Question: i need help. Type the correct answer in the box. Use numerals instead of words. Alex is a single taxpayer with $80,000 in taxable income.

i need help.

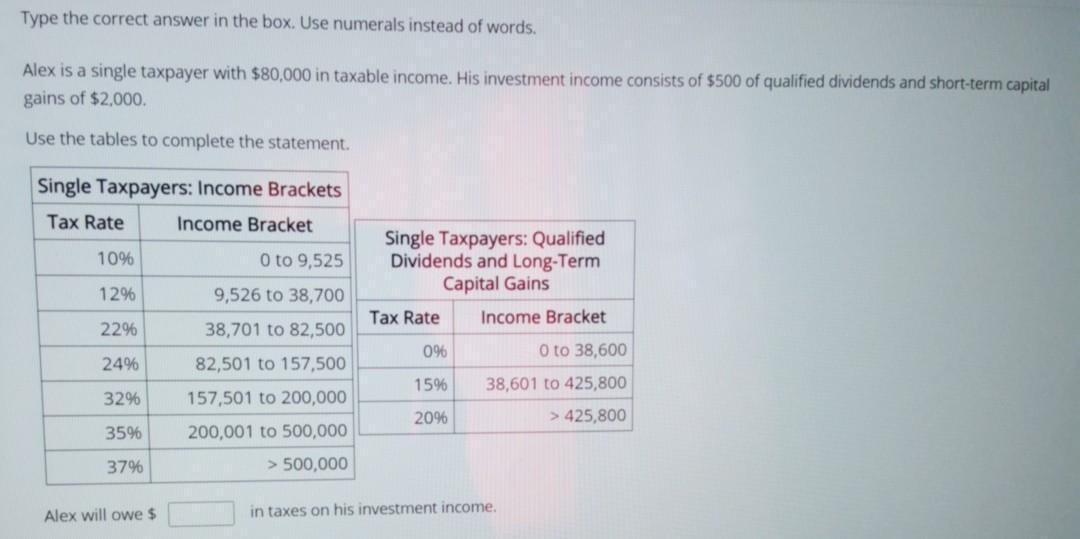

Type the correct answer in the box. Use numerals instead of words. Alex is a single taxpayer with $80,000 in taxable income. His investment income consists of $500 of qualified dividends and short-term capital gains of $2,000 Use the tables to complete the statement. Single Taxpayers: Income Brackets Tax Rate Income Bracket 10% 12% O to 9,525 9,526 to 38,700 38,701 to 82,500 22% Single Taxpayers: Qualified Dividends and Long-Term Capital Gains Tax Rate Income Bracket 096 O to 38,600 15% 38,601 to 425,800 20% > 425,800 24% 32% 82,501 to 157,500 157,501 to 200,000 200,001 to 500,000 > 500,000 3596 37% Alex will owe $ in taxes on his investment income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts