Question: I need help understanding this material so PLEASE truthfully answer, DO NOT USE AI or I will thumbs down. Today is the expiration day of

I need help understanding this material so PLEASE truthfully answer, DO NOT USE AI or I will thumbs down.

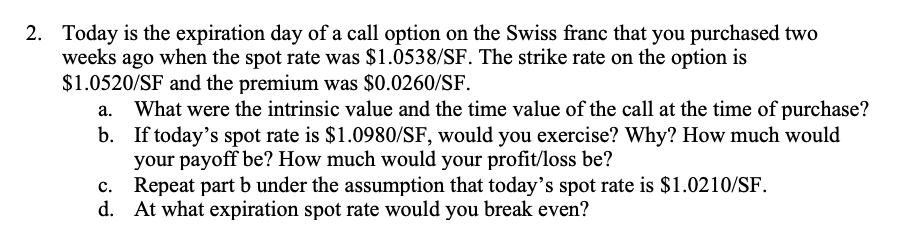

Today is the expiration day of a call option on the Swiss franc that you purchased two weeks ago when the spot rate was $1.0538/SF. The strike rate on the option is $1.0520/SF and the premium was $0.0260/SF. a. What were the intrinsic value and the time value of the call at the time of purchase? b. If today's spot rate is $1.0980/SF, would you exercise? Why? How much would your payoff be? How much would your profit/loss be? c. Repeat part b under the assumption that today's spot rate is $1.0210/SF. d. At what expiration spot rate would you break even

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts