Question: Preparing job cost sheets & materials ledger cards; computing inventory. King Company builds custom order fulfillment centers for large companies. On June 1st, the company

Preparing job cost sheets & materials ledger cards; computing inventory.

King Company builds custom order fulfillment centers for large companies. On June 1st, the company had no inventories of work in process or finished goods but held the following raw materials:

Steel 120 units @ $200 = $24,000 Woos 80 units @ $160 = $12,800 Paint (Indirect Material) 44 units @ 72 = $3,168 Total = $39,968 On June 3rd, the company began work on Job 450 for Entica Company and Job 451 for Fargo Company.

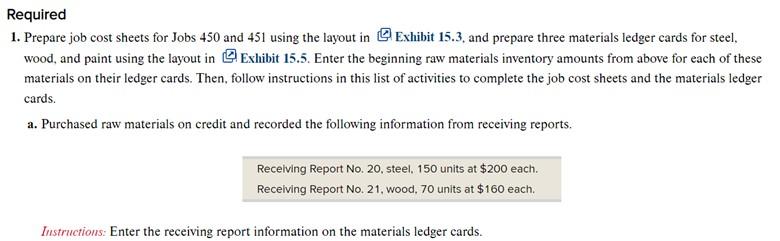

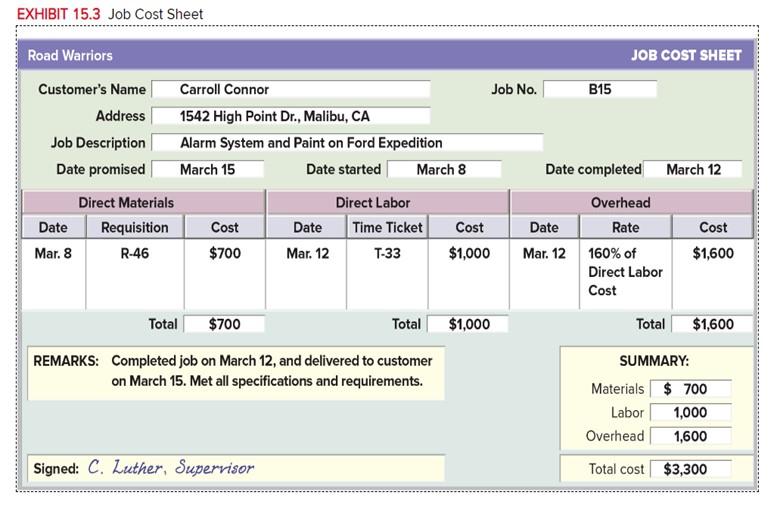

This is what layouts for Exhibit 15.3 & Exhibit 15.4 look like:

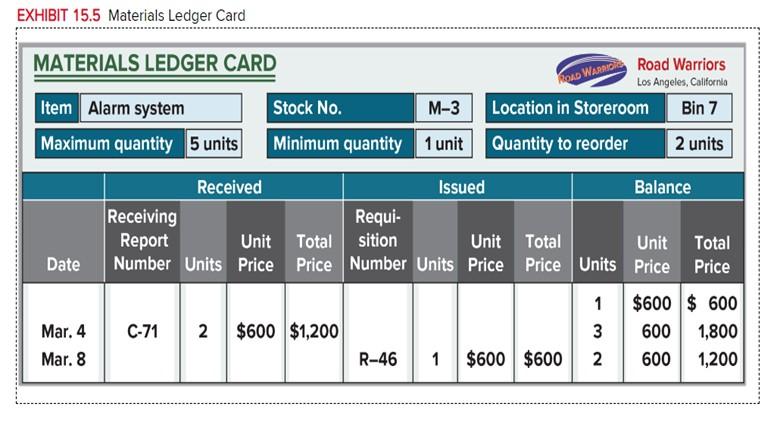

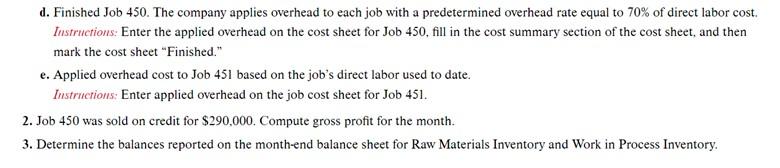

1. Prepare job cost sheets for Jobs 450 and 451 using the layout in Exhibit 15.3, and prepare three materials ledger cards for steel, wood, and paint using the layout in Exhibit 15.5. Enter the beginning raw materials inventory amounts from above for each of these materials on their ledger cards. Then, follow instructions in this list of activities to complete the job cost sheets and the materials ledger cards. a. Purchased raw materials on credit and recorded the following information from receiving reports. Recelving Report No. 20, steel, 150 units at $200 each. Recelving Report No. 21, wood, 70 units at $160 each. Instructions: Enter the receiving report information on the materials ledger cards. EXHIBIT 15.3 Job Cost Sheet EXHIBIT 15.5 Materials Ledger Card b. Requisitioned the following raw materials for production. Instructions: Enter amounts for direct materials requisitions on the materials ledger cards and the job cost sheets. Enter the indirect materials amount on the materials ledger card. c. Received the following employee time tickets for work in June. Time tickets Nos. 1 to 10 for direct labor on Job 450,$40,000. Time tickets Nos. 11 to 20 for direct labor on Job 451,$32,000. Time tickets Nos. 21 to 24 for indirect labor, $12,000. Instructions: Record direct labor from the time tickets on the job cost sheets. d. Finished Job 450 . The company applies overhead to each job with a predetermined overhead rate equal to 70% of direct labor cost. Instructions: Enter the applied overhead on the cost sheet for Job 450, fill in the cost summary section of the cost sheet, and then mark the cost sheet "Finished." e. Applied overhead cost to Job 451 based on the job's direct labor used to date. Instructions: Enter applied overhead on the job cost sheet for Job 451 . 2. Job 450 was sold on credit for $290,000. Compute gross profit for the month. 1. Prepare job cost sheets for Jobs 450 and 451 using the layout in Exhibit 15.3, and prepare three materials ledger cards for steel, wood, and paint using the layout in Exhibit 15.5. Enter the beginning raw materials inventory amounts from above for each of these materials on their ledger cards. Then, follow instructions in this list of activities to complete the job cost sheets and the materials ledger cards. a. Purchased raw materials on credit and recorded the following information from receiving reports. Recelving Report No. 20, steel, 150 units at $200 each. Recelving Report No. 21, wood, 70 units at $160 each. Instructions: Enter the receiving report information on the materials ledger cards. EXHIBIT 15.3 Job Cost Sheet EXHIBIT 15.5 Materials Ledger Card b. Requisitioned the following raw materials for production. Instructions: Enter amounts for direct materials requisitions on the materials ledger cards and the job cost sheets. Enter the indirect materials amount on the materials ledger card. c. Received the following employee time tickets for work in June. Time tickets Nos. 1 to 10 for direct labor on Job 450,$40,000. Time tickets Nos. 11 to 20 for direct labor on Job 451,$32,000. Time tickets Nos. 21 to 24 for indirect labor, $12,000. Instructions: Record direct labor from the time tickets on the job cost sheets. d. Finished Job 450 . The company applies overhead to each job with a predetermined overhead rate equal to 70% of direct labor cost. Instructions: Enter the applied overhead on the cost sheet for Job 450, fill in the cost summary section of the cost sheet, and then mark the cost sheet "Finished." e. Applied overhead cost to Job 451 based on the job's direct labor used to date. Instructions: Enter applied overhead on the job cost sheet for Job 451 . 2. Job 450 was sold on credit for $290,000. Compute gross profit for the month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts