Question: I need help to solve this. I dont have any additional information. Need real help to solve this. Please!! Case Study: Westgate Shopping Center Westgate

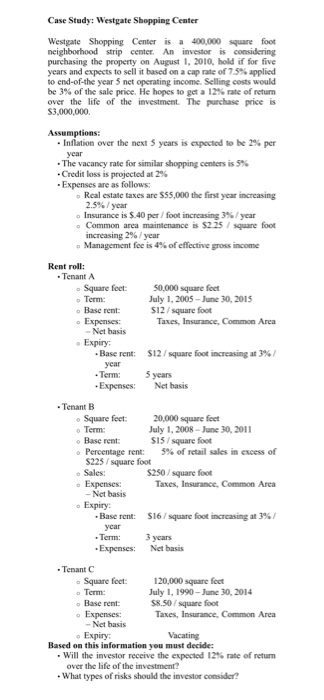

Case Study: Westgate Shopping Center Westgate Shopping Center is a 400,000 re fot neighborhood strip center. An investor is considering purchasing the property on August 1, 2010, hold if for five years and expects to sell it based on a cap rate of 75% applied o end-of-the year 5 net operating income. Selling be 3% of the sale price. He hopes to get a 12% te of return over the life of the investment. The purchase price is costs would Inflation over the next 5 years is expected to be 2% per The vacancy rate for similar shopping centers is 5% Credit loss is projected at 2% Expenses are as follows: o Real estate taxes are $55,000 the first year increasing 2.5% / year Insurance is $40 per / foot increasing 3% / year o Common area maintenance is $225 square foot increasing 2% / year Management fee is 4% of effective gross income Rent roll Tenant A o Square feet: 0,000 square feet o Term: o Base rent o Expenses: July 1, 2005-June 30, 2015 S12/square foot Taxes, Insurance, Common Area Net basis o Expiry: Base rent: S12/ square foot increasing at 3% year ycars Term: Expenses: Net basis Tenant B o Square feet o Term: o Base rent 20,000 square feet July 1, 2008-June 30, 2011 S15/ square foot Percentage rent: o Sales: o Expenses: o Expiry: 5% of retail sales in excess of square foot square foot Taxes, Insurance, Common Area Net basis Base rent: $16 / square foot increasing at 3%/ Term: Expenses:Net basis 3 ycars Tenant C 120,000 square fect o Square feet o Term: o Base rent: o Expenses: July 1, 1990-June 30, 2014 S8.50/ square foot Taxes, Insurance, Common Area Net basis o Expiry: Vacating Based on this information you must decide: Will the investor receive the expected 12% rate of return over the life of the investment? What types of risks should the investor consider

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts