Question: I need help preparing all necessary financial statements for the following. For some reason my totals are just not adding up. I have attached the

I need help preparing all necessary financial statements for the following. For some reason my totals are just not adding up. I have attached the unadjusted trial balance. I need Adjusted Trial balance, T-Accounts, Income statement, Balance sheet, Statement of Retained earnings, Closing entries, and Post Closing Trial Balance.

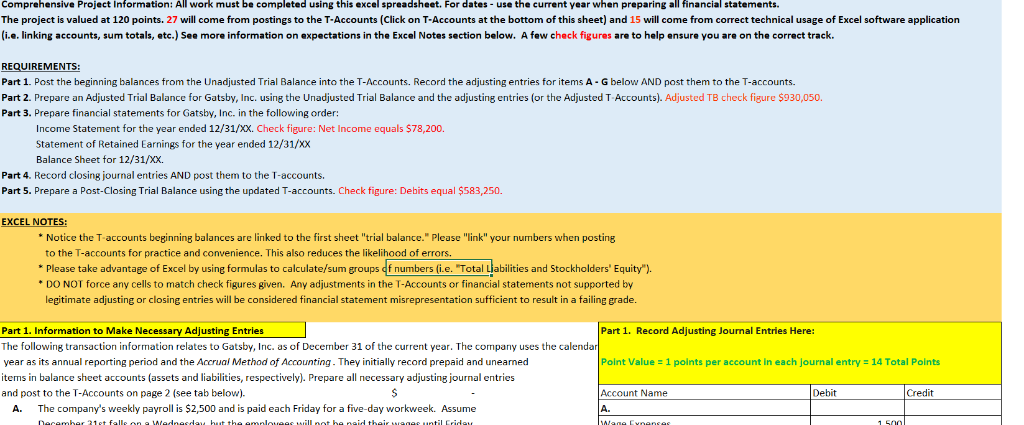

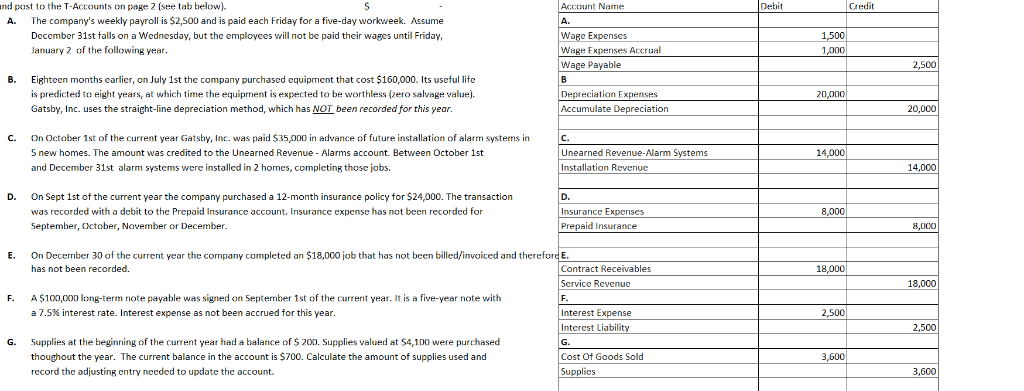

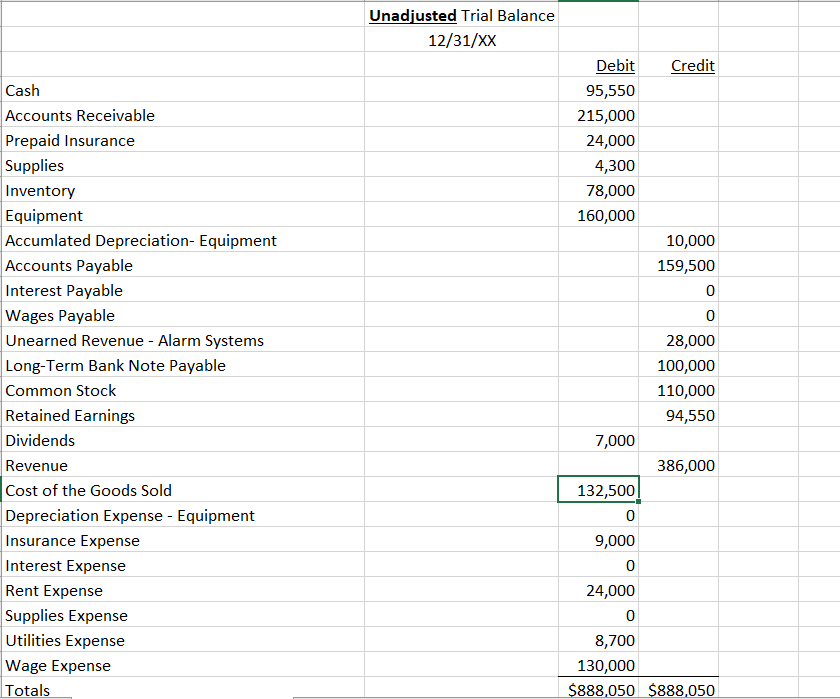

Comprehensive Project Information: All work must be completed using this excel spreadsheet. For dates use the current year when preparing all financial statements. The project is valued at 120 points. 27 will come from postings to the T-Accounts (Click on T-Accounts at the bottom of this sheet) and 15 will come from correct technical usage Excel software application (i.e. linking accounts, sum totals, atc.) See more information on expectations in the Excel Notes section below. A few check figures are to help ensure you are on the correct track. REQUIREMENTS: Part 1. Post the beginning balances from the Unadjusted Trial Balance into the T-Accounts. Record the adjusting entries for items A G below AND post them to the T-accounts Prepare an Adjusted Trial Balance for Gatsby, Inc. using the Unadjusted Trial Balance and the adjusting entries (or the Adjusted T-Accounts). Adjusted TB check figure $930,050. Part 2 Part Prepare financial for lowing order : Net Income equals $78,200. e year Stat for the vear ended 12/31/XX tof Retained D . ng: Balance Sheet for 12/31/Xx, Part 4. Record closing journal entries AND post them to the T-accounts Part 5. Prepare a Post-Closing Trial Balance using the updated T-accounts. Check figure: Debits equal $583,250. EXCEL NOTES *Notice the T-accounts beginning balances are linked to the first sheet "trial balance." Please "link" your numbers when posting to the T-accounts for practice and convenience. This also reduces the likelihood of errors. Please take advantage of Excel by using formulas to calculate/sum groups of numbers (i.e. "Total Liabilities and Stockholders' Equity"). DO NOT force any cells to match check figures given. Any adjustments in the T-Accounts or financial statements not supported by legitimate adjusting or closing entries will be considered financial statement misrepresentation sufficient to result in a failing grade. Part 1. Record Adjusting Journal Entries Here: Part 1. Information t Make Necessary Adjusting Entries The following transaction information relates to Gatsby, Inc. as of December 1 of the current year. The company uses the calendar Polnt Value=1 points per account year as its annual reporting period and the Accrual Method Accounting. They initially record prepaid and unearned each lournal entry = 14 Total Points items in balance sheet accounts (assets and liabilities, respectively). Prepare all necessary adjusting journal entries Account Name $ Debit and post to the T-Accounts page 2 (see tab below). Credit The company's weekly payroll Decamber 31 et falle on a Mednesday hut the emaloveas will pot be neid thair wages until Eridet $2,500 and is paid each Friday for a five-day workweek. Assume A. Wege ExnencR A. 1 500 nd post to the T-Accounts on page 2 (see tab below). Debit Credit Account Name A. A The company's weekly payroll is $2,500 and is paid each Friday for a five-day workweek. Assume Wage Expenses December 31st falls on a Wednesday, but the employees will not be paid their wages until Friday, 1,500 Wage Experses Accrual Wage Payable January 2 of the following vear. 1.000 2,500 B Eighteen months earlier, on July 1st the company purchased equipment that cost $160,000. Its useful life b value). oreciation Exnenses 20,000 Gatshy Inc a depreciation method which has NOT been recorded for thie Accumulate Depreciation straight-line 20.000 us year. future installation of alarm systems in On October 1st of the current year Gatsby, Inc. was paid $35,000 in advance C C. Unearned Revenue-Alarm Systems 5 new homes. The amount was credited to the Unearned Revenue Alarms account. Between October 1st 14,000 Installation Revenuc and December 31st alarm systems were installed in 2 homes, completing those jobs. 14,000 D. D On Sept 1st of the current year the company purchased a 12-month insurance policy for $24,000. The transaction Insurance Expenses was recorded with a debit to the Prepaid Insurance account. Insurance expense has not been recorded for 8.000 September, October, November or December. Prepaid Insurance 8,000 $18,000 job that has not been billed/invoiced and thereford E current year the company completed F On December 30 c Contract Receivables has not been recorded. 18,000 Service Revenue 18,000 -term note pavable was signed on 5 ... $100,000 tember 1st of the current year. It is a five-year note with tboon accod tor thie Interest Expense a 7 5% interest rato Inter 2,500 Interest Liability G. Cost Of Goods Sold Supplies 2,500 Supplies at the beginning of the current year had a balance of $ 200. Supplies valued at $4,100 were purchased G. thoughout the year. The current balance in the account is $700. Calculate the amount of supplies used and 3.600 record the adjusting entry needed to update the account 3,600 Unadjusted Trial Balance 12/31/XX Debit Credit Cash 95,550 Accounts Receivable 215,000 Prepaid Insurance |Supplies Inventory Equipment Accumlated Depreciation- Equipment Accounts Payable Interest Payable Wages Payable Unearned Revenue - Alarm Systems 24,000 4,300 78,000 160,000 10,000 159,500 0 28,000 Long-Term Bank Note Payable 100,000 Common Stock Retained Earnings Dividends Revenue Cost of the Goods Sold 110,000 94,550 7,000 386,000 132,500 Depreciation Expense - Equipment Insurance Expense Interest Expense Rent Expense |Supplies Expense Utilities Expense Wage Expense Totals 0 9,000 0 24,000 0 8,700 130,000 $888,050 $888,050

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts