Question: i need help, the question is on the 1st page and the spreedsheet is the second page. FIRE 520 Chapter 6 Highlights April 8, 2019

i need help, the question is on the 1st page and the spreedsheet is the second page.

i need help, the question is on the 1st page and the spreedsheet is the second page.

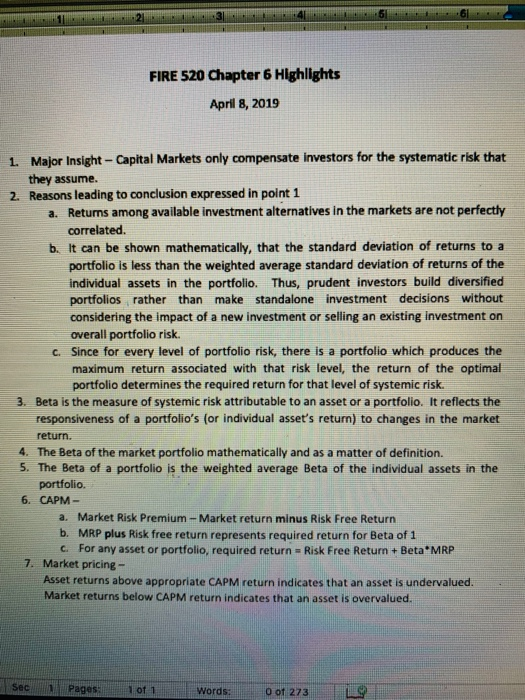

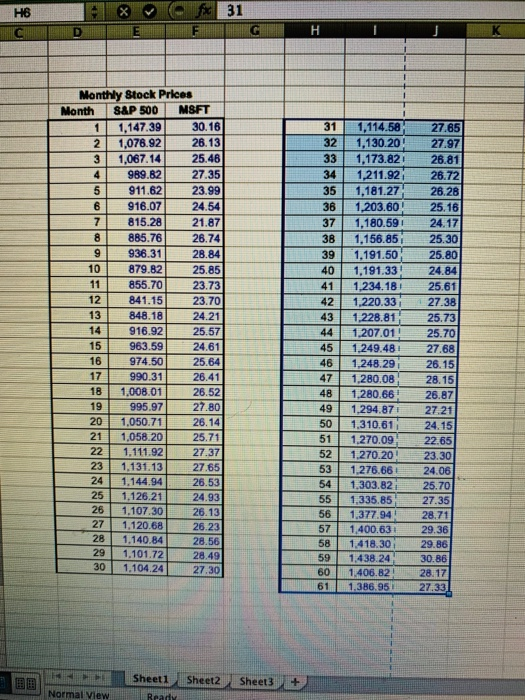

FIRE 520 Chapter 6 Highlights April 8, 2019 Major Insight- Capital Markets only compensate investors for the systematic risk that they assume. Reasons leading to conclusion expressed in point 1 1. 2. a. Returns among available investment alternatives in the markets are not perfectly correlated. b. It can be shown mathematically, that the standard deviation of returns toa portfolio is less than the weighted average standard deviation of returns of the individual assets in the portfolio. Thus, prudent investors build diversified portfolios rather than make standalone investment decisions without considering the impact of a new investment or selling an existing investment on overall portfolio risk. c. Since for every level of portfolio risk, there is a portfolio which produces the maximum return associated with that risk level, the return of the optimal portfolio determines the required return for that level of systemic risk. 3. Beta is the measure of systemic risk attributable to an asset or a portfolio. It reflects the responsiveness of a portfolio's (or individual asset's return) to changes in the market return. 4. The Beta of the market portfolio mathematically and as a matter of definition. 5. The Beta of a portfolio is the weighted average Beta of the individual assets in the portfolio. 6. CAPM- a. Market Risk Premium - Market return minus Risk Free Return b. MRP plus Risk free return represents required return for Beta of 1 c. For any asset or portfolio, required return Risk Free Return + Beta MRP 7. Market pricing- Asset returns above appropriate CAPM return indicates that an asset is undervalued. Market returns below CAPM return indicates that an asset is overvalued Sec 1 Pages:N of 1 words: Oot 273 1Lg H6 31 Monthly Stock Prices Month S&P 500 MSFT 1,147.3930.16 26.13 25.48 4 989.82 27.35 5 911.62 23.99 6 916.07 24.54 7815.28 21.87 26.74 9936.3128.84 10879.8225.85 311,114.58 27.65 2 1,076.92 3 1,067.14 32 1,130.20 27.97 33 1,173.82 34 1,211.92 26.72 35 1,181.27 26.28 36 1,203.60 25.16 37 1,180.59 24.1 1 26.81 8 885.76 38 1.156.85 25.30 39 1.191.50 40 1,191.33 41 1234.18 42 1,220.33 43 1.228.8 44 1.207.01 45 1,249.48 46 1,248.29 47 1,280.08 48 1,280.66 49 1294.87 50 1,310.61 51 1.270.09 52 1,270.20 53 1,276.66 54 1.303.82 55 1,335.85 56 1.377.94 24.84 25.61 27.38 11 855.70 23.73 23.70 848.18 916.92 963.59 974.50 17 990.31 24.21 25.57 24.61 25.64 25.70 26.15 18 1,008.01 26.52 221,111.92 27.37 23 1,131.13 24 1,144.94 25.71 27.65 24.93 25.70 26 28.49 30 1.104.2427.30 58 1418.30 59 1.438.24 60 1.406.82 29.86 30.86 27.33 Sheet1 Sheet2 Sheet3 + Normal view FIRE 520 Chapter 6 Highlights April 8, 2019 Major Insight- Capital Markets only compensate investors for the systematic risk that they assume. Reasons leading to conclusion expressed in point 1 1. 2. a. Returns among available investment alternatives in the markets are not perfectly correlated. b. It can be shown mathematically, that the standard deviation of returns toa portfolio is less than the weighted average standard deviation of returns of the individual assets in the portfolio. Thus, prudent investors build diversified portfolios rather than make standalone investment decisions without considering the impact of a new investment or selling an existing investment on overall portfolio risk. c. Since for every level of portfolio risk, there is a portfolio which produces the maximum return associated with that risk level, the return of the optimal portfolio determines the required return for that level of systemic risk. 3. Beta is the measure of systemic risk attributable to an asset or a portfolio. It reflects the responsiveness of a portfolio's (or individual asset's return) to changes in the market return. 4. The Beta of the market portfolio mathematically and as a matter of definition. 5. The Beta of a portfolio is the weighted average Beta of the individual assets in the portfolio. 6. CAPM- a. Market Risk Premium - Market return minus Risk Free Return b. MRP plus Risk free return represents required return for Beta of 1 c. For any asset or portfolio, required return Risk Free Return + Beta MRP 7. Market pricing- Asset returns above appropriate CAPM return indicates that an asset is undervalued. Market returns below CAPM return indicates that an asset is overvalued Sec 1 Pages:N of 1 words: Oot 273 1Lg H6 31 Monthly Stock Prices Month S&P 500 MSFT 1,147.3930.16 26.13 25.48 4 989.82 27.35 5 911.62 23.99 6 916.07 24.54 7815.28 21.87 26.74 9936.3128.84 10879.8225.85 311,114.58 27.65 2 1,076.92 3 1,067.14 32 1,130.20 27.97 33 1,173.82 34 1,211.92 26.72 35 1,181.27 26.28 36 1,203.60 25.16 37 1,180.59 24.1 1 26.81 8 885.76 38 1.156.85 25.30 39 1.191.50 40 1,191.33 41 1234.18 42 1,220.33 43 1.228.8 44 1.207.01 45 1,249.48 46 1,248.29 47 1,280.08 48 1,280.66 49 1294.87 50 1,310.61 51 1.270.09 52 1,270.20 53 1,276.66 54 1.303.82 55 1,335.85 56 1.377.94 24.84 25.61 27.38 11 855.70 23.73 23.70 848.18 916.92 963.59 974.50 17 990.31 24.21 25.57 24.61 25.64 25.70 26.15 18 1,008.01 26.52 221,111.92 27.37 23 1,131.13 24 1,144.94 25.71 27.65 24.93 25.70 26 28.49 30 1.104.2427.30 58 1418.30 59 1.438.24 60 1.406.82 29.86 30.86 27.33 Sheet1 Sheet2 Sheet3 + Normal view

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts