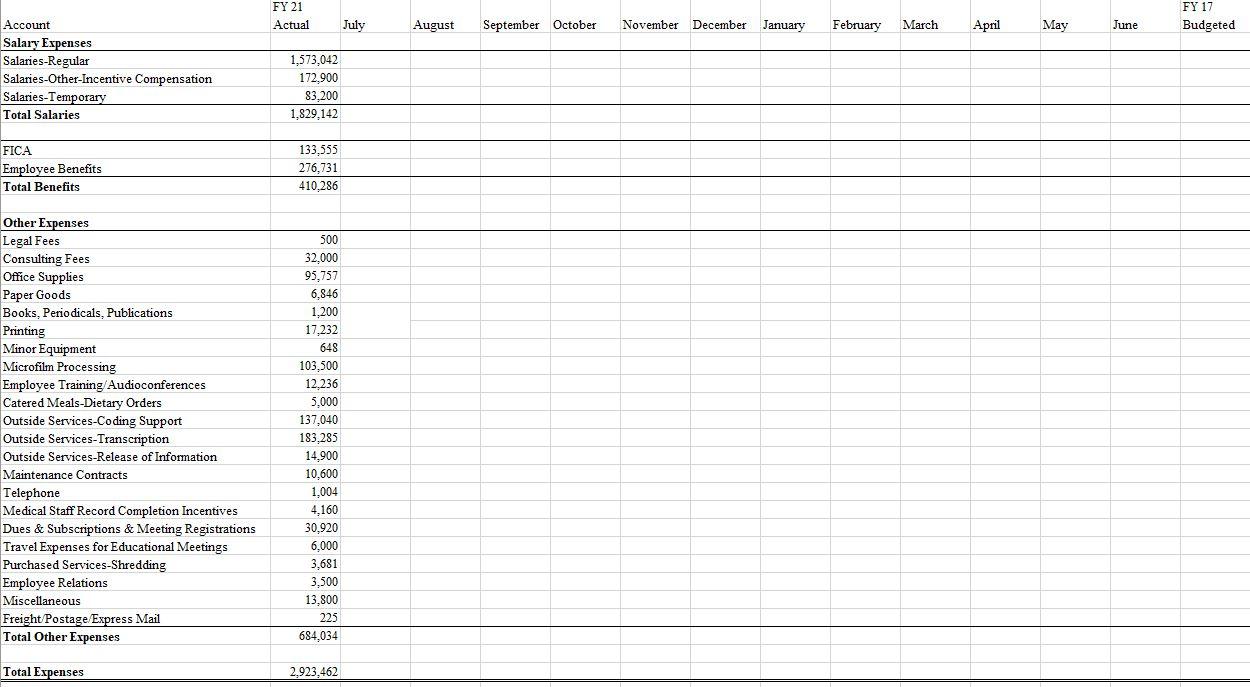

FY 21 Actual July FY 17 Budgeted August September October November December January February March April May June Account Salary Expenses Salaries-Regular Salaries-Other-Incentive Compensation Salaries-Temporary Total Salaries 1,573,042 172,900 83.200 1,829.142 FICA Employee Benefits Total Benefits 133,555 276,731 410,286 Other Expenses Legal Fees Consulting Fees Office Supplies Paper Goods Books, Periodicals, Publications Printing Minor Equipment Microfilm Processing Employee Training/Audioconferences Catered Meals-Dietary Orders Outside Services-Coding Support Outside Services Transcription Outside Services-Release of Information Maintenance Contracts Telephone Medical Staff Record Completion Incentives Dues & Subscriptions & Meeting Registrations Travel Expenses for Educational Meetings Purchased Services-Shredding Employee Relations Miscellaneous Freight/Postage/Express Mail Total Other Expenses 500 32,000 95,757 6,846 1,200 17,232 648 103,500 12.236 5,000 137,040 183,285 14,900 10,600 1,004 4,160 30,920 6,000 3,681 3,500 13,800 225 684,034 Total Expenses 2,923,462 FY 21 Actual July FY 17 Budgeted August September October November December January February March April May June Account Salary Expenses Salaries-Regular Salaries-Other-Incentive Compensation Salaries-Temporary Total Salaries 1,573,042 172,900 83.200 1,829.142 FICA Employee Benefits Total Benefits 133,555 276,731 410,286 Other Expenses Legal Fees Consulting Fees Office Supplies Paper Goods Books, Periodicals, Publications Printing Minor Equipment Microfilm Processing Employee Training/Audioconferences Catered Meals-Dietary Orders Outside Services-Coding Support Outside Services Transcription Outside Services-Release of Information Maintenance Contracts Telephone Medical Staff Record Completion Incentives Dues & Subscriptions & Meeting Registrations Travel Expenses for Educational Meetings Purchased Services-Shredding Employee Relations Miscellaneous Freight/Postage/Express Mail Total Other Expenses 500 32,000 95,757 6,846 1,200 17,232 648 103,500 12.236 5,000 137,040 183,285 14,900 10,600 1,004 4,160 30,920 6,000 3,681 3,500 13,800 225 684,034 Total Expenses 2,923,462

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts