Question: I need help preparing the Cash Flow using the balance sheet , income statement and supporting information. Thanks For this question, you will prepare a

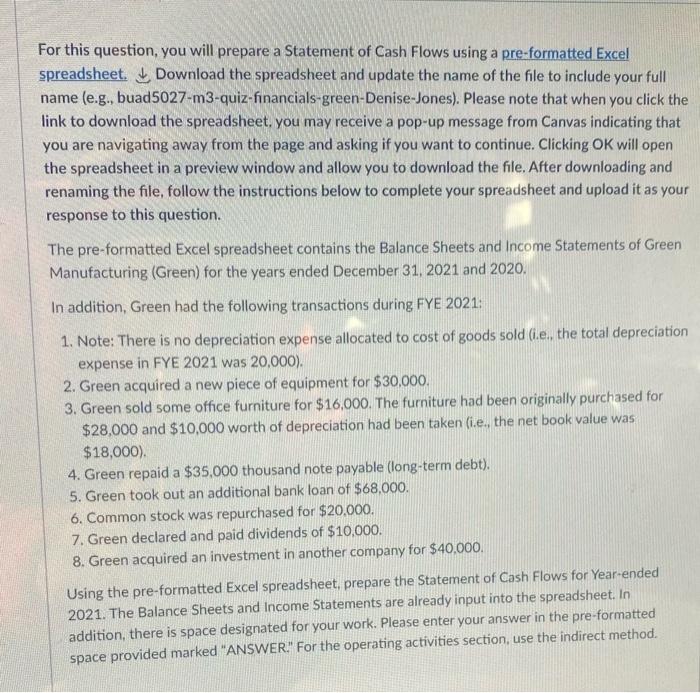

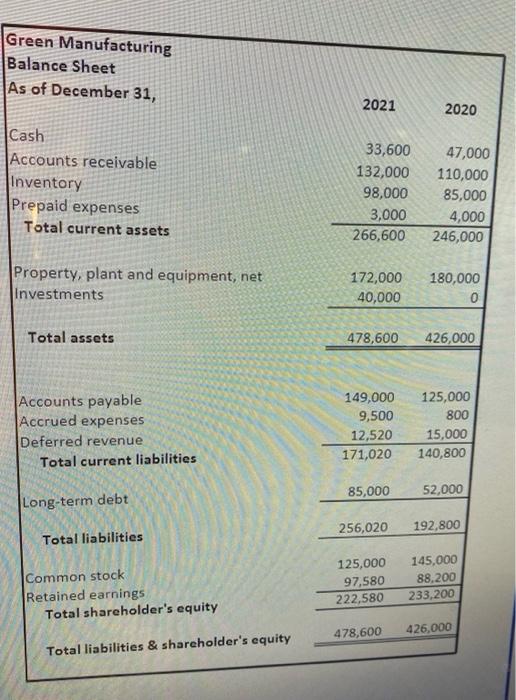

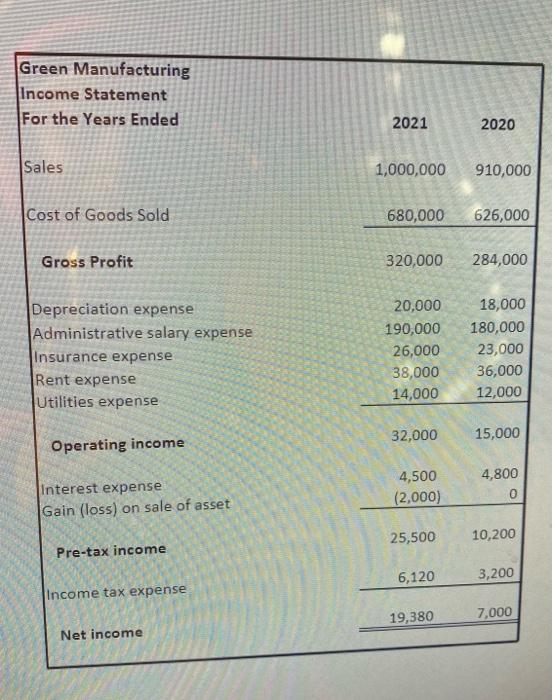

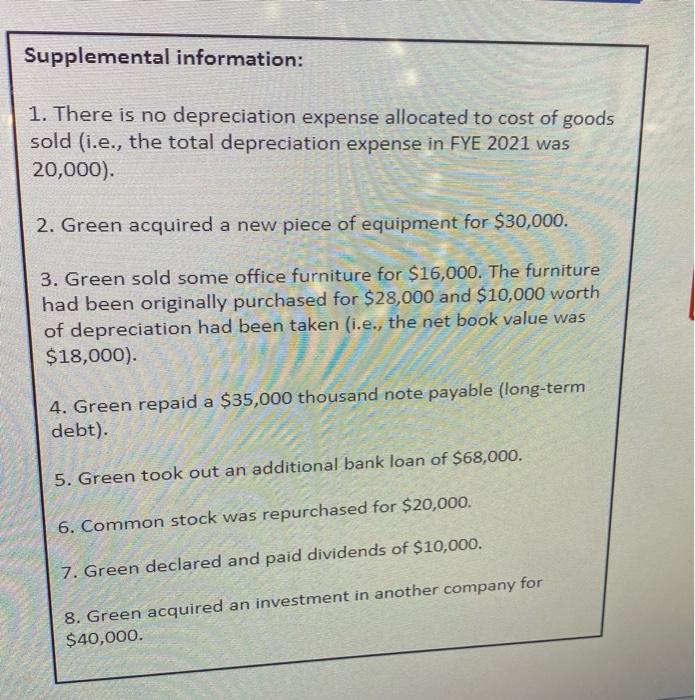

For this question, you will prepare a statement of Cash Flows using a pre-formatted Excel spreadsheet. Download the spreadsheet and update the name of the file to include your full name (e.g., buad5027-m3-quiz-financials-green-Denise-Jones). Please note that when you click the link to download the spreadsheet, you may receive a pop-up message from Canvas indicating that you are navigating away from the page and asking if you want to continue. Clicking OK will open the spreadsheet in a preview window and allow you to download the file. After downloading and renaming the file, follow the instructions below to complete your spreadsheet and upload it as your response to this question. The pre-formatted Excel spreadsheet contains the Balance Sheets and Income Statements of Green Manufacturing (Green) for the years ended December 31, 2021 and 2020. In addition, Green had the following transactions during FYE 2021: 1. Note: There is no depreciation expense allocated to cost of goods sold (.es, the total depreciation expense in FYE 2021 was 20,000). 2. Green acquired a new piece of equipment for $30,000. 3. Green sold some office furniture for $16,000. The furniture had been originally purchased for $28,000 and $10,000 worth of depreciation had been taken (i.e., the net book value was $18,000), 4. Green repaid a $35.000 thousand note payable (long-term debt). 5. Green took out an additional bank loan of $68,000. 6. Common stock was repurchased for $20,000. 7. Green declared and paid dividends of $10,000. 8. Green acquired an investment in another company for $40.000. Using the pre-formatted Excel spreadsheet, prepare the Statement of Cash Flows for Year-ended 2021. The Balance Sheets and Income Statements are already input into the spreadsheet. In addition, there is space designated for your work. Please enter your answer in the pre-formatted space provided marked "ANSWER." For the operating activities section, use the indirect method. Green Manufacturing Balance Sheet As of December 31, 2021 2020 Cash Accounts receivable Inventory Prepaid expenses Total current assets 33,600 132,000 98,000 3,000 266,600 47,000 110,000 85,000 4,000 246,000 Property, plant and equipment, net Investments 180,000 172,000 40,000 Total assets 478,600 426,000 Accounts payable Accrued expenses Deferred revenue Total current liabilities 149,000 9,500 12,520 171,020 125,000 800 15,000 140,800 85,000 52,000 Long-term debt 256,020 192,800 Total liabilities Common stock Retained earnings Total shareholder's equity 125,000 97,580 222,580 145,000 88,200 233,200 478,600 426,000 Total liabilities & shareholder's equity Green Manufacturing Income Statement For the Years Ended 2021 2020 Sales 1,000,000 910,000 Cost of Goods Sold 680,000 626,000 Gross Profit 320,000 284,000 Depreciation expense Administrative salary expense Insurance expense Rent expense Utilities expense 20,000 190,000 26,000 38,000 14,000 18,000 180,000 23,000 36,000 12,000 32,000 15,000 Operating income 4,800 Interest expense Gain (loss) on sale of asset 4,500 (2,000) 25,500 10,200 Pre-tax income 6,120 3,200 Income tax expense 19,380 7,000 Net income Supplemental information: 1. There is no depreciation expense allocated to cost of goods sold (i.e., the total depreciation expense in FYE 2021 was 20,000). 2. Green acquired a new piece of equipment for $30,000. 3. Green sold some office furniture for $16,000. The furniture had been originally purchased for $28,000 and $10,000 worth of depreciation had been taken (i.e., the net book value was $18,000). 4. Green repaid a $35,000 thousand note payable (long-term debt). 5. Green took out an additional bank loan of $68,000. 6. Common stock was repurchased for $20,000. 7. Green declared and paid dividends of $10,000. 8. Green acquired an investment in another company for $40,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts