Question: I need help, the answers i entered are incorrected Exercise 1 9 - 2 2 ( LO . 5 ) During 2 0 2 4

I need help, the answers i entered are incorrected

Exercise LO

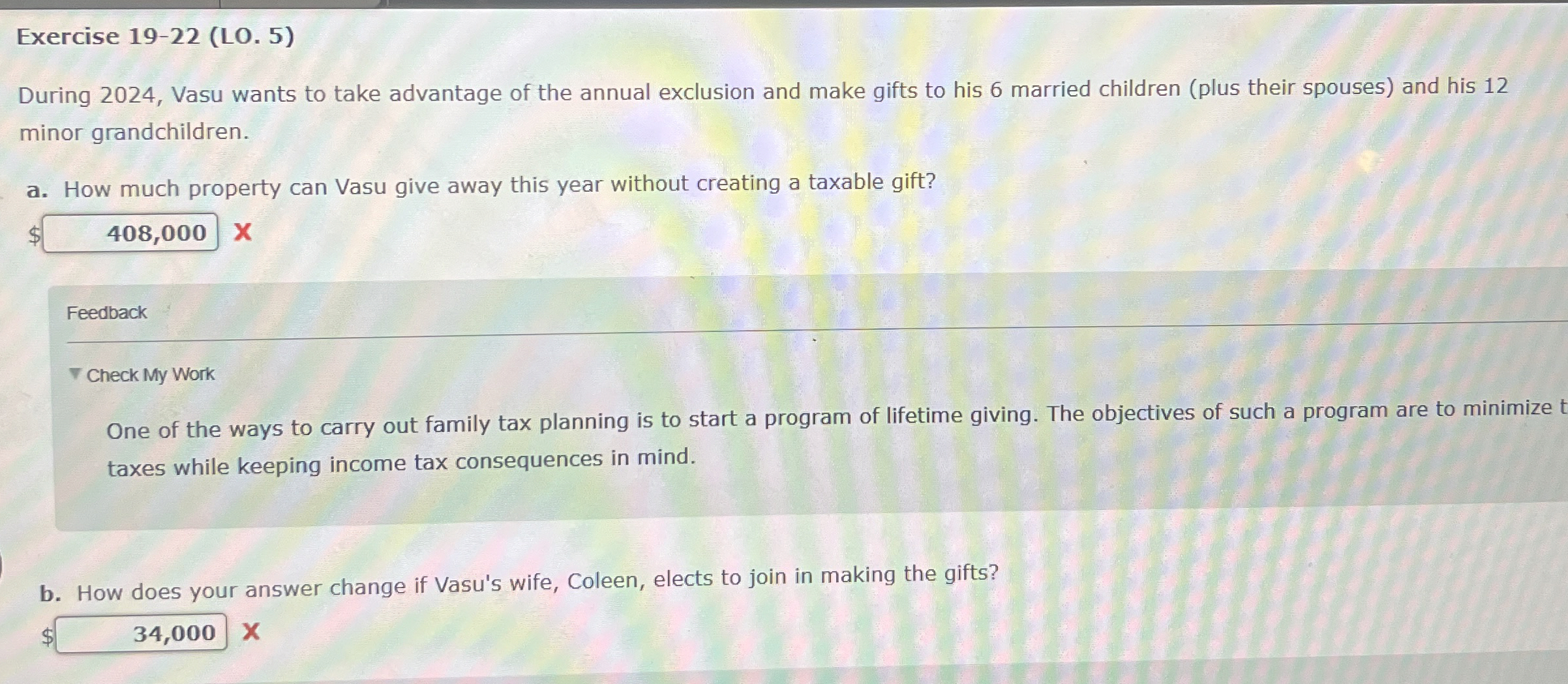

During Vasu wants to take advantage of the annual exclusion and make gifts to his married children plus their spouses and his minor grandchildren.

a How much property can Vasu give away this year without creating a taxable gift?

$

Feedback

Check My Work

One of the ways to carry out family tax planning is to start a program of lifetime giving. The objectives of such a program are to minimize taxes while keeping income tax consequences in mind.

b How does your answer change if Vasu's wife, Coleen, elects to join in making the gifts?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock