Question: I need help solving this, want to make sure I'm doing it right. Wilbur and Orville are brothers. They're both serious investors, but they have

I need help solving this, want to make sure I'm doing it right.

I need help solving this, want to make sure I'm doing it right.

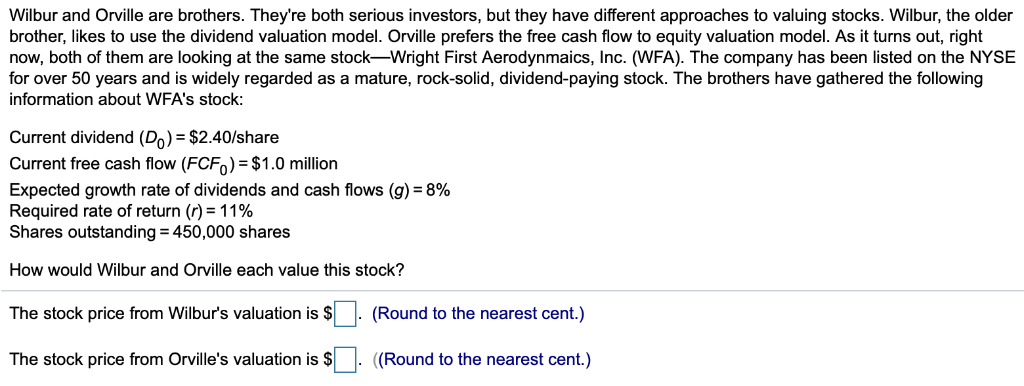

Wilbur and Orville are brothers. They're both serious investors, but they have different approaches to valuing stocks. Wilbur, the older brother, likes to use the dividend valuation model. Orville prefers the free cash flow to equity valuation model. As it turns out, right now, both of them are looking at the same stock-Wright First Aerodynmaics, Inc. (WFA). The company has been listed on the NYSE for over 50 years and is widely regarded as a mature, rock-solid, dividend-paying stock. The brothers have gathered the following information about WFA's stock: Current dividend (Dn) $2.40/share Current free cash flow (FCFn) = $1.0 million Expected growth rate of dividends and cash flows (g) 8% Required rate of return (r) = 11% Shares outstanding 450,000 shares How would ur and Orvill this k? The stock price from Wilbur's valuation is $ (Round to the nearest cent.) The stock price from Orville's valuation is $ ((Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts