Question: I need help specifically with 1 D . After calculating the BCR and PI , and then using to select projects, my answer does not

I need help specifically with D After calculating the BCR and PI and then using to select projects, my answer does not demonstrate that the BCR and PI would yield the same results. As with projects a b and c the BCR is therefore I would not choose to select them but with PI all are soo all are up for selection. Therefore when taking into account the capital rationing budget and calculating the NPV I get different as with BCR I reject projects and reject none with PI Sorry if what I have wrote does not make sense

Practice Paper

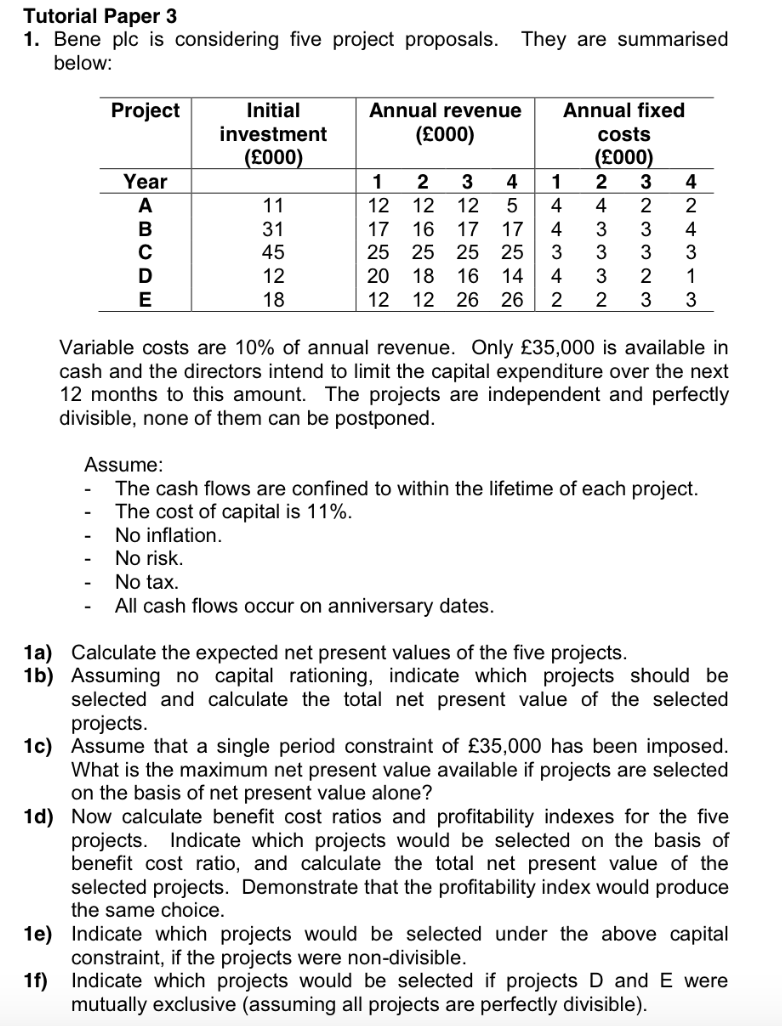

Bene plc is considering five project proposals. They are summarised below:

Variable costs are of annual revenue. Only is available in cash and the directors intend to limit the capital expenditure over the next months to this amount. The projects are independent and perfectly divisible, none of them can be postponed.

Assume:

The cash flows are confined to within the lifetime of each project.

The cost of capital is

No inflation.

No risk.

No tax.

All cash flows occur on anniversary dates.

a Calculate the expected net present values of the five projects.

b Assuming no capital rationing, indicate which projects should be selected and calculate the total net present value of the selected projects.

c Assume that a single period constraint of has been imposed. What is the maximum net present value available if projects are selected on the basis of net present value alone?

d Now calculate benefit cost ratios and profitability indexes for the five projects. Indicate which projects would be selected on the basis of benefit cost ratio, and calculate the total net present value of the selected projects. Demonstrate that the profitability index would produce the same choice.

e Indicate which projects would be selected under the above capital constraint, if the projects were nondivisible.

f Indicate which projects would be selected if projects D and E were mutually exclusive assuming all projects are perfectly divisible

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock