Question: I need help solving this three answers, please... Review the list of taxable income amounts below: (Click the icon to view the taxable income amounts.)

I need help solving this three answers, please...

I need help solving this three answers, please...

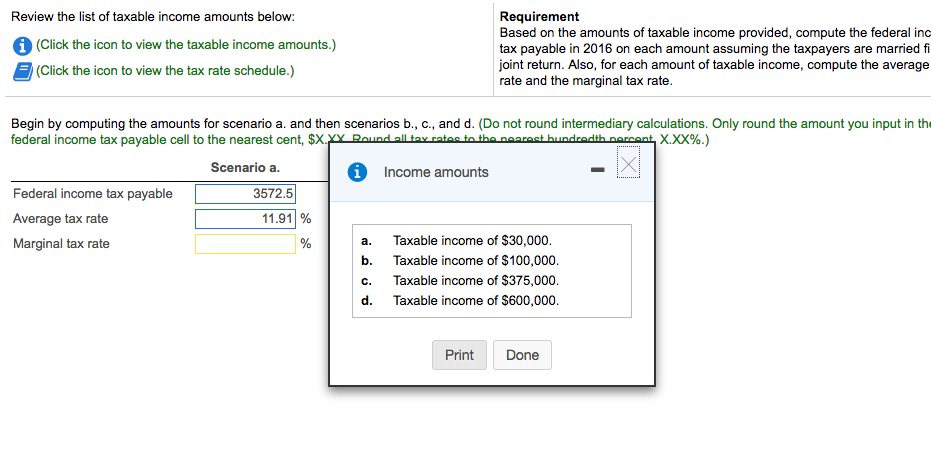

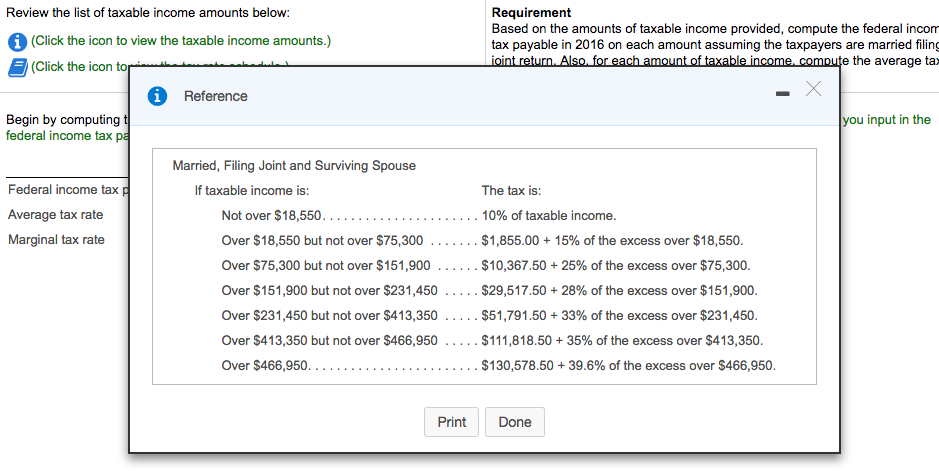

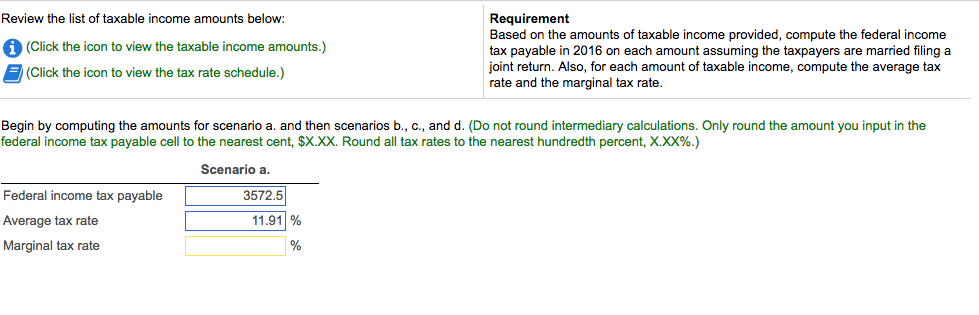

Review the list of taxable income amounts below: (Click the icon to view the taxable income amounts.) (Click the icon to view the tax rate schedule.) Requirement Based on the amounts of taxable income provided, compute the federal Inc. tax payable in 2016 on each amount assuming the taxpayers are married joint return. Also, for each amount of taxable income, compute the average rate and the marginal tax rate. Begin by computing the amounts for scenario a. and then scenarios b., c., and d. (Do not round intermediary calculations. Only round the amount you input in the federal income tax payable cell to the nearest cent, $X.XX Round all toy rates hundredth X.XX%.) Federal income tax payable 3572.5 Average tax rate 11.91% Marginal tax rate % a. Taxable income of $30,000. b. Taxable income of $100,000. c. Taxable income of $375,000. d. Taxable income of $600,000. Review the list of taxable income amounts below: (Click the icon to view the taxable income amounts.) (Click the icon Requirement Based on the amounts of taxable income provided, compute the federal incurred tax payable in 2016 on each amount assuming the taxpayers are married filing joint return. Also, for each amount of taxable income, compute the average tax. Review the list of taxable income amounts below: (Click the icon to view the taxable income amounts.) (Click the icon to view the tax rate schedule.) Requirement Based on the amounts of taxable income provided, compute the federal income tax payable in 2016 on each amount assuming the taxpayers are married filing a joint return. Also, for each amount of taxable income, compute the average tax rate and the marginal tax rate. Begin by computing the amounts for scenario a. and then scenarios b., c., and d. (Do not round intermediary calculations. Only round the amount you input in the federal income tax payable cell to the nearest cent, $X.XX. Round all tax rates to the nearest hundredth percent, X.XX%.) Federal income tax payable 3572.5 Average tax rate 11.91 % Marginal tax rate%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts