Question: I need help solving this problem. Thanks! Problem 3: Suppose that the Moon Lighting Company makes a decision to partition its assets into equity and

I need help solving this problem. Thanks!

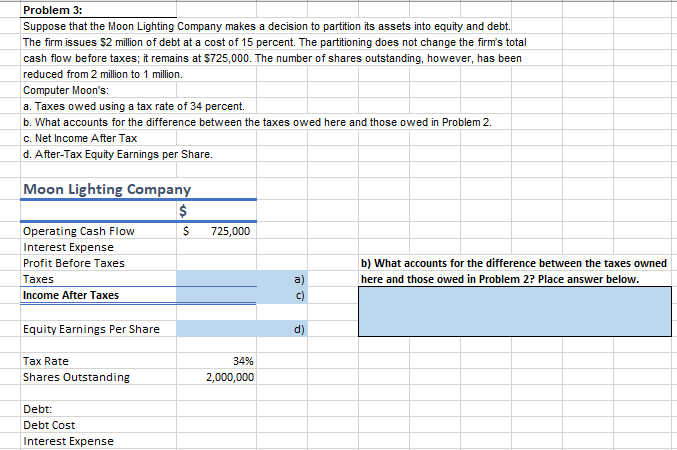

Problem 3: Suppose that the Moon Lighting Company makes a decision to partition its assets into equity and debt. The firm issues $2 million of debt at a cost of 15 percent. The partitioning does not change the firm's total cash flow before taxes; it remains at $725,000. The number of shares outstanding, however, has been reduced from 2 million to 1 million. Computer Moon's: a. Taxes owed using a tax rate of 34 percent. b. What accounts for the difference between the taxes owed here and those owed in Problem 2. c. Net Income After Tax d. After-Tax Equity Earnings per Share. 725,000 Moon Lighting Company $ Operating Cash Flow $ Interest Expense Profit Before Taxes Taxes Income After Taxes b) What accounts for the difference between the taxes owned here and those owed in Problem 2? Place answer below. a) c) Equity Earnings Per Share d) Tax Rate Shares Outstanding 34% 2,000,000 Debt: Debt Cost Interest Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts