Question: I need help to make Microsoft Excel spreadsheet that will generate an amortization table for loans. The table should be able to model 360 payments

I need help to make Microsoft Excel spreadsheet that will generate an amortization table for loans. The table should be able to model 360 payments (30 year mortgage). The user should be able to input: initial loan amount, the APR, and number of monthly payments for the period of the loan. Columns in the table should include the month, the amount of interest, the principal payment, and the ending balance. Additional principal payments such as $100.00 per payment period should be able to be considered as an input from the user.

Please include: the ready to use model, a replication of example 6-11 (be sure this includes the modifications mentioned above), and a table for a 30-year $95,000 mortgage used at a nominal 9% interest rate.

Also, If the amount of principal paid was increased so that the total payment is $1,000, in which month would this mortgage be paid off?

Example (does not include all items). Please include instructions/cell formula screenshots.

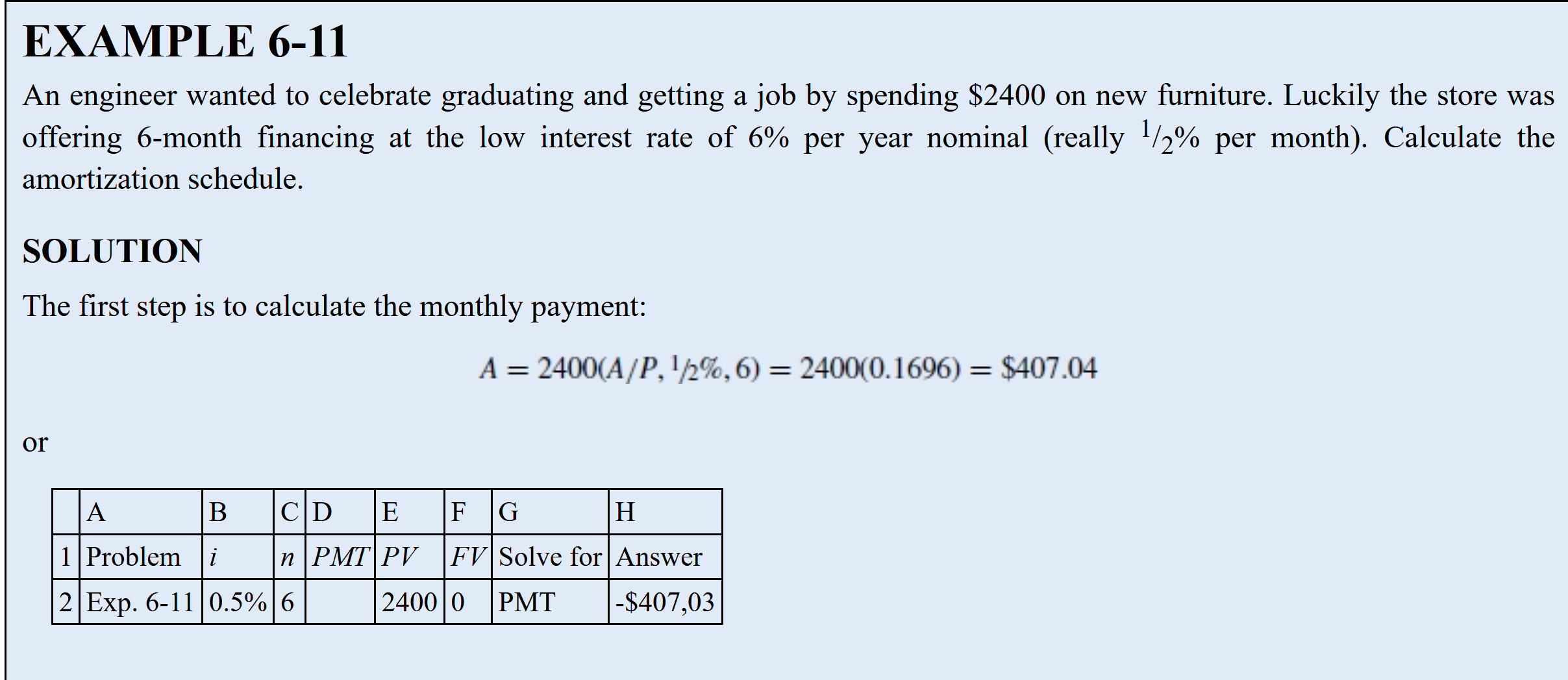

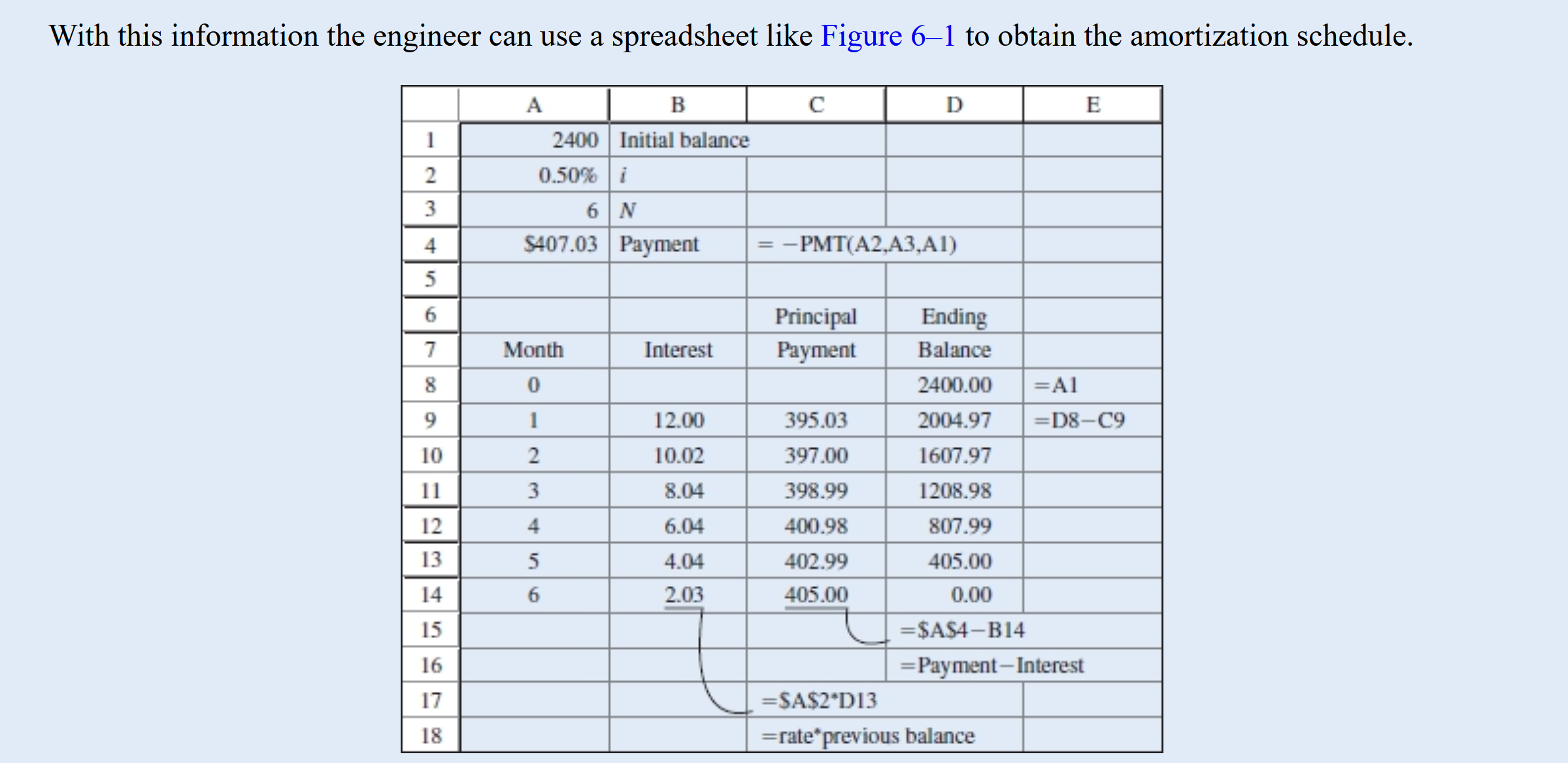

EXAMPLE 6-11 An engineer wanted to celebrate graduating and getting a job by spending $2400 on new furniture. Luckily the store was offering 6-month nancing at the low interest rate of 6% per year nominal (really 1/2% per month). Calculate the amortization schedule. SOLUTION The rst step is to calculate the monthly payment: A = 2400(A/P, I)'2%,6) = 2400(0.1696) = $407.04 S olve for Answer PMT -$407,03 \f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts