Question: I need help solvinv this homework please if anyone can help. Cant seem to get it right and thanks! Requirements - X - 1. Show

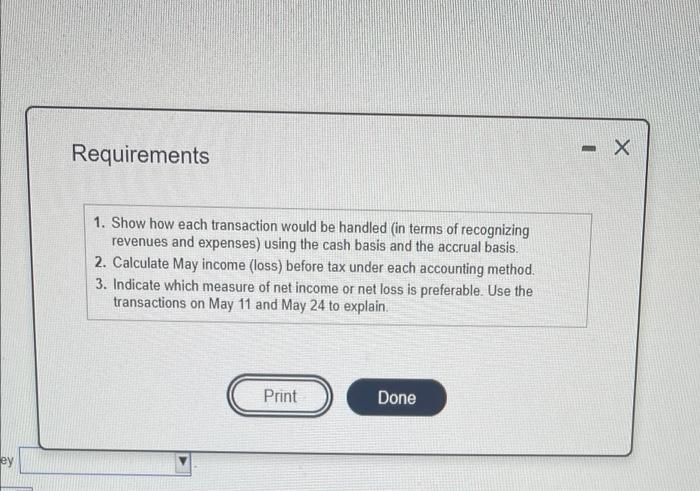

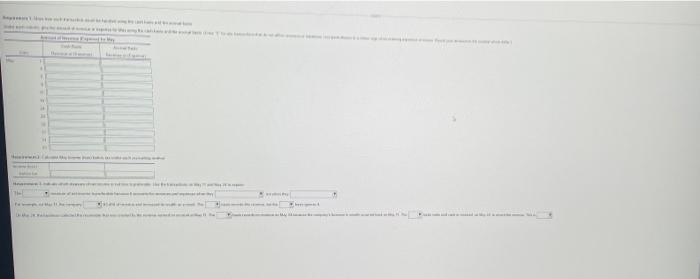

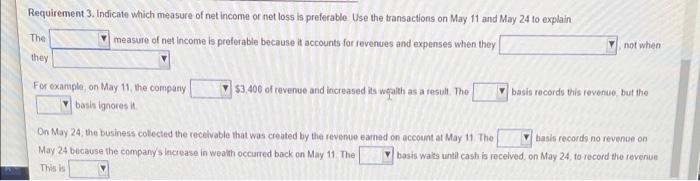

Requirements - X - 1. Show how each transaction would be handled (in terms of recognizing revenues and expenses) using the cash basis and the accrual basis. 2. Calculate May income (loss) before tax under each accounting method. 3. Indicate which measure of net income or net loss is preferable. Use the transactions on May 11 and May 24 to explain. Print Done ey Requirement 3. Indicate which measure of net income or net loss is preferable. Use the transactions on May 11 and May 24 to explain measure of net income is preferable because it accounts for revenues and expenses when they The not when they For example, on May 11, the company w basis ignores W $3,400 of revenue and increased its quilth as a result. The basis records this revenue, but the On May 24 the business collected the receivable that was created by the revenue earned on account at May 11 The basis records no revenue on May 24 because the company's increase in wealth occurred back on May 11 The basis waits until cash is received, on May 24 to record the revenue This is Requirements - X - 1. Show how each transaction would be handled (in terms of recognizing revenues and expenses) using the cash basis and the accrual basis. 2. Calculate May income (loss) before tax under each accounting method. 3. Indicate which measure of net income or net loss is preferable. Use the transactions on May 11 and May 24 to explain. Print Done ey Requirement 3. Indicate which measure of net income or net loss is preferable. Use the transactions on May 11 and May 24 to explain measure of net income is preferable because it accounts for revenues and expenses when they The not when they For example, on May 11, the company w basis ignores W $3,400 of revenue and increased its quilth as a result. The basis records this revenue, but the On May 24 the business collected the receivable that was created by the revenue earned on account at May 11 The basis records no revenue on May 24 because the company's increase in wealth occurred back on May 11 The basis waits until cash is received, on May 24 to record the revenue This is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts