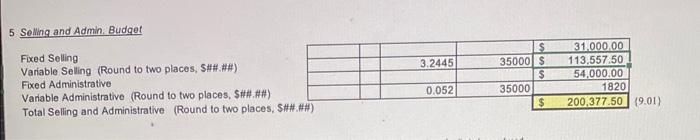

Question: i need help solving 9.01 my answer is wrong. thanks! 5 Selling and Admin. Budget Fixed Selling Variable Selling (Round to two places, St. ##)

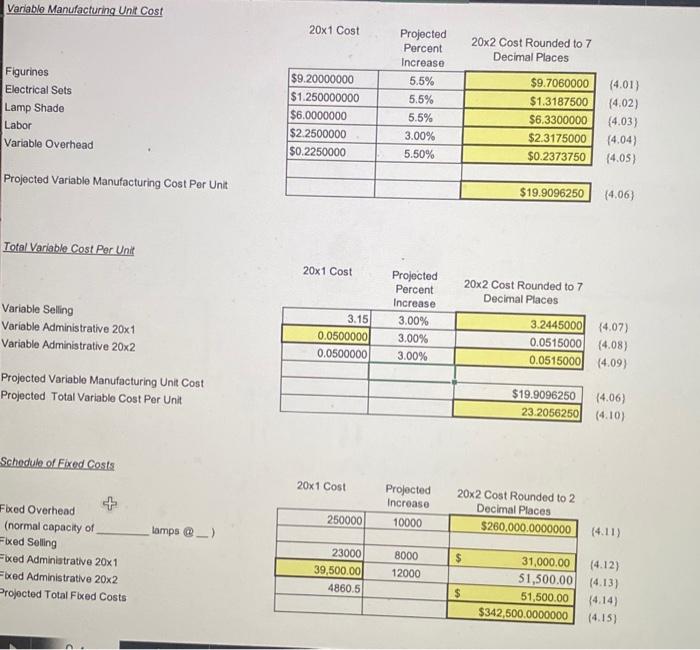

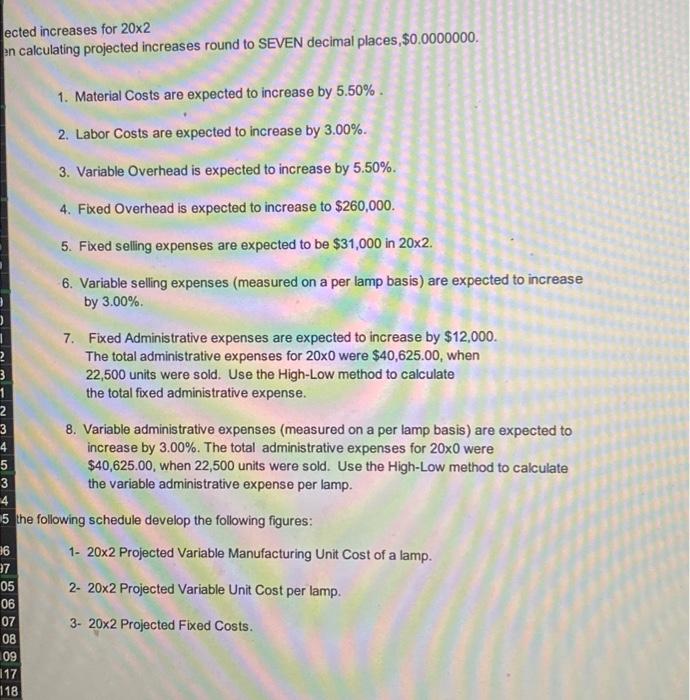

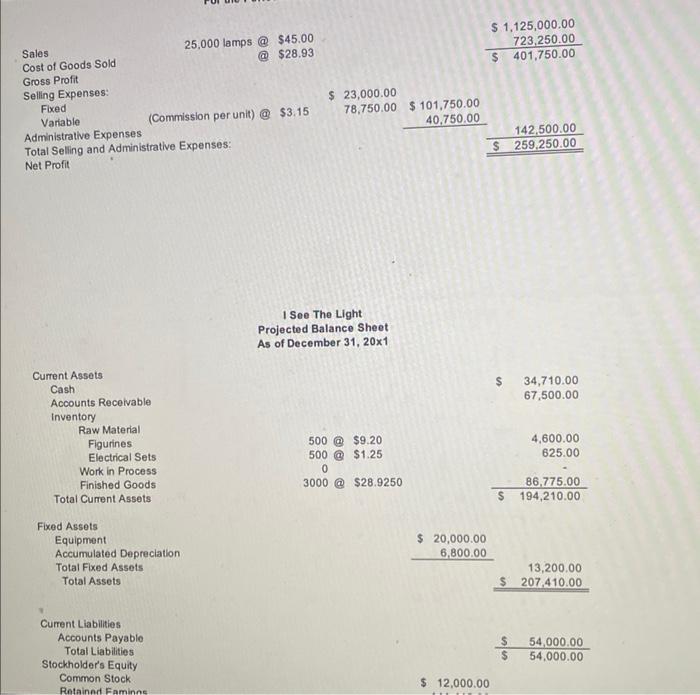

5 Selling and Admin. Budget Fixed Selling Variable Selling (Round to two places, St. \#\#) Fixed Administrative Variable Administrative (Round to two places, SH\#. HA) Total Selling and Administrative (Round to two places, SH\#..HAl) (9.01) 1 cted increases for 202 calculating projected increases round to SEVEN decimal places, $0.0000000. 1. Material Costs are expected to increase by 5.50%. 2. Labor Costs are expected to increase by 3.00%. 3. Variable Overhead is expected to increase by 5.50%. 4. Fixed Overhead is expected to increase to $260,000. 5. Fixed selling expenses are expected to be $31,000 in 202. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.00%. 7. Fixed Administrative expenses are expected to increase by $12,000. The total administrative expenses for 200 were $40,625.00, when 22,500 units were sold. Use the High-Low method to calculate the total foxed administrative expense. 8. Variable administrative expenses (measured on a per lamp basis) are expected to increase by 3.00%. The total administrative expenses for 200 were $40,625.00, when 22,500 units were sold. Use the High-Low method to calculate the variable administrative expense per lamp. the following schedule develop the following figures: 1. 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 2- 20x2 Projected Variable Unit Cost per lamp. 3. 20x2 Projected Fixed Costs. Sales Cost of Goods Sold 25,000 lamps @ $45.00 (a) $28.93 $1,125,000.00723,250.00$401,750.00 Gross Profit Selling Expenses: Fixed Variable Administrative Expenses Total Selling and Administrative Expenses: 142,500.00$259,250.00 Net Profit I See The Light Projected Balance Sheet As of December 31, 20x1 Current Assets Cash Accounts Receivable Inventory Raw Material RawMaterialFigurinesElectricalSetsWorkinProcessFinishedGoods500@$9.20500@$1.2503000@$28.9250625.0086.775.00$194,210.004.600.00 Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets 13,200.00$207,410.00 Cument Liabilities Accounts Payablo Total Liabilities Stockholder's Equity Common Stock Rotainet Famk \$ 12,000.00 5 Selling and Admin. Budget Fixed Selling Variable Selling (Round to two places, St. \#\#) Fixed Administrative Variable Administrative (Round to two places, SH\#. HA) Total Selling and Administrative (Round to two places, SH\#..HAl) (9.01) 1 cted increases for 202 calculating projected increases round to SEVEN decimal places, $0.0000000. 1. Material Costs are expected to increase by 5.50%. 2. Labor Costs are expected to increase by 3.00%. 3. Variable Overhead is expected to increase by 5.50%. 4. Fixed Overhead is expected to increase to $260,000. 5. Fixed selling expenses are expected to be $31,000 in 202. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.00%. 7. Fixed Administrative expenses are expected to increase by $12,000. The total administrative expenses for 200 were $40,625.00, when 22,500 units were sold. Use the High-Low method to calculate the total foxed administrative expense. 8. Variable administrative expenses (measured on a per lamp basis) are expected to increase by 3.00%. The total administrative expenses for 200 were $40,625.00, when 22,500 units were sold. Use the High-Low method to calculate the variable administrative expense per lamp. the following schedule develop the following figures: 1. 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 2- 20x2 Projected Variable Unit Cost per lamp. 3. 20x2 Projected Fixed Costs. Sales Cost of Goods Sold 25,000 lamps @ $45.00 (a) $28.93 $1,125,000.00723,250.00$401,750.00 Gross Profit Selling Expenses: Fixed Variable Administrative Expenses Total Selling and Administrative Expenses: 142,500.00$259,250.00 Net Profit I See The Light Projected Balance Sheet As of December 31, 20x1 Current Assets Cash Accounts Receivable Inventory Raw Material RawMaterialFigurinesElectricalSetsWorkinProcessFinishedGoods500@$9.20500@$1.2503000@$28.9250625.0086.775.00$194,210.004.600.00 Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets 13,200.00$207,410.00 Cument Liabilities Accounts Payablo Total Liabilities Stockholder's Equity Common Stock Rotainet Famk \$ 12,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts