Question: i need help solving for it . In 2 0 - - , the annual salaries paid to each of the officers of Abrew, Inc.,

i need help solving for it

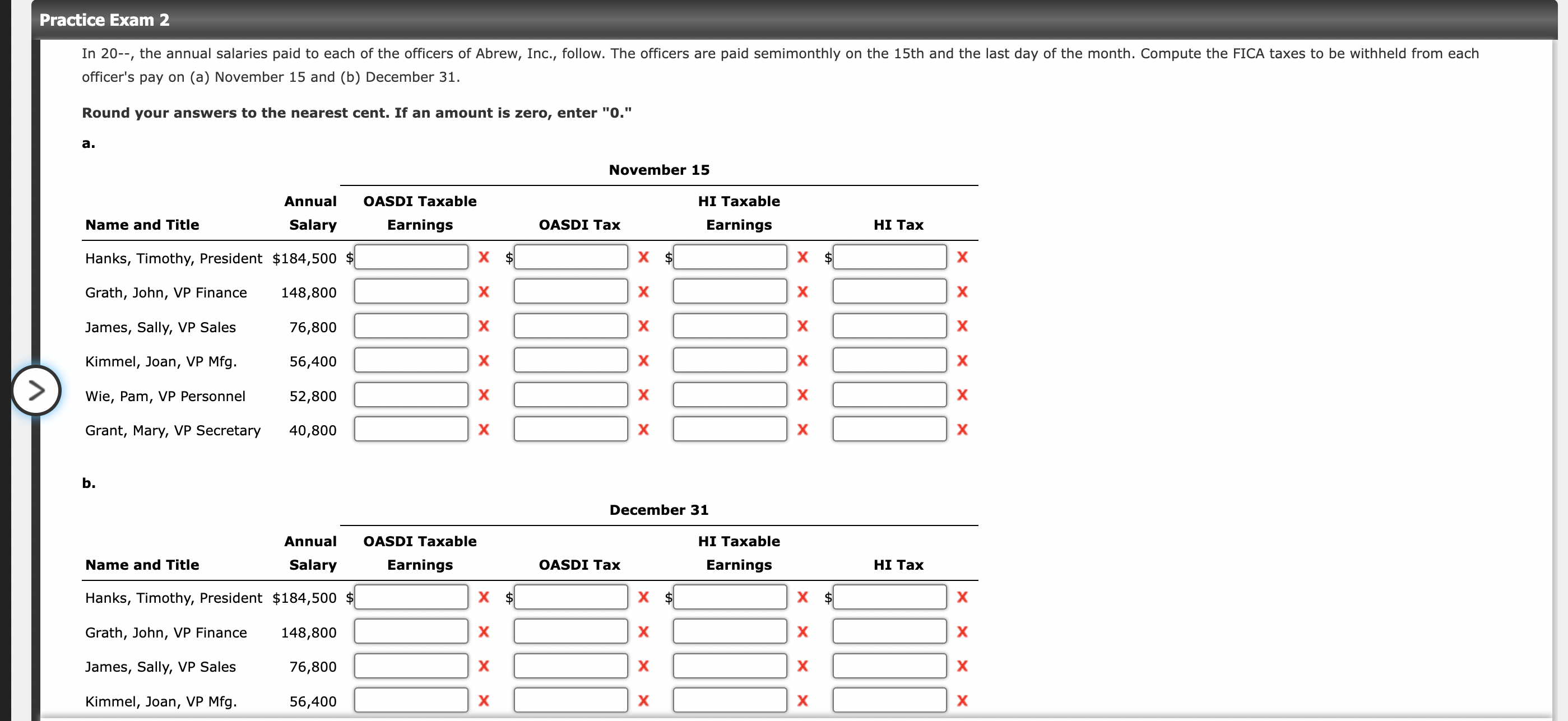

In the annual salaries paid to each of the officers of Abrew, Inc., follow. The officers are paid semimonthly on the th and the last day of the month. Compute the FICA taxes to be withheld from each officer's pay on a November and b December Round your answers to the nearest cent. If an amount is zero, enter aNovember Name and TitleAnnual SalaryOASDI Taxable Earnings OASDI TaxHI Taxable Earnings HI TaxHanks, Timothy, President$fill in the blank of $fill in the blank of $fill in the blank of $fill in the blank of $Grath, John, VP Financefill in the blank of fill in the blank of fill in the blank of fill in the blank of James, Sally, VP Salesfill in the blank of fill in the blank of fill in the blank of fill in the blank of Kimmel, Joan, VP Mfgfill in the blank of fill in the blank of fill in the blank of fill in the blank of Wie, Pam, VP Personnelfill in the blank of fill in the blank of fill in the blank of fill in the blank of Grant, Mary, VP Secretaryfill in the blank of fill in the blank of fill in the blank of fill in the blank of bDecember Name and TitleAnnual SalaryOASDI Taxable Earnings OASDI TaxHI Taxable Earnings HI TaxHanks, Timothy, President$fill in the blank of $fill in the blank of $fill in the blank of $fill in the blank of $Grath, John, VP Financefill in the blank of fill in the blank of fill in the blank of fill in the blank of James, Sally, VP Salesfill in the blank of fill in the blank of fill in the blank of fill in the blank of Kimmel, Joan, VP Mfgfill in the blank of fill in the blank of fill in the blank of fill in the blank of Wie, Pam, VP Personnelfill in the blank of fill in the blank of fill in the blank of fill in the blank of Grant, Mary, VP Secretaryfill in the blank of fill in the blank of fill in the blank of fill in the blank of Practice Exam In the annual salaries paid to each of the officers of Abrew, Inc., follow. The officers are paid semimonthly on the th and the last day of the month. Compute the FICA taxes to be withheld from each officer's pay on a November and b December Round your answers to the nearest cent. If an amount is zero, enter a November b December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock