Question: I need help seeing the steps to find the answer for this: The business of selling insurance is based on probability and the law of

I need help seeing the steps to find the answer for this:

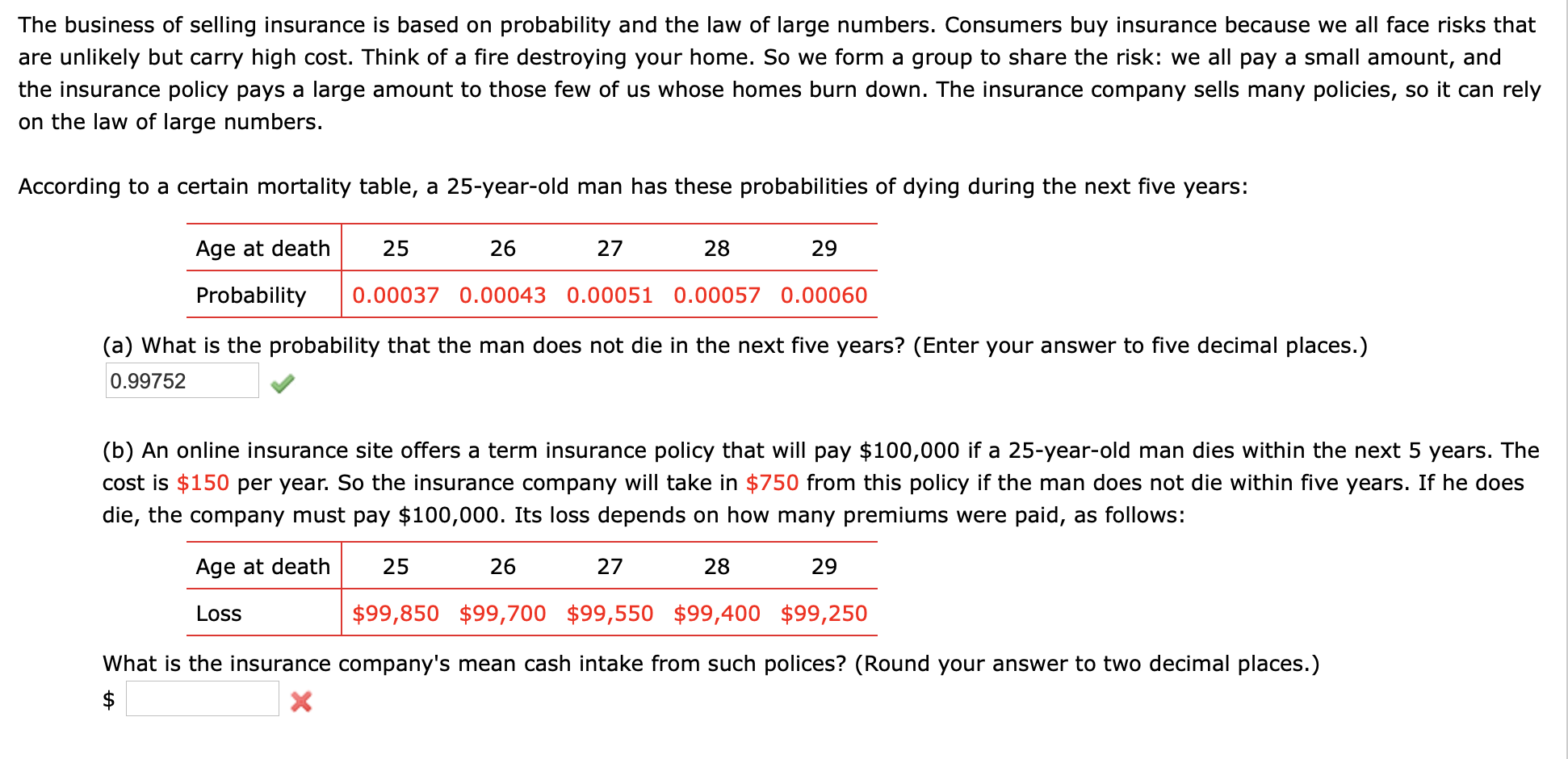

The business of selling insurance is based on probability and the law of large numbers. Consumers buy insurance because we all face risks that are unlikely but carry high cost. Think of a re destroying your home. So we form a group to share the risk: we all pay a small amount, and the insurance policy pays a large amount to those few of us whose homes burn down. The insurance company sells many policies, so it can rely on the law of large numbers. According to a certain mortality table, a 25-year-old man has these probabilities of dying during the next ve years: Age at death Probability 25 26 27 28 29 0.00037 0.00043 0.00051 0.00057 0.00060 (a) What is the probability that the man does not die in the next five years? (Enter your answer to ve decimal places.) 0.99752 4 (b) An online insurance site offers a term insurance policy that will pay $100,000 if a 25-year-old man dies within the next 5 years. The cost is $150 per year. So the insurance company will take in $750 from this policy if the man does not die within five years. If he does die, the company must pay $100,000. Its loss depends on how many premiums were paid, as follows: Age at death L05 5 25 26 27 28 29 $99,850 $99,700 $99,550 $99,400 $99,250 What is the insurance company's mean cash intake from such polices? (Round your answer to two decimal places.) $ X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts