Question: 8. Macaulay duration and Modified Duration are two different ways of calculating the average duration of a security. a. Why would an insurance company want

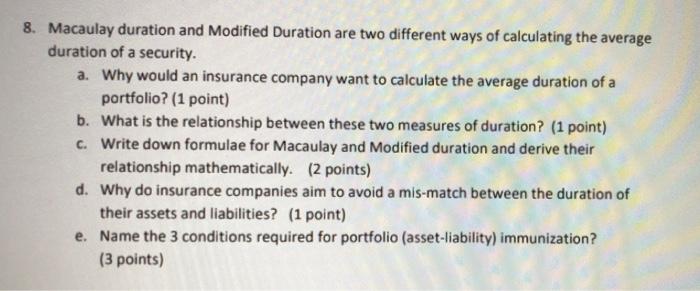

8. Macaulay duration and Modified Duration are two different ways of calculating the average duration of a security. a. Why would an insurance company want to calculate the average duration of a portfolio? (1 point) b. What is the relationship between these two measures of duration? (1 point) c. Write down formulae for Macaulay and Modified duration and derive their relationship mathematically. (2 points) d. Why do insurance companies aim to avoid a mis-match between the duration of their assets and liabilities? (1 point) e. Name the 3 conditions required for portfolio (asset-liability) immunization? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts