Question: i need help to: 1. Record the remaining May transactions in the sales journal, cash receipts journal, purchases journal, cash payments journal, and general journal.

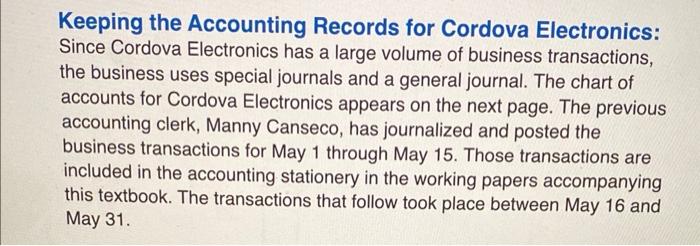

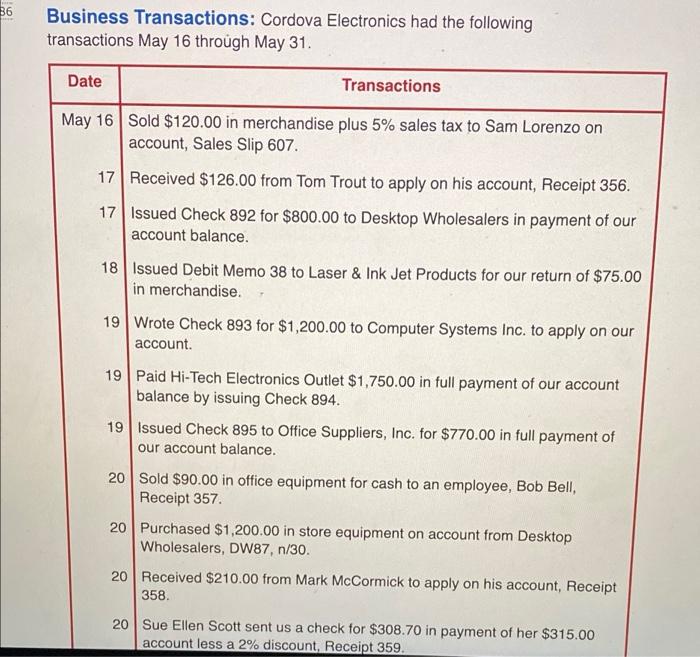

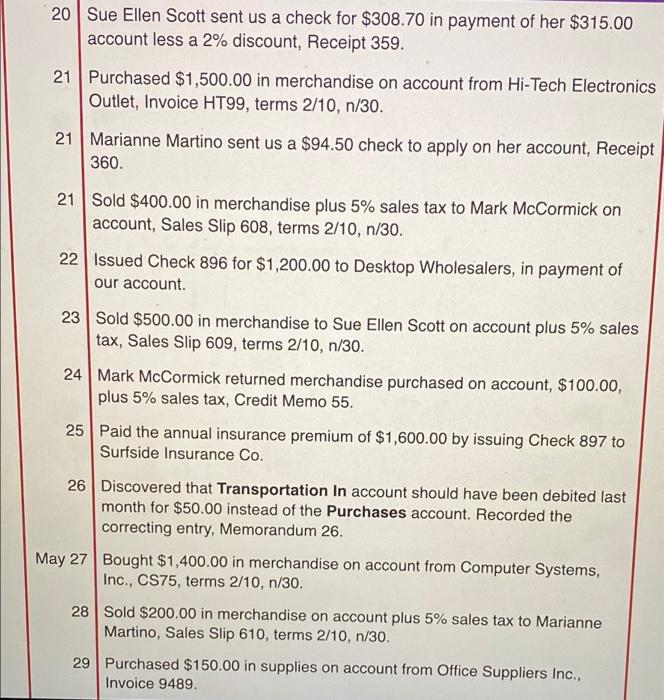

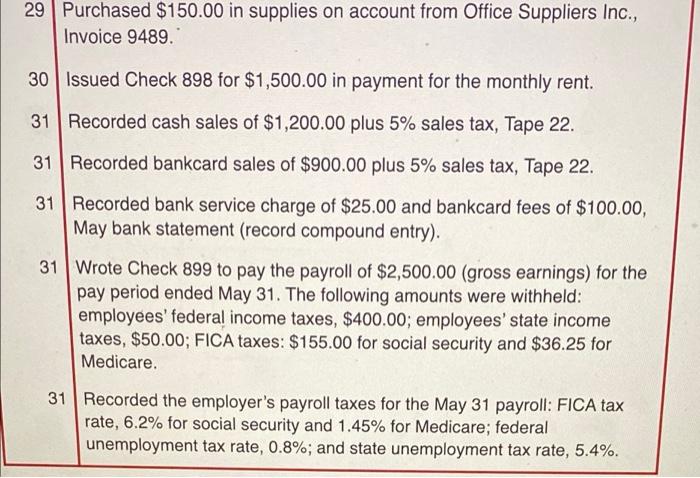

Keeping the Accounting Records for Cordova Electronics: Since Cordova Electronics has a large volume of business transactions, the business uses special journals and a general journal. The chart of accounts for Cordova Electronics appears on the next page. The previous accounting clerk, Manny Canseco, has journalized and posted the business transactions for May 1 through May 15. Those transactions are included in the accounting stationery in the working papers accompanying this textbook. The transactions that follow took place between May 16 and May 31. B6 Business Transactions: Cordova Electronics had the following transactions May 16 through May 31. Date Transactions May 16 Sold $120.00 in merchandise plus 5% sales tax to Sam Lorenzo on account, Sales Slip 607. 17 Received $126.00 from Tom Trout to apply on his account, Receipt 356. 17 Issued Check 892 for $800.00 to Desktop Wholesalers in payment of our account balance. 18 Issued Debit Memo 38 to Laser & Ink Jet Products for our return of $75.00 in merchandise. 19 Wrote Check 893 for $1,200.00 to Computer Systems Inc. to apply on our account. 19 Paid Hi-Tech Electronics Outlet $1,750.00 in full payment of our account balance by issuing Check 894. 19 Issued Check 895 to Office Suppliers, Inc. for $770.00 in full payment of our account balance. 20 Sold $90.00 in office equipment for cash to an employee, Bob Bell, Receipt 357 20 Purchased $1,200.00 in store equipment on account from Desktop Wholesalers, DW87, n/30. 20 Received $210.00 from Mark McCormick to apply on his account, Receipt 358 20 Sue Ellen Scott sent us a check for $308.70 in payment of her $315.00 account less a 2% discount, Receipt 359. 20 Sue Ellen Scott sent us a check for $308.70 in payment of her $315.00 account less a 2% discount, Receipt 359. 21 Purchased $1,500.00 in merchandise on account from Hi-Tech Electronics Outlet, Invoice HT99, terms 2/10, n/30. 21 Marianne Martino sent us a $94.50 check to apply on her account, Receipt 360 21 Sold $400.00 in merchandise plus 5% sales tax to Mark McCormick on account, Sales Slip 608, terms 2/10, n/30. 22 Issued Check 896 for $1,200.00 to Desktop Wholesalers, in payment of our account. 23 Sold $500.00 in merchandise to Sue Ellen Scott on account plus 5% sales tax, Sales Slip 609, terms 2/10, n/30. 24 Mark McCormick returned merchandise purchased on account, $100.00, plus 5% sales tax, Credit Memo 55. 25 Paid the annual insurance premium of $1,600.00 by issuing Check 897 to Surfside Insurance Co. 26 Discovered that Transportation In account should have been debited last month for $50.00 instead of the Purchases account. Recorded the correcting entry, Memorandum 26. May 27 Bought $1,400.00 in merchandise on account from Computer Systems, Inc., CS75, terms 2/10, n/30. 28 Sold $200.00 in merchandise on account plus 5% sales tax to Marianne Martino, Sales Slip 610, terms 2/10, n/30. 29 Purchased $150.00 in supplies on account from Office Suppliers Inc., Invoice 9489 29 Purchased $150.00 in supplies on account from Office Suppliers Inc., Invoice 9489. 30 Issued Check 898 for $1,500.00 in payment for the monthly rent. 31 Recorded cash sales of $1,200.00 plus 5% sales tax, Tape 22. 31 Recorded bankcard sales of $900.00 plus 5% sales tax, Tape 22. 31 Recorded bank service charge of $25.00 and bankcard fees of $100.00, May bank statement (record compound entry). 31 Wrote Check 899 to pay the payroll of $2,500.00 (gross earnings) for the pay period ended May 31. The following amounts were withheld: employees' federal income taxes, $400.00; employees' state income taxes, $50.00; FICA taxes: $155.00 for social security and $36.25 for Medicare. 31 Recorded the employer's payroll taxes for the May 31 payroll: FICA tax rate, 6.2% for social security and 1.45% for Medicare; federal unemployment tax rate, 0.8%; and state unemployment tax rate, 5.4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts