Question: I need help! plz write every step, thank you~ Macaulay duration and Modified Duration are two different ways of calculating the average duration of a

I need help! plz write every step, thank you~

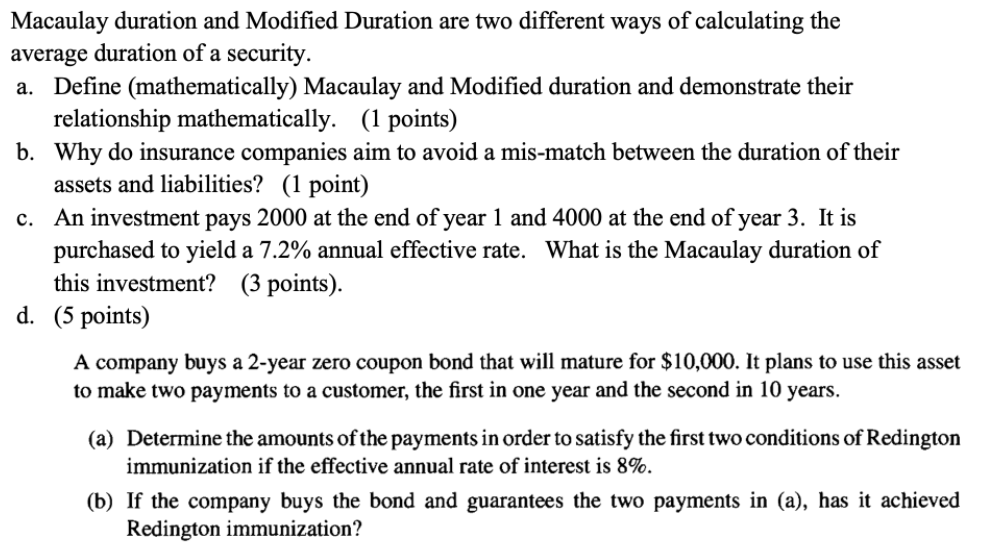

Macaulay duration and Modified Duration are two different ways of calculating the average duration of a security. a. Define (mathematically) Macaulay and Modified duration and demonstrate their relationship mathematically. (1 points) b. Why do insurance companies aim to avoid a mis-match between the duration of their assets and liabilities? (1 point) c. An investment pays 2000 at the end of year 1 and 4000 at the end of year 3. It is purchased to yield a 7.2% annual effective rate. What is the Macaulay duration of this investment? (3 points). d. (5 points) A company buys a 2-year zero coupon bond that will mature for $10,000. It plans to use this asset to make two payments to a customer, the first in one year and the second in 10 years. (a) Determine the amounts of the payments in order to satisfy the first two conditions of Redington immunization if the effective annual rate of interest is 8%. (b) If the company buys the bond and guarantees the two payments in (a), has it achieved Redington immunization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts