Question: I need help seeing the steps on this assignment You have a pension plan that will begin in one month. The plan is guaranteed to

I need help seeing the steps on this assignment

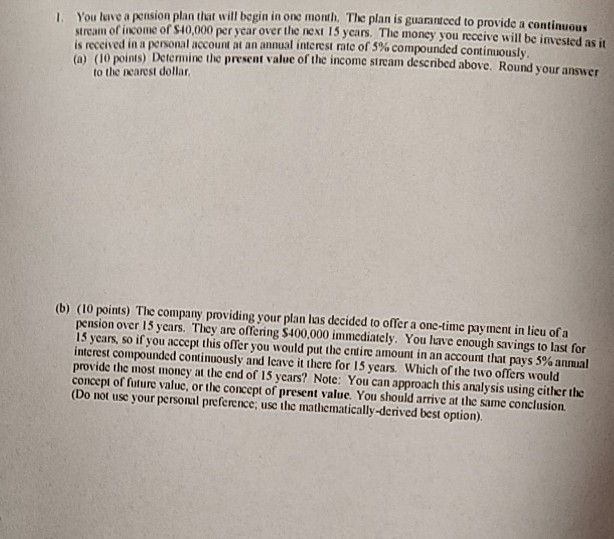

You have a pension plan that will begin in one month. The plan is guaranteed to provide a continuous stream of income or S10,000 per year over the next 15 years. The money you receive will be invested as it is received in a personal account at an annual interest rate of 5% compounded continuously (10 points) Determine the present value of the income stream described above. Round your answer to the nearest dollar (b) (10 points) The company providing your plan las decided to offer a one-time payment in lieu of a pension over 15 years. They are offering $400,000 immediately. You have enough savings to last for 15 years, so if you accept this offer you would put the entire amount in an account that pays 5% annual interest compounded continuously and leave it there for 15 years. Which of the two offers would provide the most money at the end of 15 years? Note: You can approach this analysis using cither the concept of future value, or the concept of present value. You should arrive at the same conclusion (Do not use your personal preference; use the mathematically-derived best option)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts