Question: Suppose you want to create a Bear Put option strategy based on AAPL put options. The Bear Put strategy will involve the following: Buying

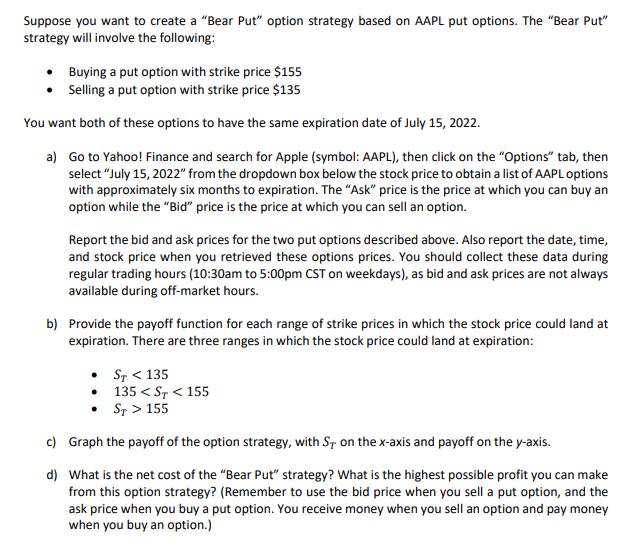

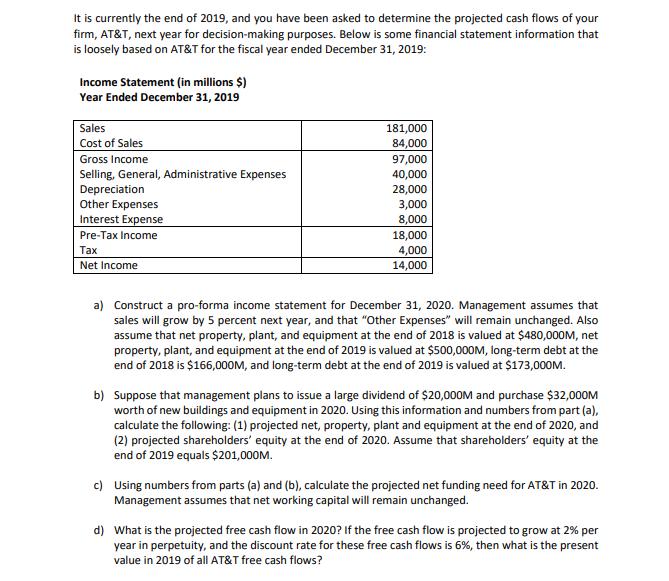

Suppose you want to create a "Bear Put" option strategy based on AAPL put options. The "Bear Put" strategy will involve the following: Buying a put option with strike price $155 Selling a put option with strike price $135 You want both of these options to have the same expiration date of July 15, 2022. a) Go to Yahoo! Finance and search for Apple (symbol: AAPL), then click on the "Options" tab, then select "July 15, 2022" from the dropdown box below the stock price to obtain a list of AAPL options with approximately six months to expiration. The "Ask" price is the price at which you can buy an option while the "Bid" price is the price at which you can sell an option. Report the bid and ask prices for the two put options described above. Also report the date, time, and stock price when you retrieved these options prices. You should collect these data during regular trading hours (10:30am to 5:00pm CST on weekdays), as bid and ask prices are not always available during off-market hours. b) Provide the payoff function for each range of strike prices in which the stock price could land at expiration. There are three ranges in which the stock price could land at expiration: ST < 135 135 155 c) Graph the payoff of the option strategy, with ST on the x-axis and payoff on the y-axis. d) What is the net cost of the "Bear Put" strategy? What is the highest possible profit you can make from this option strategy? (Remember to use the bid price when you sell a put option, and the ask price when you buy a put option. You receive money when you sell an option and pay money when you buy an option.) It is currently the end of 2019, and you have been asked to determine the projected cash flows of your firm, AT&T, next year for decision-making purposes. Below is some financial statement information that is loosely based on AT&T for the fiscal year ended December 31, 2019: Income Statement (in millions $) Year Ended December 31, 2019 Sales Cost of Sales Gross Income Selling, General, Administrative Expenses Depreciation Other Expenses Interest Expense Pre-Tax Income Tax Net Income 181,000 84,000 97,000 40,000 28,000 3,000 8,000 18,000 4,000 14,000 a) Construct a pro-forma income statement for December 31, 2020. Management assumes that sales will grow by 5 percent next year, and that "Other Expenses" will remain unchanged. Also assume that net property, plant, and equipment at the end of 2018 is valued at $480,000M, net property, plant, and equipment at the end of 2019 is valued at $500,000M, long-term debt at the end of 2018 is $166,000M, and long-term debt at the end of 2019 is valued at $173,000M. b) Suppose that management plans to issue a large dividend of $20,000M and purchase $32,000M worth of new buildings and equipment in 2020. Using this information and numbers from part (a), calculate the following: (1) projected net, property, plant and equipment at the end of 2020, and (2) projected shareholders' equity at the end of 2020. Assume that shareholders' equity at the end of 2019 equals $201,000M. c) Using numbers from parts (a) and (b), calculate the projected net funding need for AT&T in 2020. Management assumes that net working capital will remain unchanged. d) What is the projected free cash flow in 2020? If the free cash flow is projected to grow at 2% per year in perpetuity, and the discount rate for these free cash flows is 6%, then what is the present value in 2019 of all AT&T free cash flows?

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Here are the projections for ATTs cash flows in 2020 a Proforma income statement fo... View full answer

Get step-by-step solutions from verified subject matter experts