Question: I need help solving the problem provided below. All the details for the problem are included. I lease use the pre below Plex 6812659 (

I need help solving the problem provided below. All the details for the problem are included.

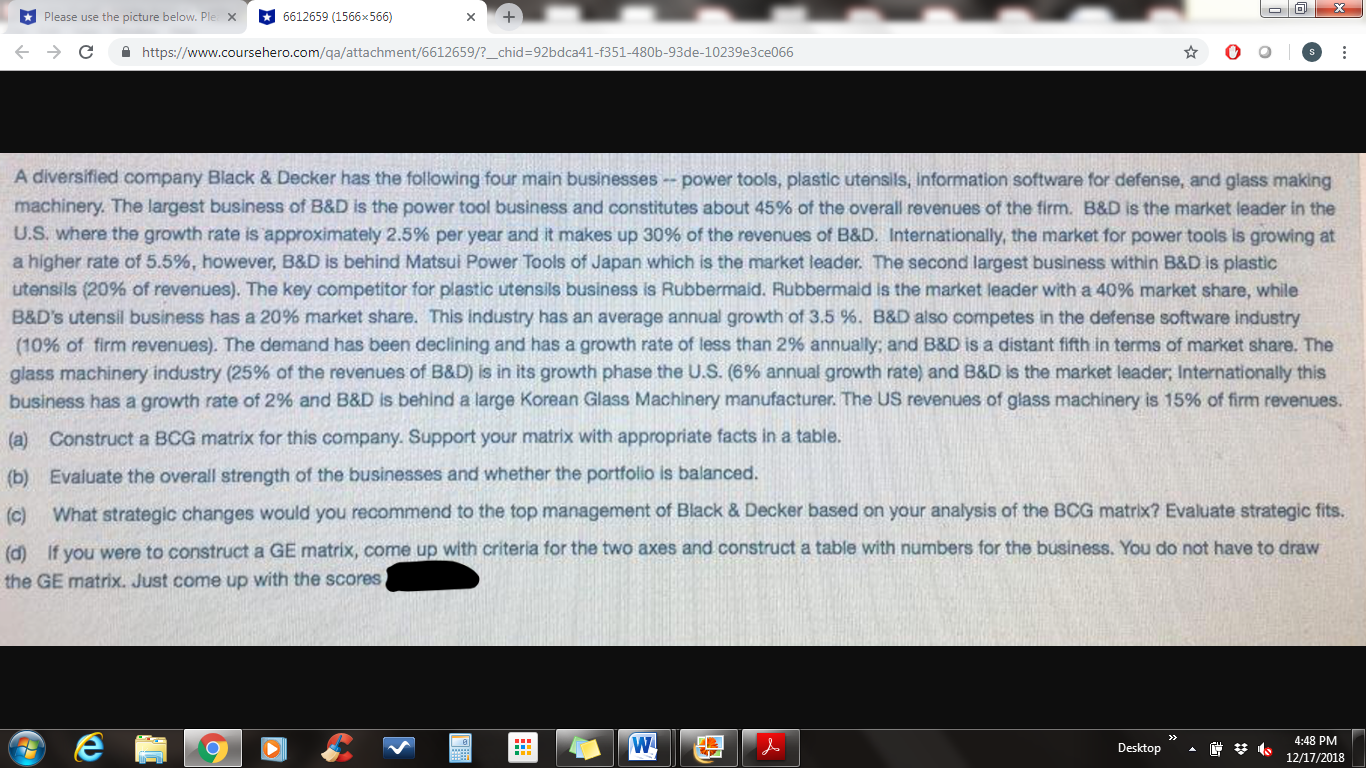

I lease use the pre below Plex 6812659 ( 1566 * 565 ) https / way coursehero com / ga/attachment 612659 /? chud 92 bd 1 1351 4806 93de - 10239 e 3 ce ( 6 6 O J A diversified company Black & Decker has the following four main businesses - power tools , plastic utensils , Information software for defense , and glass making machinery . The largest business of BED is the power tool bus business and constitutes about 45% of the overall revenues of the firm . BAD is the market leader in the et leader U .S . where the growth rate is approximately 2 596 per year and It makes up 3096 of the revenues of BED Internationally , the market for pow wer tools is growing at a higher rate of 5 .5% however , B &D Is behind Matsui Power Tools of Japan which is the market leader . The second largest business within BAD is plastic utensils ( 20 % of revenues ) . The Key competitor for plastic utensils business is Rubbermaid Rubbermaid is the market leader with a 40% market share , while B &D's utensil business has a 20% market share . This industry has an average annual growth of 3 5 % . B&D also competes in the defense software industry ( 1096 of firm revenues ) . The demand has been declining and has a growth than 205 annual of less than 2% annually and BBD is a distant fifth in terms of market share . The glass machinery industry ( 25/ of the revenues of BED ) is in Its growth phase the U .S . ( 69/ annual growth rate ) and BED is the market leader , Internationally this of the rey business has a growth rate of 2% and BED Is behind a large Korean Glass Machinery manufacturer . The US revenues of glass machinery is 159 6 of firm revenues ( 2 ) Construct a BCG matrix for this company . Support your matrix with appropriate facts in a table ( b ) Evaluate the overall strength of the businesses and whether the portfolio Is balanced (0 ) What strategic changes would you recommend to the top management of Black & Decker based on your analysis of the BCG matrix ? Evaluate strategic fi ( ) it you were to construct a GE matrix , come up with criteria for the two axes and construct a table with numbers for the business . You do not have to draw the GE matrix . Just come up with the scores

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts