Question: I need help solving these 3 questions please 7 A five year, zero coupon bond, with a $1,000 face value sells at auction for $710.00

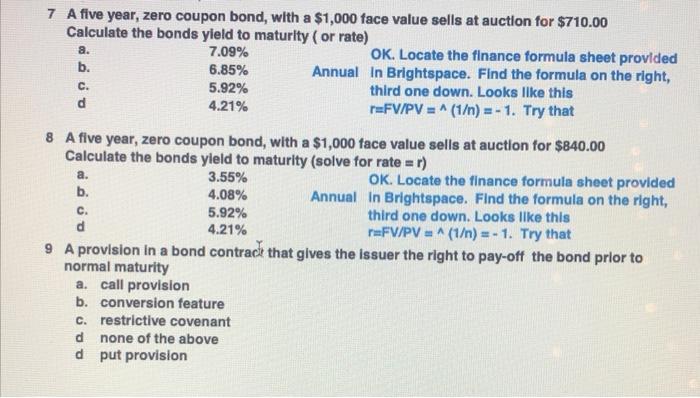

7 A five year, zero coupon bond, with a $1,000 face value sells at auction for $710.00 Calculate the bonds yield to maturity (or rate) Annual 8. b. C. d 7.09% 6.85% a. b. 5.92% 4.21% 8 A five year, zero coupon bond, with a $1,000 face value sells at auction for $840.00 Calculate the bonds yield to maturity (solve for rate= r) Annual C. d OK. Locate the finance formula sheet provided In Brightspace. Find the formula on the right, third one down. Looks like this r=FV/PV=^(1) = -1. Try that 9 A provision in a bond contract that gives the issuer the right to pay-off the bond prior to normal maturity a. call provision b. conversion feature c. restrictive covenant d d OK. Locate the finance formula sheet provided In Brightspace. Find the formula on the right, third one down. Looks like this r=FV/PV = ^ (1) = -1. Try that 3.55% 4.08% 5.92% 4.21% none of the above put provision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts